In the era of Trump 2.0, chaos has reigned, change has become the only constant and if fund managers are certain of one thing, it’s that uncertainty is pervasive.

Although tariffs have been reduced significantly since the ‘Liberation Day’ announcements on 2 April, they are still expected to cause a slowdown in global trade, so fund managers are turning to quality stocks that have strong enough balance sheets to weather policy uncertainty and slower growth.

Simon McGarry, head of equity research at Canaccord Wealth, said: “When economic growth slows, investors want companies that have strong balance sheets, consistent earnings and resilient cash flows. And at a time when inflation is lingering and interest rates aren’t falling as quickly as investors would like, companies with low debt and strong fundamentals are preferred over highly leveraged stocks.”

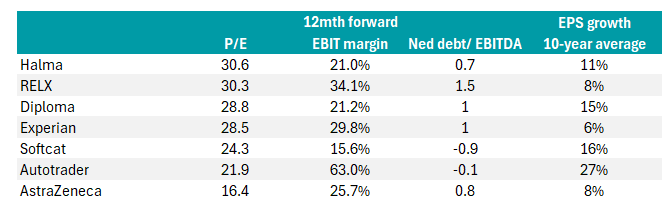

To find companies with high profit margins and low leverage, McGarry used Canaccord’s Quest database to measure net debt to EBITDA (earnings before interest, taxes, depreciation and amortisation), EBIT margins and earnings per share (EPS) growth. Quest identified seven high-quality stocks, as the table below illustrates.

The UK’s highest-quality stocks

Source: Quest, a division of Canaccord Genuity, data as of Mar 2025

Halma

McGarry described Halma as “a high-quality defensive stock with a strong track record in safety and environmental technology”. Its portfolio of technology companies solve challenges, such as water safety and health during childbirth.

“Its 21% EBIT margin highlights strong operational efficiency. With steady 11% average EPS growth over the past decade and low leverage (net debt/EBITDA of 0.7x), Halma offers consistent compounding returns,” McGarry explained.

Alexandra Jackson, manager of Rathbone UK Opportunities, said Halma’s decentralised model enables companies to focus on what they do best but draw “support from the Halma nerve centre” for hiring best practice or by using the balance sheet for deals.

“When the finance team was charged with improving working capital in the business, they took the time to explain to those responsible for streamlining inventory and collecting cash why exactly it was such a priority. The result was a much more rapid improvement in cash conversion than we were expecting,” she said.

RELX

RELX’s data analytics and decision-making software draw on specialised, proprietary data assets and incorporate a deep understanding of clients’ workflows, said Chris Elliott, portfolio manager of the Evenlode Global Equity fund.

“As RELX’s client base grows, the company is able to gain additional insights into its clients and thus continuously deliver incremental value through new services. For instance, the Lexis Nexis product can be trained to deliver more relevant historical case studies in response to a search,” he explained.

“This pipeline of innovation creates strong switching costs and a reliable stream of subscription revenue, resilient to any wider macroeconomic volatility.”

Diploma

Diploma resells industrial components such as seals, wiring, surgical and diagnostic equipment.

Rathbones' Jackson said: “Its low cost, mission-critical components, crucially with a service wrapper, allow it to make a 20% margin. Its end markets also have strong structural tailwinds, such as onshoring of manufacturing capacity in the US, or increased spend on medical equipment for an ageing population.”

Diploma is less cyclical than other industrial names thanks to its global revenue spread, strong market positions and the diversity of its end markets, said Abby Glennie, manager of the abrdn UK Smaller Companies Growth Trust.

Diploma has a consistent track record of organic growth, while its bolt-on acquisition strategy, funded through cash generation and well-supported capital raises, expands its addressable market, Glennie said.

Experian

Experian’s strength lies in its data network effect, according to Chloe Smith, an investment analyst on Sanford DeLand Asset Management’s Buffettology fund.

“The more data it aggregates, the more powerful and accurate its analytics become. In a world of rising digitalisation and personalisation, data is the key asset and Experian owns some of the most valuable proprietary data sets globally. This gives it pricing power, recurring revenue and a defensible competitive moat.”

Experian has multiple growth levers, she continued. “It reinvests effectively in technology while maintaining shareholder returns through dividends and buybacks. Experian exemplifies the kind of resilient, high-return business that can thrive across cycles.”

Softcat

Softcat is the largest value-added reseller of IT software, hardware and services in the UK, said Eric Burns, deputy manager of the CFP SDL UK Buffettology fund.

“Customers often view Softcat as being like an outsourced IT department and rely on it to help navigate an increasingly complex technology landscape. As a people business, Softcat is capital light and consistently earns a return on equity in excess of 40%. The conversion of profit into cash is high and the balance sheet is rock solid,” he noted.

“It has consistently delivered double-digit growth in revenue supported by long-term drivers such as cloud computing, cybersecurity and artificial intelligence (AI) adoption.”

Duncan Green, manager of Schroder UK Multi-Cap Income, owns Softcat for its “rare blend of quality, resilience and long-term growth”.

“It sits at the centre of clients’ critical IT decisions – helping them navigate the complexity of infrastructure, cybersecurity and digital transformation. This positioning, in a space where spend is increasingly non-discretionary, makes the business highly relevant and defensible,” Green explained.

“The company’s culture – entrepreneurial, client-centric and performance-driven – is a key competitive advantage that supports sustained market share gains. With expanding capabilities in AI and data, and management guiding to low double-digit profit growth, we believe Softcat is well positioned to continue compounding value.”

Autotrader

Autotrader has become the key place for dealers to list cars, said Imran Sattar, manager of the Liontrust UK Equity fund and the Edinburgh Investment Trust. "Having a dominant share of consumer eyeballs, as well as having essentially all of the inventory of used cars on its platform, allows the business to have long-duration pricing power. Growth also comes from developing more advanced data products for used car dealers to make them more efficient,” he said.

"Autotrader has a powerful economic moat and now commands very attractive profit margins and returns on capital. The capital light nature of the business model also means cash flow dynamics are excellent and the vast majority of cashflows are returned to shareholders in the form of dividends and share buybacks.”

AstraZeneca

AstraZeneca is attractively valued and “remains a strong defensive play”, Canaccord Wealth's McGarry said. “Its diversified drug pipeline and strong oncology segment make it a compelling investment for long-term stability and growth.”

AstraZeneca has been a core holding in the Liontrust UK Growth fund for over a decade and accounts for around 9% of assets. Fund manager Matt Tonge said it possesses three ‘economic advantage’ moats.

“It's one of the most innovative businesses in the UK with a market‑leading intellectual‑property estate (especially in oncology) that is refreshed by reinvesting roughly a fifth of annual revenue into research and development,” he explained.

“It has a global manufacturing and commercial network that can launch new products at scale and a stream of high‑visibility, patented revenues that funds disciplined reinvestment and a progressive dividend.”