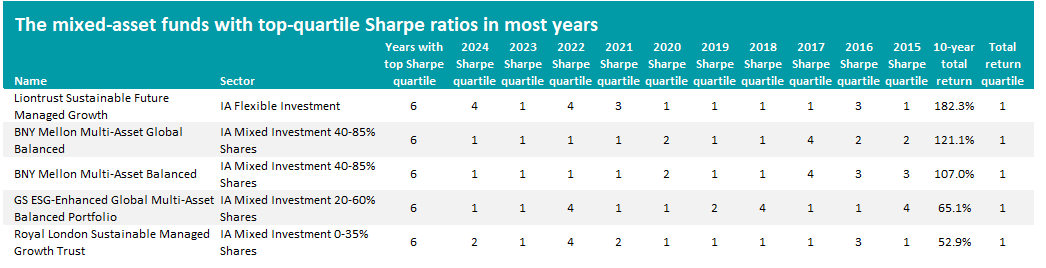

Just five funds in the Investment Association’s four multi-asset sectors have consistently been among the top of their peer group for the Sharpe ratio, according to Trustnet research.

The Sharpe ratio calculates an investment’s return in excess of the risk-free rate relative to its volatility, as measured by standard deviation. Investments with higher Sharpe ratios are considered more efficient, as they offer greater returns for the level of risk taken.

In this series, Trustnet is analysing the Sharpe ratios of funds over the past decade to identify those that have achieved a top-quartile ranking in their sector for at least six of those years for this key risk-adjusted performance metric.

Here, we looked at the four mixed asset sectors – IA Flexible Investment, IA Mixed Investment 40-85% Shares, IA Mixed Investment 20-60% Shares and IA Mixed Investment 0-35% Shares – to find out which funds have consistently generated the best Sharpe ratios.

Source: FE Analytics. Total return in sterling between 1 Jan 2025 and 31 Dec 2024.

There are 328 funds with a track record of at least 10 years spread across these four peer groups but only five – or 1.5% – have made the shortlist in this research. They can be seen in the table above, with their quartile rankings for Sharpe ratio in each year and their total return over the 10 years to the end of 2024.

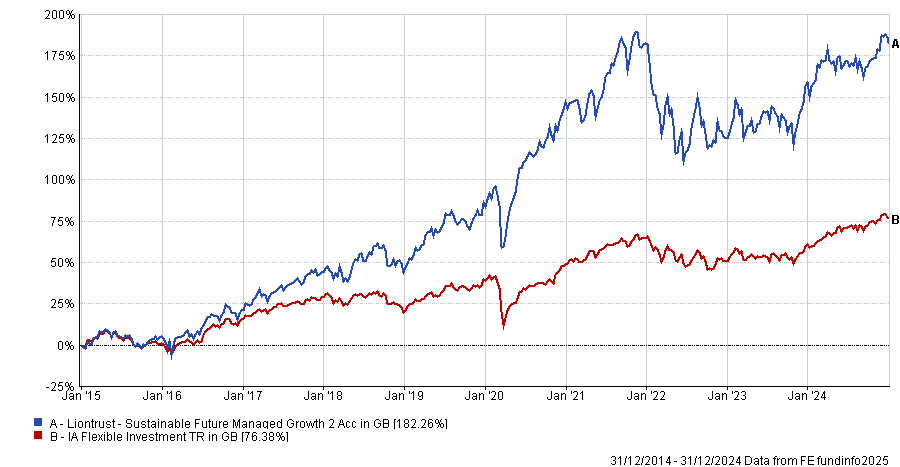

We’ve ranked the funds by their 10-year returns, which means Liontrust Sustainable Future Managed Growth is at the top after making 182.3%. This compares with a return of 76.4% for its average peer in the IA Flexible Investment sector.

Managed by Peter Michaelis, Simon Clements and Chris Foster, the fund’s approach revolves around the belief that sustainable companies can generate stronger growth and are more resilient than the market expects. The managers invest in companies tied to several themes, such as better resource efficiency and improved health, but also work with an external independent advisory committee of leading sustainability experts.

Analysts at Square Mile Investment Consulting & Research said: “The managers have demonstrated they can deliver robust returns following this tried and tested process but the approach can lead to a return profile that is more volatile than many peers. However, we think over the long term it can deliver superior returns.”

Performance of Liontrust Sustainable Future Managed Growth vs sector between 1 Jan 2015 and 31 Dec 2024

Source: FE Analytics. Total return in sterling between 1 Jan 2025 and 31 Dec 2024.

BNY Mellon has two funds on the list: BNY Mellon Multi-Asset Balanced and BNY Mellon Multi-Asset Global Balanced, both of which reside in the IA Mixed Investment 40-85% Shares and are managed by Newton’s Simon Nichols, Bhavin Shah and Paul Flood.

Funds managed by Newton make use of the asset management house’s global thematic investment approach, which identifies long-term ‘big picture’ themes such as financialisation, evolving trade and big government.

The top-down framework is combined with bottom-up research to discover the companies best-placed to benefit from these themes. The fund will also hold assets with a low correlation to equities to dampen volatility.

David Copsey and Shoqat Bunglawala’s GS ESG-Enhanced Global Multi-Asset Balanced Portfolio is the fourth on the shortlist, after posting top-quartile Sharpe ratios in six years with a 10-year total return of 65.1%. This is below the triple-digit returns of the three previous funds, but enough to put it in the first quartile of the IA Mixed Investment 20-60% Shares sector.

Goldman Sachs views long-term strategic asset allocation as the main driver of returns, so this fund tilts its portfolio depending on the current stage of the market cycle (recession, recovery, expansion, late cycle). To do this, it invests mainly in other funds managed by Goldman Sachs Asset Management, although it can also hold external funds.

Royal London Sustainable Managed Growth Trust is the final fund to meet the criteria for inclusion on the shortlist. Managed by Shalin Shah and Matthew Franklin, the fund has made 52.9% over the decade we examined, putting it in the top quartile of the IA Mixed Investment 0-35% Shares sector.

Analysts at Rayner Spencer Mills Research said: “Performance over the long term has been good and is testament to the in-depth analysis carried out by the team. They should be capable of continuing to deliver competitive risk-adjusted returns whilst focusing on investments which are helping to make a positive change to society and the environment.”