The Schroder Income Growth investment trust is making a raft of changes to mitigate its recent underperformance and enhance shareholder returns.

From 1 September, it will operate with a fee of 0.40% instead of the current 0.45%, which will be charged on either its market capitalisation or net asset value (NAV), depending on which one is lower.

Chairman Ewen Cameron Watt admitted: “One of the largest elements of costs is the fee paid for investment management services provided by Schroders”.

The separate fee for secretarial and administration services will also be eliminated, with an expected cost reduction of over £300,000 (based on the market cap and NAV of the company as at 12 May 2025).

The board also appointed Matthew Bennison, who currently leads the Schroder Sustainable UK Equity funds and co-runs Schroder UK Alpha Income and Schroder Prime UK Equity funds, as co-manager. He will join Sue Noffke at the helm of the company with immediate effect.

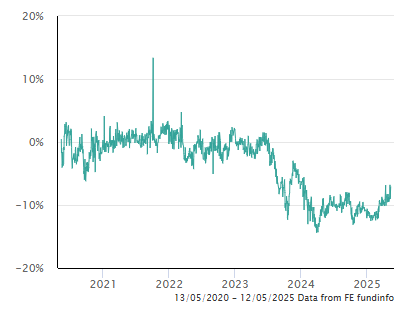

Finally, the trust announced it will be adopting “an increasingly active attitude” to managing the volatility and level of discount (currently at -7.1%, as the table below shows) and maintaining it within a single-digit range in normal market conditions.

Discount/premium to NAV

Source: Trustnet

The trust has underperformed during the past six months, which Noffke mainly to her small-cap holdings, which remain unloved and lagged their larger counterparts, but also to stock selection. The FTSE 250 ex Investment Trusts and the FTSE SmallCap ex Investment Trusts indices fell by 4.2% and 7.3%, respectively; the FTSE 100 achieved a positive total return of 6.5% over the same period.“This performance divergence impacted the portfolio, which has greater exposure to small and mid-sized companies (7.3% overweight relative to its benchmark) and consequently a significant underweight position of -8.2% in larger companies,” the manager said.

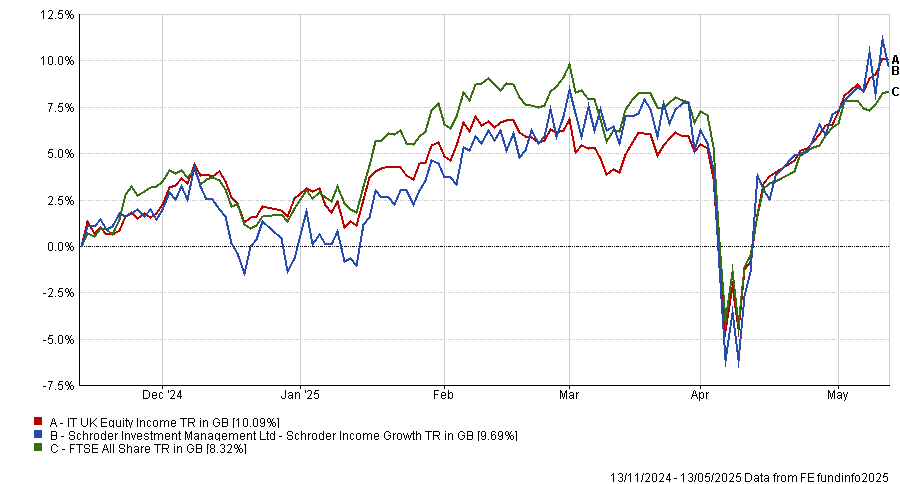

Performance of fund against index and sector over 6 months

Source: FE Analytics

“As well as the impact of market-cap dynamics, underperformance was a result of adverse stock selection in several sectors, most notably consumer discretionary, industrials and consumer staples. This more than offset positive positioning and stock selection in the financial sector, which was the largest contributor to relative performance.”

In the six months to end February 2025, the main detractors were Rolls Royce (-0.8%), defence technology company QinetiQ (-0.6%) and retailer Pets at Home (-0.6%); the main positive contribution came from Standard Chartered (1.3&), Burberry (0.5%) and Pearson (0.5%).

Underperformance against the IT UK Equity Income sector has been a feature in the even longer term; the strategy ranked in the fourth quartile of returns over the past 10 years and third-quartile over the past five, three and one year.