European investors would have been better off holding a passive tracker than taking their chances on an active fund since 2020, according to Trustnet research.

It has been a volatile five years for European investors, with portfolios shaken by the war between Russia and Ukraine, a global pandemic and heavy reciprocal tariffs. In theory, active funds should navigate these challenges better than their passive counterparts – in practice, it has been hard to escape the spectre of passive outperformance.

In the next part of an ongoing series, Trustnet examined the market capitalisation, investment style and performance of active and passive funds to determine the ultimate way to invest in Europe since 2020. We have concentrated specifically on the European ex-UK sectors, funds and indices.

Market capitalisation and investment styles

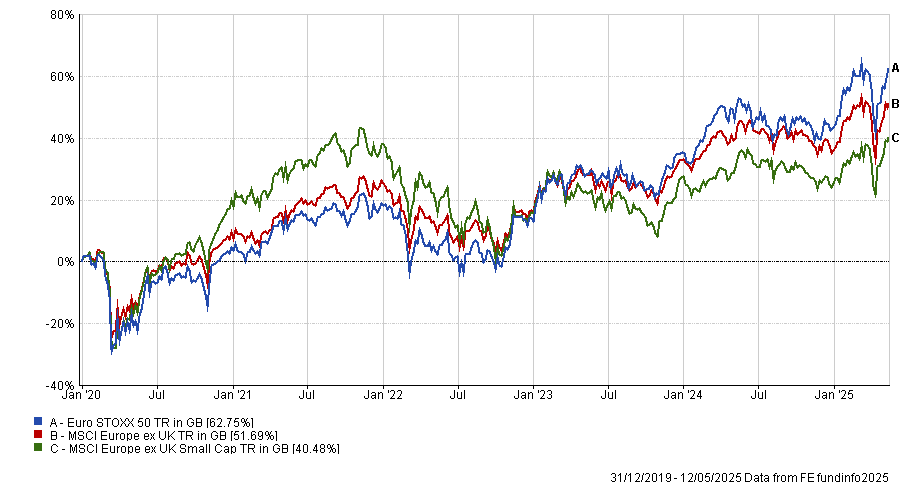

Starting with the indices, we examined the performance of the Euro STOXX 50, MSCI Europe ex UK and MSCI Europe ex UK small cap.

Since 1 January 2020, the mega-cap Euro STOXX 50 emerged triumphant, up by 62.8%, followed by the MSCI Europe ex UK at 51.8%, with small-caps trailing at 40.5%

Performance of indices since 2020

Source: FE Analytics

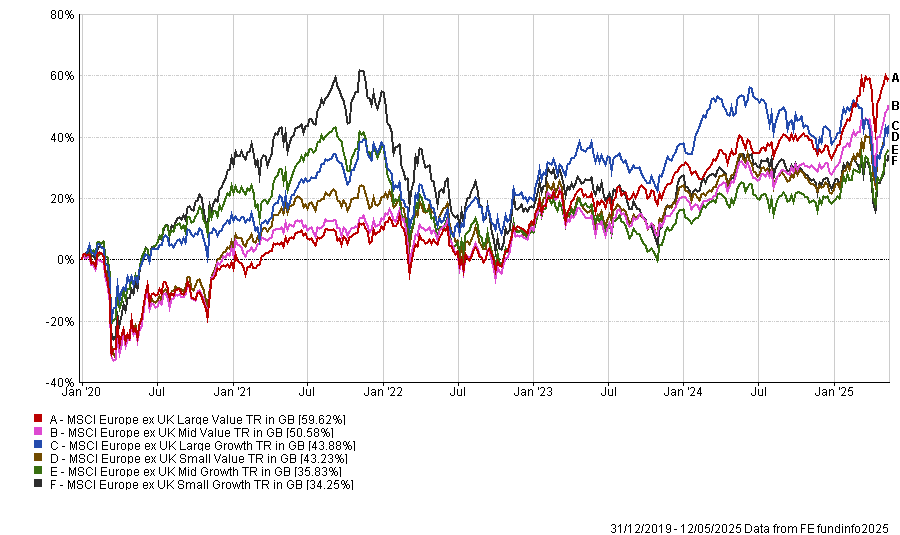

Dig deeper into investment styles and some interesting data emerges. On the one hand, the large-cap value index is the best-performing, up by 59.6%. However, for most of the period, it trailed its large-cap growth counterpart and has only started outperforming this year.

Nevertheless, value has generally performed better across the market capitalisation spectrum, with large, mid and small-cap value ranking as the first, second and fourth best investment styles of the period.

Performance of indices since 2020

Source: FE Analytics

Active vs passive

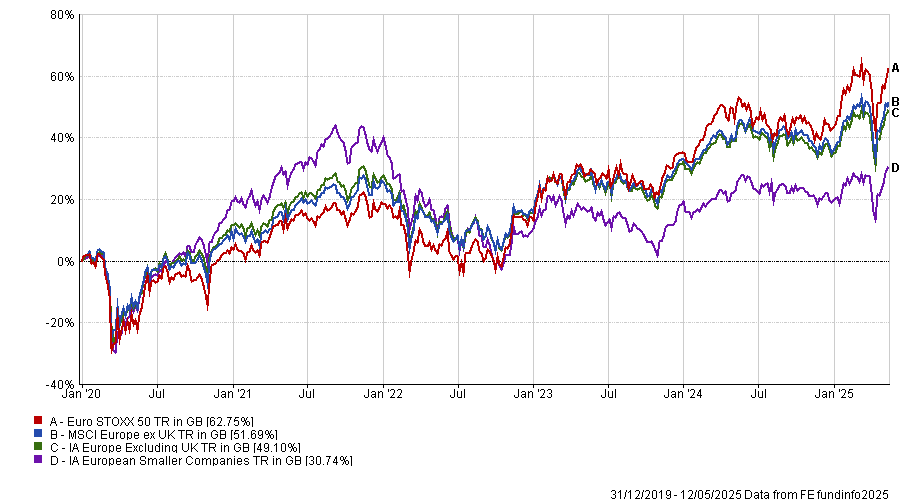

Turning to how active funds performed compared to their passive counterparts, passives emerged on top, much like they did in the UK.

An investor who tracked the MSCI Europe ex UK index would be up 51.7% at the time of writing. Those tracking the Euro STOXX 50 would be in an even better position, with the index having surged 62.8% since 2020.

By contrast, the average IA European ex UK active fund is up 49.1%, while the IA European Smaller Companies peer group is up 30.7%.

Performance of IA Sectors vs the benchmark since 2020

Source: FE Analytics

As a result, over the past five years, the best way to invest in Europe was to buy a large-cap tracker.

Rory Powe, portfolio manager at Man Group, explained why larger companies had the edge: “In an unpredictable world, companies need global breadth and balance to succeed. Many of Europe’s leading firms avoid overreliance on any single region, instead drawing revenues from a broad geographic base.”

Marcus Morris-Eyton, manager of the AB European Growth fund, added that large European companies such as SAP Software and ASML had "their destinies in their hands". With great fundamentals, solid balance sheets and sustainable barriers to entry, the largest stocks in the European market have been more resistant to macroeconomic challenges such as trade wars and geopolitical conflict than some of their competitors, he explained.

For an investor who wanted to take advantage of large-cap outperformance, there are several appealing choices. For example, the Xtrackers Euro STOXX 50 UCITS ETF tracks the 50 most prominent stocks in the European market. At an ongoing charges figure (OCF) of 0.09%, it is one of the cheapest ways of gaining exposure to Europe’s most prominent and top-performing stocks. Other asset managers such as BlackRock and HSBC offer similar low-cost passive products.

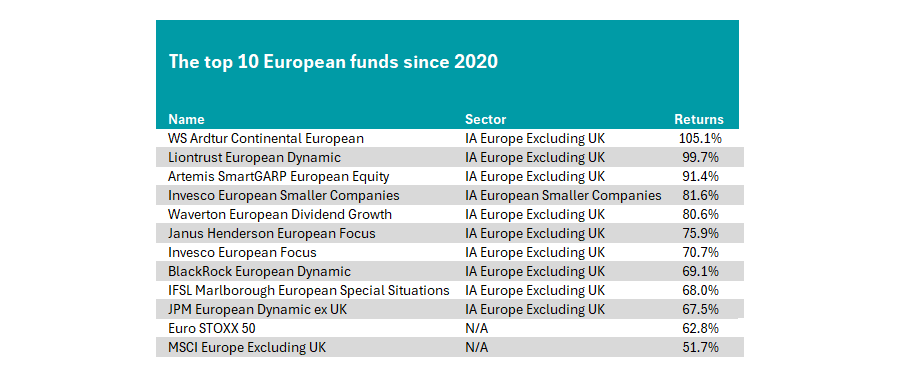

However, while beating the market was difficult for many active funds, it was certainly not impossible. For example, 48% of funds in the IA Europe ex UK sector beat the MSCI Europe ex UK, and 14% beat the Euro STOXX 50 over this period. The table below shows the top 10 funds in Europe since 2020, all of which beat the MSCI Europe ex UK and the Euro STOXX 50.

Source: FE Analytics

Topping the list is the WS Ardtur Continental European fund, managed by Oliver Kelton since 2015.

It is followed by the Liontrust European Dynamic fund, managed by Samantha Gleave and James Inglis-Jones. This is a more flexible strategy than many of its peers and has outperformed recently due to the fund's willingness to pivot from growth investing in some years to value in others, according to the managers.

The only smaller companies fund to rank within the top 10 since 2020 is the Invesco European Smaller Companies fund, managed by FE fundinfo Alpha Manager James Matthews. He has proven an excellent stockpicker with the fund achieving the fourth highest information ratio in the entire IA universe last year.

Other funds to qualify included Artemis SmartGARP European Equity, Waverton European Dividend Growth, Janus Henderson European Focus, BlackRock European Dynamic, Marlborough European Special Situations, Invesco European Focus, and JPM European Dynamic Ex UK.

Previously in this series, we have looked at the UK.