After years of growth stocks dominating returns, income is finally poised for a resurgence, according to Mark Jackson, multi-asset specialist at JP Morgan Asset Management.

Investors have not worried about equity diversification in their portfolios for years, he explained, as the post-pandemic environment has been led by a handful of high-growth stocks known as the Magnificent Seven (Apple, Nvidia, Microsoft, Tesla, Amazon, Meta, Alphabet).

This has been to the detriment of equity income strategies, which do not own these top performers as they generally produce low or zero dividends.

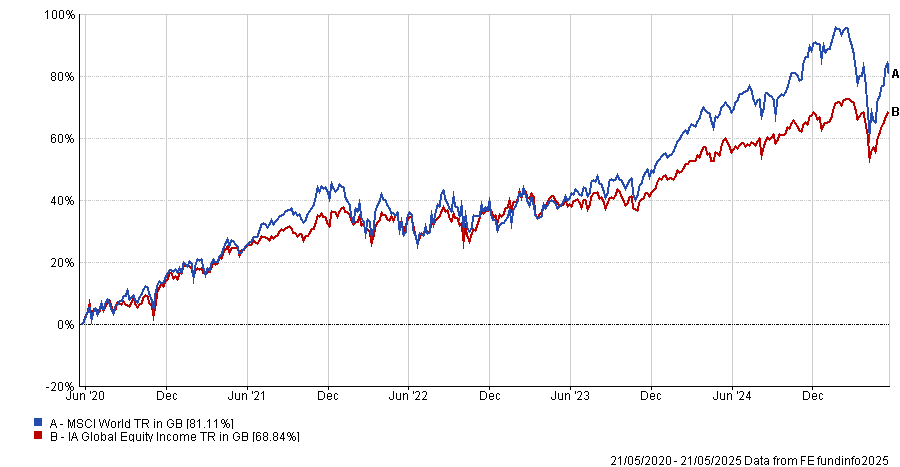

As a result, while the average IA Global Equity Income fund is up 68.8% over the past five years, investors could have outperformed by just tracking the MSCI World.

Performance of sector vs index over the past 5yrs

Source: FE Analytics

Meanwhile government bonds offered increasingly appealing yields on a relatively stable asset class as interest rates rose post-pandemic. In a period where most government bonds offer a yield of around 4%, equity income has been unappealing, he argued.

It has therefore been a “relatively easy trade” to own government bonds over the past five years alongside a broad equity market tracker, rather than turning to equity income strategies.

However, “I think more recently, that is starting to change and we are seeing a case for diversification working again,” Jackson explained.

Volatility around president Donald Trump’s fluctuating approach to trade has shaken markets this year. While most have recovered from their initial ‘Liberation Day’ sell-offs, Jackson said increased volatility is strengthening the case for income in portfolios.

It is becoming difficult to believe this will be another year where “everything goes up together” or where “equities could do another 20% rally”, meaning more differentiated and reliable sources of returns, will become more appealing.

Equity income strategies can serve as a “ballast” within portfolios if volatility is here to stay because high dividend stocks are generally low beta, meaning they offer you a reliable source of income while being “much less racy and much more consistent” in periods of market volatility, he said.

Jackson also argued equity income is more compelling because dividend stocks are extremely undervalued. Growth names, such as the Magnificent Seven, have done so well that their valuations have been pushed to historic highs.

While he conceded this has been true for several years, the valuation gap between dividend stocks and growth stocks is wide enough that “even if growth becomes cheaper and income becomes more expensive, equity income will still be attractively valued”. While investors wait for valuations to narrow, these companies are generating a return from income, meaning they are getting "paid to wait".

“We are getting more questions from clients about where they can go for income and we are seeing greater flows into our income strategies from investors. I think that will become a theme across the market this year," he explained.

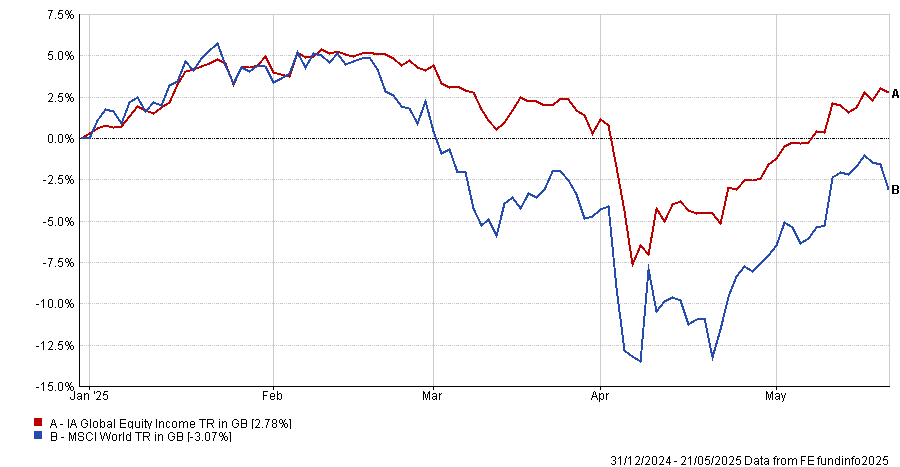

Indeed, global equity income strategies are outperforming this year, with the average global equity income fund up 2.8%, while the MSCI World is down by 3%. Additionally, a study from Trustnet last month found that equity income funds were some of the best performers this year, offering great protection through the ‘Trump slump’.

Jackson conceded this is a relatively short time frame and the market could certainly rally again if it gains more clarity on tariffs and trade. However, he argued recent outperformance indicates a change in investors' priorities.

Performance of sector vs index year to date

Source: FE Analytics

Additionally, the potential for more interest rate cuts will be another tailwind for equity income as concerns about a weaker global economy will prompt further rate cuts from the European Central Bank, Bank of England and Federal Reserve, which will bring rates “closer to long-term averages”, he said.

While it is “unrealistic to assume that we will return to zero interest rates” even a cut of 1 or 2 percentage points this year will lower the yield of government bonds, encouraging investors to find a more diversified source of income.

“You will not be able to just sit on government bonds and get the same level of risk-free income anymore”, he argued. In this environment, dividend yields will look more attractive, increasing the demand for equity income strategies.

“I think from here there are interesting opportunities for income investors to differentiate themselves. In a more uncertain market, income is finally becoming a core part of your total return again.”