Bond managers are too risk-averse for their own good, according to Artemis’ Jack Holmes, and are missing out on crucial opportunities at the riskier end of the market.

“No one ever ends up in fixed income because they are optimistic about the world,” he admitted, but even for the usually risk-averse, their risk-off approach has become too much.

Bond managers are currently conflicted on high-yield, with the more bearish arguing that tight spreads and unappealing valuations compound the problems of investing in a naturally riskier asset class. This has made the high yield bonds unappealing in a period where government bonds offered yields of around 4%.

But dismissing high-yield bonds is a big mistake because “the only way you can make money in any market or asset class is by being more optimistic than your peers,” said Holmes.

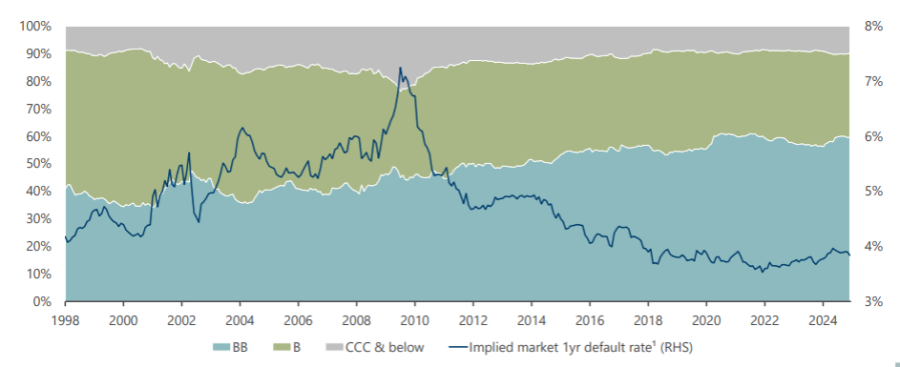

He argued that it is a more attractive market than many investors give it credit for. Firstly, it was a much higher quality market than it used to be. CCC bonds, the riskiest type of bond, represent around 7% of the high yield market, down from almost 20% pre-global financial crisis. The more stable B and BB bonds now account for more than 90% of the total market by comparison, he explained.

“Over the past 20 years, we have seen a massive structural shift away from these quite risky names into these higher quality names. I think people forget the impact that has on volatility and default risk”, he said.

The risk of the average high-yield bond defaulting in one year has halved over the past two decades to less than 4%. There is significant variation within this, however. BB bonds have historically had a 0.6% chance of default over the past 25 years, compared to an almost 25% chance in CCC bonds.

Additionally, it is a much shorter duration market, meaning investors’ cash is tied up for a shorter time and therefore the risk of default is relatively lower. The average maturity of a high-yield bond is around four years.

Composition of high yield market and default risk over the past 20yrs

Source: Artemis, ICE BofA Merrill Lynch Global High Yield Constrained index. Data accurate as of 31 Dec 2024

He added that, while government and investment-grade bonds are currently appealing, they do not offer much room for outperformance or asset allocation. A 130-basis-point difference in Treasuries is a big deal but, by contrast, high-yield bonds could have yields as low as 5% and as high as 22%, if you are more adventurous.

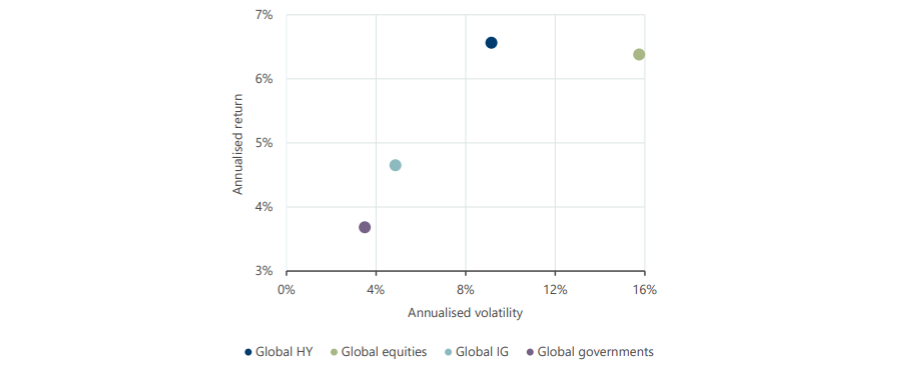

Because there is such a wide variation between different parts of the fixed income market, active managers can find opportunities that match or surpass other asset classes. For example, the chart below shows high-yield bonds have outperformed global equities, with lower risks, on an annualised basis.

Annualised performance and volatility of asset classes since 2020

Source: Artemis

“I fundamentally do not understand why you would be petrified of high-yield but are perfectly happy to own global equities,” he said.

The average fixed income investor has also developed an overtly simplistic and pessimistic approach to credit spreads, according to Holmes. While spreads have been wide in the past, such as during the 2008 global financial crisis or the 2020 pandemic, they never remain that way for long.

“There is almost no chance you will be able to time the market and purchase high-yield bonds at peak spread. I would argue it is farcical to wait for spreads to widen to begin with,” he said.

Most of the time, spreads are relatively tight. Investors would have made some of their best returns by being optimistic and buying BB bonds early and waiting for the spreads to widen, rather than waiting for a catalyst to buy them at all.

“Fixed-income investors will tell you to wait for those really wide periods and only then is it worth buying high yield, but you would be better off doing the opposite”, he said.

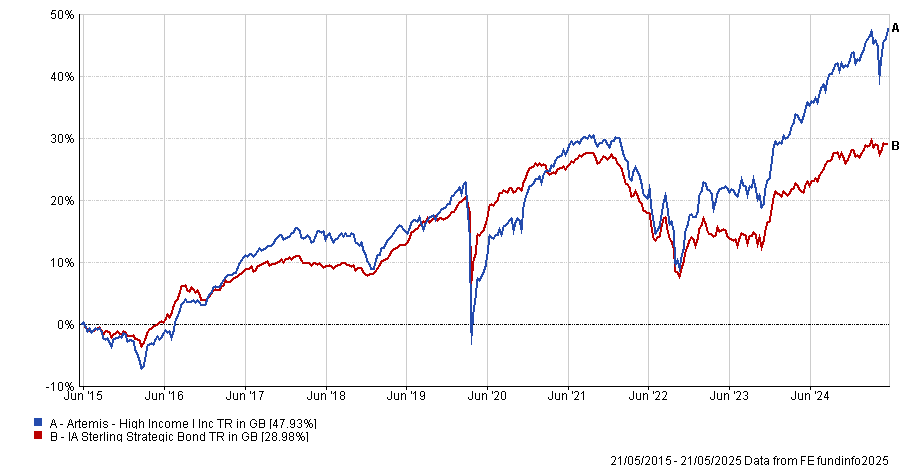

Over the past one, three, five and 10 years, his Artemis High Income fund has delivered top-quartile returns in the IA Sterling strategic bond sector. He said this performance is due to his more optimistic credit selection, such as a 53% allocation to high yield bonds.

Performance of the fund vs the sector over 10 yrs

Source: FE Analytics

“Fixed income investors have confirmation bias: They look for reasons to be pessimistic and cautious. They will never be the type of people who want to go be adventurous and look for opportunities. I think that is a mistake”, he concluded.