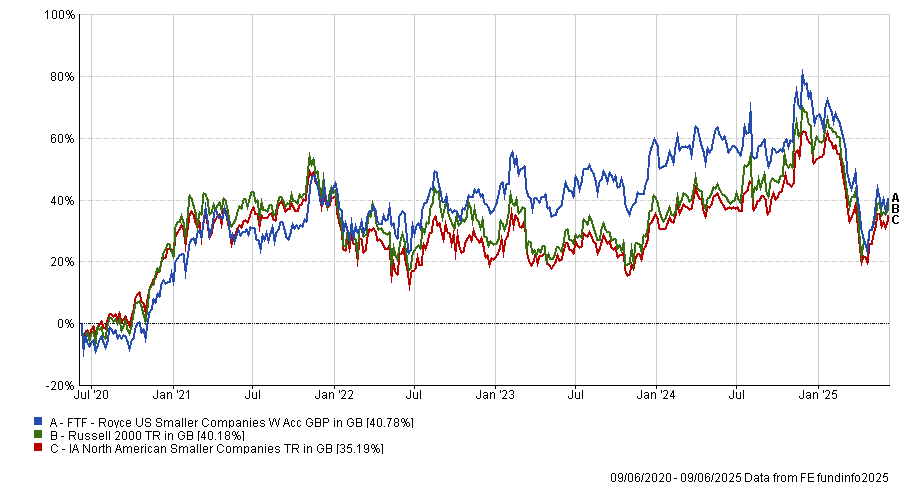

RC Brown has scaled back its US exposure in recent months but is still backing a trio of active strategies that Glenn Meyer, head of managed funds, believes are well placed for the next phase of the cycle.

“We don’t think the US is as good a place to be looking forward as it has been,” he said. “Global growth is slowing and America is likely to slow even more because of its trade policy.”

He pointed to the inflationary impact of new tariffs and the policy uncertainty surrounding the region, which “makes it difficult to judge” where interest rates will ultimately settle.

“We’re getting a lot of information from the Federal Reserve about tariffs being inflationary,” he said, “but the policy landscape changes so quickly that it's very difficult for us to assess where interest rates will actually be.”

As a result, RC Brown’s exposure to the US is now below its weighting in global indices such as the MSCI World. However, the firm has kept its core allocations in place – built around a quantitative-driven large-cap fund, a mid-cap specialist and a small-cap manager, the latter of which Meyer said provides a useful insight even at a minimal weighting.

The largest part of RC Brown’s US allocation remains an actively managed quant fund. Meyer said this reflects the difficulty of consistently outperforming in such an efficient market.

“A lot of trade goes through the US market, so pricing is fairly efficient in the large-cap area,” he said. “We’ve stuck with an active quant fund because it gives us broad exposure with a growth tilt.”

To complement that, Meyer added the Baillie Gifford American fund, as it remains one of the strongest options for gaining access to long-term growth trends in the US.

“The US has been a growth market for a long time, particularly when interest rates were very low. That’s where discounted future earnings matter most, so we added a dedicated growth fund on top of the index-like quant allocation.”

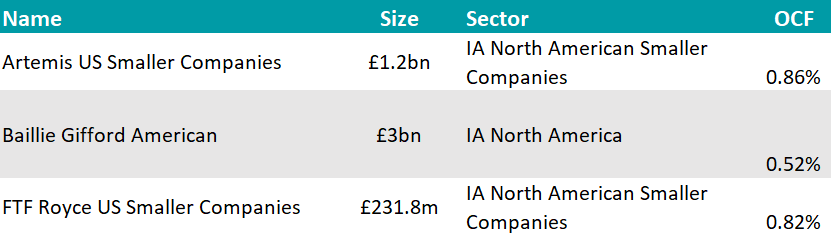

This £3bn fund is co-managed by Gary Robinson, FE fundinfo Alpha Manager Tom Slater, Kirsty Gibson and Dave Bujnowski and is rated by both FE Invest and RSMR analysts.

It had stellar years in 2020, 2023 and 2024, when it was top-decile for returns against the IA North America sector, but fell a very long way in 2021 and 2022, when it ranked as the second-worst fund in the 200-strong peer group.

Performance of fund against index and sector over 5yrs

Source: FE Analytics

Meyer is not betting exclusively on growth, however.

“Growth won’t always be the dominant style,” he said. “So we’ll introduce a value-tilted fund to balance that out, depending on what’s driving returns at the time.”

While large-cap tech has dominated US returns in recent years, Meyer said the firm is focused on areas of relative inefficiency further down the market-cap spectrum – particularly among small-caps.

“If you’re looking for undiscounted growth opportunities, you need to go to mid- and small-caps,” he said. “Everyone knows everything about the largest companies – and the rise of index investing means they keep getting more attention.”

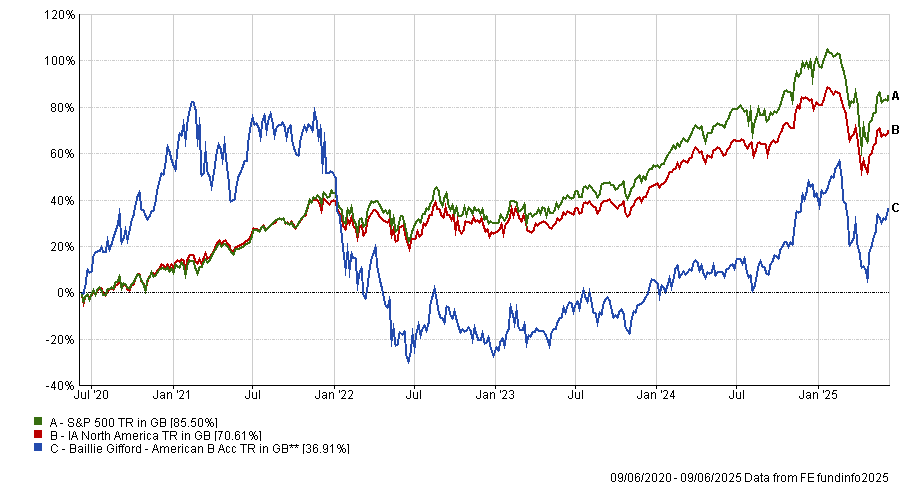

To tap into these opportunities, he allocated to Artemis US Smaller Companies, run by Cormac Weldon and Olivia Micklem – recently increasing his positions in the fund slightly.

“My feeling is that in three to six months’ time this fund will have recovered quite well having gone through a fairly torrid time,” he said.

This year has been difficult so far, as was 2022 and many of the years prior to 2024. Last year itself was more positive, with the fund achieving the second-best return of the whole IA North American Smaller Companies sector. The fund also came out on top over the past five years, as the chart below shows.

Performance of fund against index and sector over 5yrs

Source: FE Analytics

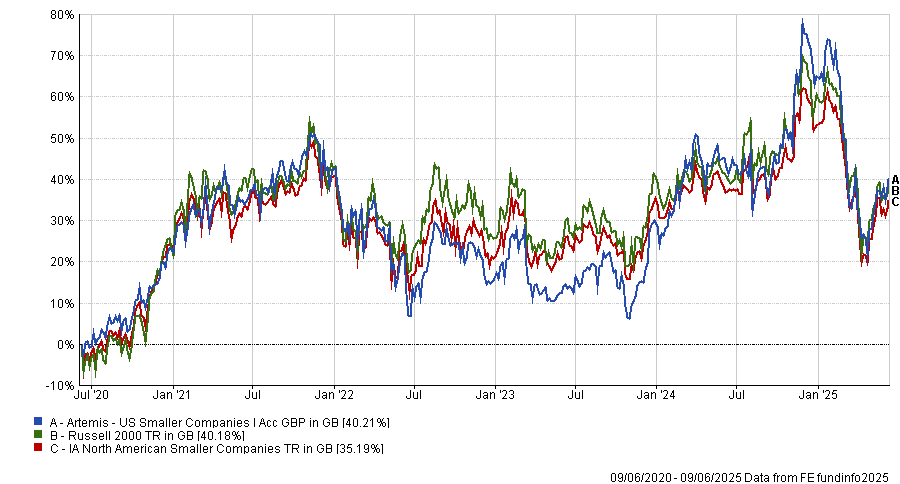

Finally, alongside the Artemis fund, Meyer believes Lauren Romeo’s FTF Royce US Smaller Companies, which offers a different lens on US small-cap quality stocks, is another strong choice.

Although the weighting is “currently minimal”, the fund picker said this solution is still useful as a barometer of sentiment and strategy.

“If I sell out of it entirely, how am I going to get the feel of whether Romeo’s approach is working?” he asked. “We don’t do in-and-out decisions – we tend to flex our position sizes depending on conditions.”

Performance of fund against index and sector over 5yrs

Source: FE Analytics

A turnaround in small-caps is far from certain, Meyer admitted, especially in the US. But he remained positive that the trade uncertainty caused by tariffs will settle down and whenever that will be the case investors have to be ready.

“In Europe and the UK, small-caps are coming back,” he said. “In the US, there’s still a lot of uncertainty – but if the trade volatility eases and regional companies start looking undervalued again, that’s when these strategies will benefit.”

Until then, RC Brown is maintaining its underweight but keeping the tools in place to react when market conditions shift.

“We’re not walking away from the US, we’re just choosing our exposure more carefully,” he concluded.