Funds run by Legal & General Investment Management, Columbia Threadneedle and Fidelity are among the handful of global equity strategies that have consistently made their sectors’ highest Sharpe ratios, Trustnet research has found.

The Sharpe ratio measures the risk-adjusted return of an investment by comparing its excess return over the risk-free rate to its standard deviation. A higher Sharpe ratio indicates more return per unit of risk, making it a useful tool for evaluating the efficiency of investment performance.

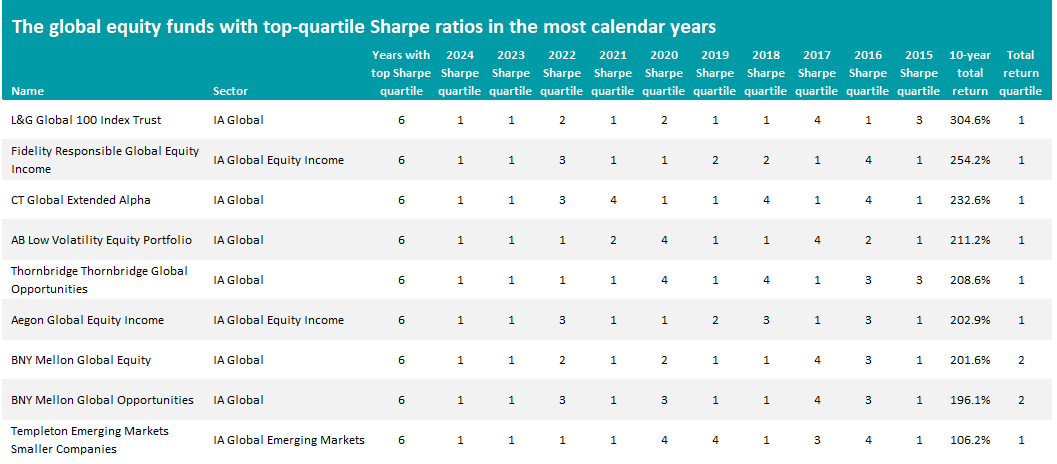

In this series, Trustnet is looking at the Sharpe ratios of funds over the past decade to find out which ones have spent at least six of those years in their sector’s top quartile for this closely watched risk/return metric.

We start with funds that have a global reach, putting the IA Global, IA Global Equity Income and IA Global Emerging Markets sectors under the spotlight.

Across these three peer groups, there are 381 funds with a track record of 10 or more years, but only nine have been in the top quartile for Sharpe ratio in six of the past decade. They can be seen in the table below, along with their total return over the entire period.

Source: FE Analytics. Total return in sterling between 1 Jan 2025 and 31 Dec 2024.

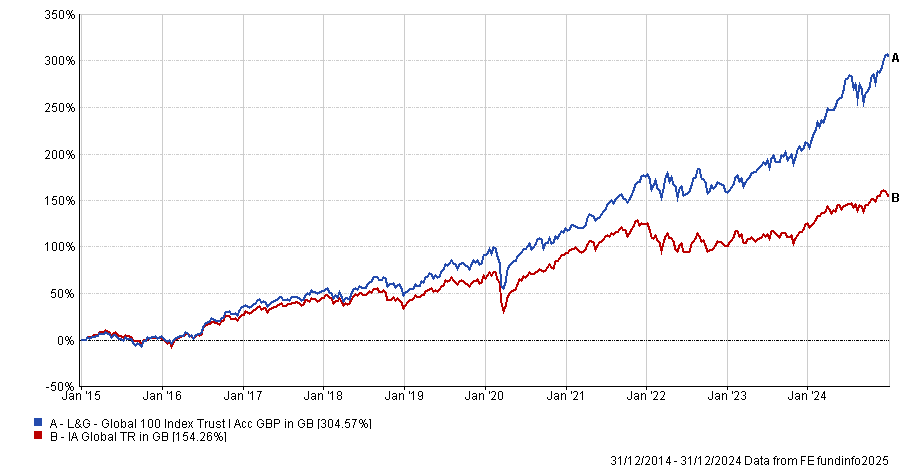

At the top of the table is L&G Global 100 Index Trust, which has made the highest total return of the nine shortlisted funds – it was up 304.6% over the decade under consideration, compared with a rise of 154.3% for the average fund in the IA Global sector.

The £1.8bn tracker physically replicates the S&P Global 100 index, which is made up of the largest 100 companies from across the globe. This means the portfolio’s biggest holdings are the likes of Apple (11.8%), Microsoft (10%) and Nvidia (9.3%), resulting in a hefty skew towards the US (78.6% of the portfolio).

Performance of L&G Global 100 Index Trust vs sector between 1 Jan 2015 and 31 Dec 2024

Source: FE Analytics. Total return in sterling between 1 Jan 2015 and 31 Dec 2024

The remaining eight funds on the shortlist are active strategies, with Fidelity Responsible Global Equity Income putting in the second-best performance after making 272.7% since the start of the period we examined.

It has been managed by Aditya Shivram since July 2021, although he has run the offshore Fidelity Global Equity Income fund since its launch in 2013. The approach behind the £189m fund looks for sustainable, higher quality companies with stable and/or improving returns on capital, reasonable valuations, low leverage and predictable, stable business models.

Fidelity Responsible Global Equity Income has a much lower allocation to the US than many global portfolios. It has just one-third of its portfolio in US companies, compared with 64.6% in its MSCI AC World benchmark. Six of its top 10 holdings are from outside of the US, including Deutsche Boerse, Munich Re Group, Relx and Unilever.

CT Global Extended Alpha came in third place. Like all the funds on the shortlist, it was top quartile in its sector for Sharpe ratio in six of the 10 full years we examined and made a 232.6% across the decade.

This fund has been run by Neil Robson since 2012 and, unlike the typical global equity fund, follows an ‘equity extension strategy’ that allows proceeds from short positions to be used to extend the portfolio’s long positions – thereby offering more exposure to the strongest investment ideas.

As can be seen, most of the consistent top Sharpe ratio funds are in the IA Global sector while two reside in IA Global Equity Income. Only one – Templeton Emerging Markets Smaller Companies – is in the IA Global Emerging Markets sector.

Templeton Emerging Markets Smaller Companies has been run by Chetan Sehgal since 2017, with FE fundinfo Alpha Manager Vika Chiranewal joining as co-manager in 2020. Like all Templeton emerging market funds, it takes a valuation-oriented approach with a focus on bottom-up analysis and little emphasis on top-down views.

While the nine funds in the table above are the only ones to have achieved top-quartile Sharpe ratios in six of the past 10 full years, there are 35 without a single year in the first quartile.

Among them are Pictet Global Megatrend Selection, CT Global Equity Income, Jupiter Merlin Worldwide Portfolio, TM Stonehage Fleming Global Equities and abrdn Emerging Markets Equity.