Columbia Threadneedle Investments has admitted that its CT European Bond and CT UK Mid 250 funds offer poor value in its most recent Value Assessment Report, published this month.

The firm measured its funds against seven criteria, including investment performance, then awarded each fund an overall score, ranging from outstanding to poor.

It found that 17 funds had failed to meet their performance objective – a third of the funds assessed. Yet only two received an overall score of poor.

Of the 50 funds assessed (which come under the Threadneedle Investment Services umbrella), none were marked as outstanding overall but 17 were rated as providing good value for customers.

The largest cohort of 29 funds – more than half of those in the report – were found to be moderate. Another two were marked n/a because their track records are too short to be assessed due to a change in their objectives.

The firm will publish a second Value Assessment Report for another 40 of its funds in July (which are part of Columbia Threadneedle Fund Management).

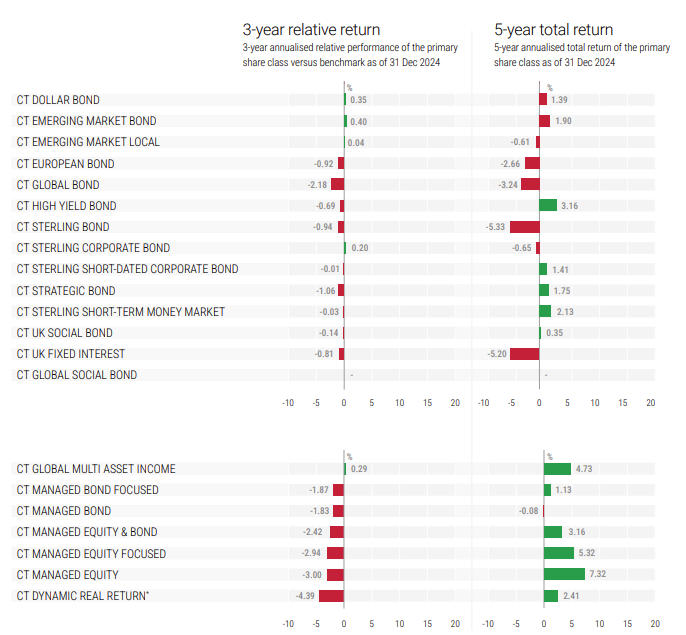

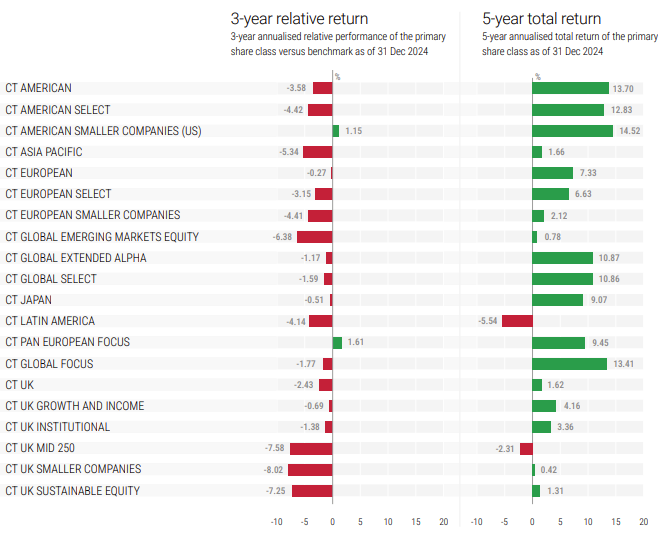

For the investment performance scores, Columbia Threadneedle measured each fund’s performance after fees versus its benchmark over rolling three- and five-year periods using data to 31 December 2024.

The 17 underperformers included six bond funds: CT European Bond, CT Global Bond, CT High Yield Bond, CT Sterling Bond, CT Strategic Bond and CT UK Fixed Interest.

They were joined by four multi-asset funds: CT Managed Bond Focused, CT Managed Bond, CT Managed Equity & Bond and CT Dynamic Real Return.

Performance of fixed income and multi-asset funds

Source: Columbia Threadneedle Investments’ Value Assessment Report, data to 31 Dec 2024

Seven underperforming equity funds rounded out the list: CT UK Mid 250, CT Asia Pacific, CT European Smaller Companies, CT Global Emerging Market Equity, CT Latin America, CT UK and CT UK Smaller Companies.

Performance of equity funds

Source: Columbia Threadneedle Investments’ Value Assessment Report, data to 31 Dec 2024

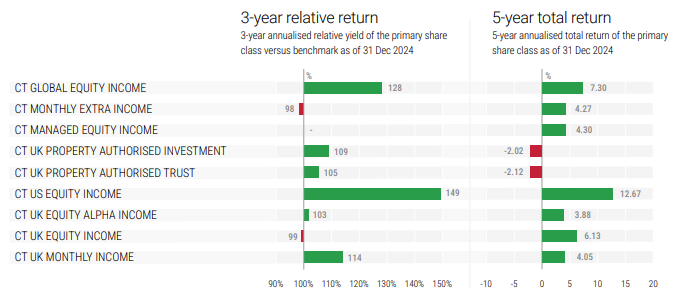

At the other end of the spectrum, Columbia Threadneedle Investments said five of its funds were outstanding performers: CT Global Equity Income, CT UK Equity Alpha Income, CT UK Equity Income, CT UK Monthly Income and CT US Equity Income. All of these fit into its equity income range and were judged by whether their yield after fees exceeded the benchmark.

Performance of income funds

Source: Columbia Threadneedle Investments’ Value Assessment Report, data to 31 Dec 2024

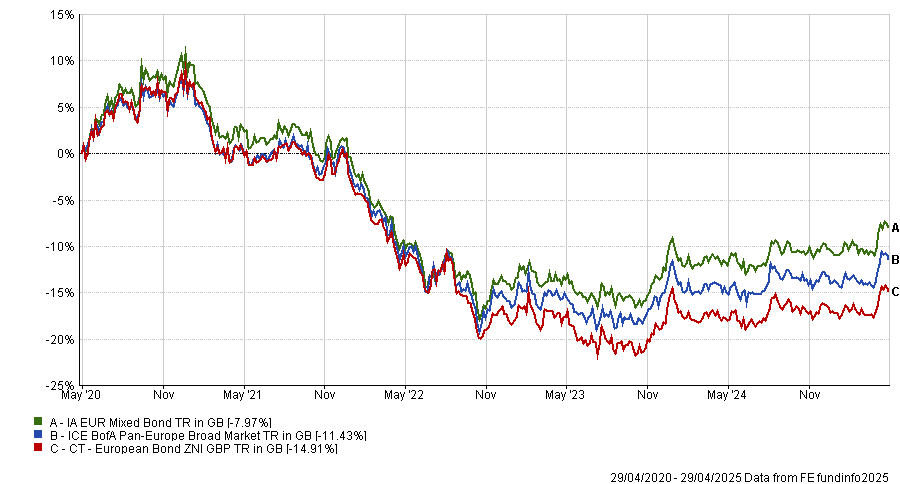

Relatively few investors are likely to hold the two funds with an overall poor score because they only have £136m under management between them. Even so, both have underperformed their benchmarks significantly and lost money for investors.

The £94m CT European Bond has lost 3.6% over three years and 14.9% over five years to 29 April 2025 – periods when its benchmark was also in the red.

Performance of fund vs sector and benchmark over 5yrs

Source: FE Analytics

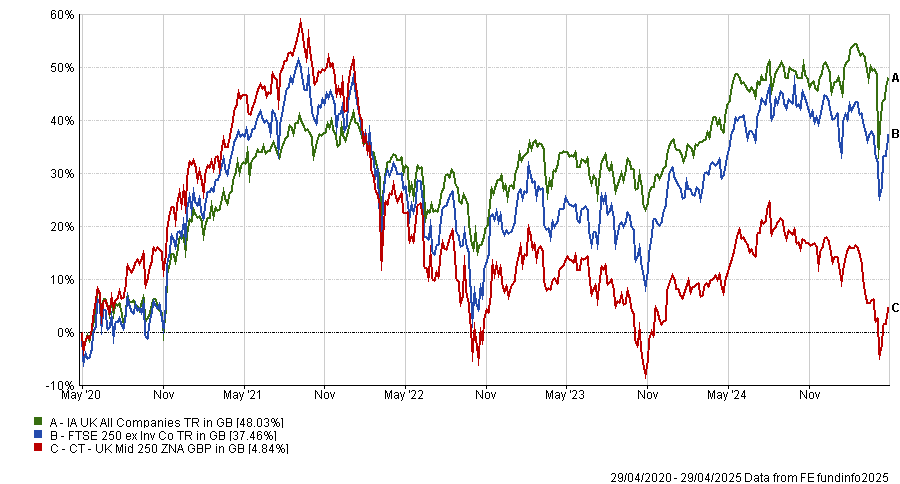

Meanwhile, the £42m CT UK Mid 250 fund lost 4.6% over 12 months and 15.1% over three years, during which time its benchmark and the IA UK All Companies sector made money. It’s five year return is positive (4.8%) but way behind the FTSE 250 index excluding investment companies, which gained 37.5%.

Performance of fund vs sector and benchmark over 5yrs

Source: FE Analytics

As well as returns, all 50 funds were assessed for service, investment performance, costs, how prices compare to competitors and similar in-house funds, economies of scale and, finally, whether clients are charged different amounts and is there justification for doing so.

The manager has taken action to offer better value for money, a spokesperson said. “Where we believe that we can improve value we look to take suitable remedial action, such as fee cuts, and have implemented hundreds of remedies across our fund ranges since Value Assessments began in 2020.”

It also closed five funds last year due to concerns about performance and/or scale: CT UK Extended Alpha, CT American Extended Alpha, CT China Opportunities CT UK Index-Linked and CT Sterling Medium & Long-Dated Corporate Bond.

Finally, it merged CT UK Equity Opportunities into the CT Growth and Income fund on 1 March 2024.