The recent popularity of defence stocks has made it challenging to find opportunities that still have room to run, according to Fidelity’s Alex Wright.

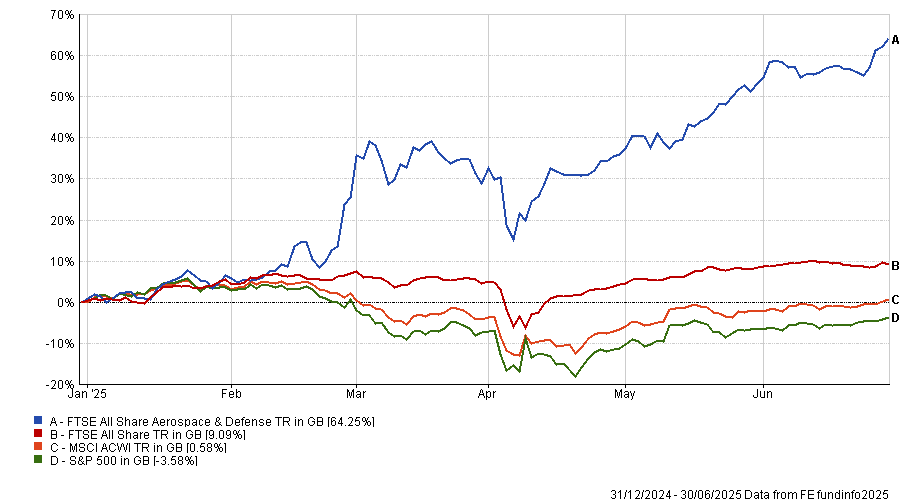

As geopolitical tensions boiled over, defence investment has been thrust into the limelight, with NATO members recently committing to spending 5% of GDP on defence. This is the latest in a string of positive developments for defence companies, causing the FTSE All Share Aerospace & Defense index to climb 64.3% so far this year.

This is significantly ahead of the wider FTSE All Share (up 9.1%), as well as the S&P 500 and the MSCI AC World, as seen in the chart below.

Performance of the indices year to date

Source: FE Analytics. Total return in sterling

Following this, defence-focused funds have surged in popularity. For example, the WisdomTree European Defence ETF has accumulated $3bn in capital in just three months.

However, Wright explained: “I think defence has become extremely fashionable and therefore valuations are too high, so we’re reducing it.”

This marks a turnaround in Wright’s approach, with his Fidelity Special Values trust and Fidelity Special Situations fund typically having very high allocations to defence, he explained.

While both portfolios currently hold Babcock, Serco and Rolls-Royce, these positions were heavily reduced since 2020, due to most of the surge in defence spending being already priced in.

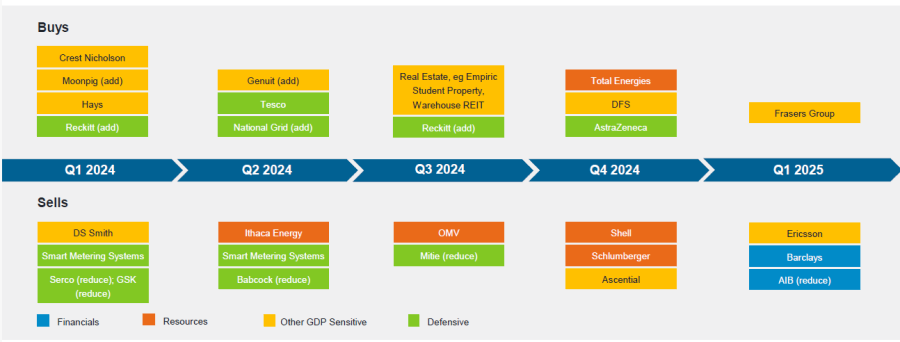

Recent trades in Fidelity Special Situations and Special Values

Source: Fidelity International.

While he conceded that the defence has done “a lot better than we would have expected”, other areas appeared more compelling: “Overall, I think defence has become fashionable, but I would say banks are coming back and have a lot further to go.”

For the first time since 2016, Wright has raised his allocation towards Lloyds Bank. Restrictive regulations hit banks hard and Lloyds had particularly suffered, but the tone seems much better from here, the Fidelity manager said.

“In the UK, there’s been an easing of the regulatory burden, which had been very onerous for banks,” he said.

Partially, this is because of the need to remain globally competitive. The US is making “a lot of noise” about deregulation and if other developed markets do not follow suit, the US will continue to drain capital from the rest of the world. To prevent this, he argued that regulators have been easing up on banks.

Most UK banks are also extremely cash-generative with plenty of excess capital, he explained. Traditionally, banks used this capital to fund share buybacks, but as banks perform well, buybacks become more expensive. As a result, many UK banks are opting to grow through buying out smaller competitors.

“It makes a lot more sense for these banks to buy other banks, rather than buy your own, which is essentially what you do in share buybacks,” he said.

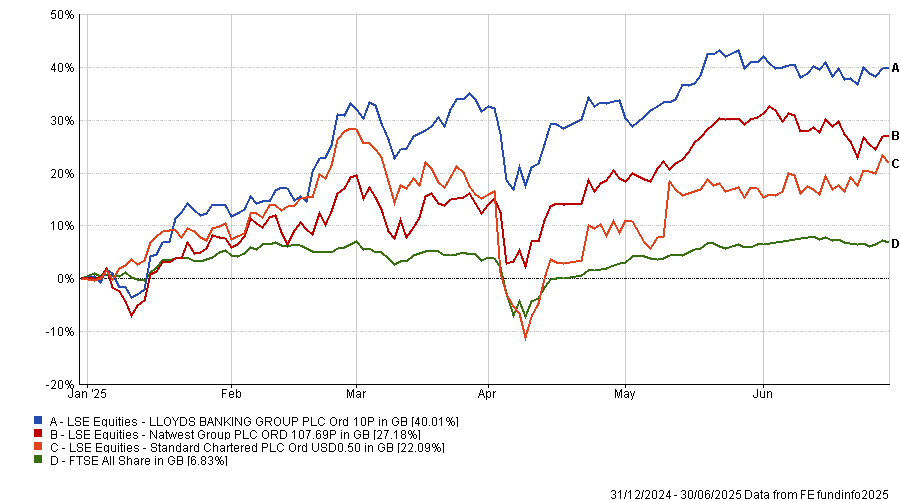

As a result, Wright also holds significant positions in NatWest and Standard Chartered. All three banks are up so far this year, as demonstrated on the chart below.

Share prices vs the index year to date

Source: FE Analytics. Share price in sterling

However, he noted that he is not positive on banks universally, with the increased position in Lloyds being funded by selling out of Barclays.

The more domestic companies in the UK index have also been appealing this year, he explained. Businesses that are sensitive to gross domestic product (GDP) are becoming more attractive in a period where dollar assets seem to be risky. Additionally, the UK consumer is in a much stronger position than the narrative suggests.

“I think the interesting thing this year is that consumers have a lot of money, with wage increases above the level of Inflation and savings at a very high level,” he said. “There has just not been that confidence to spend.”

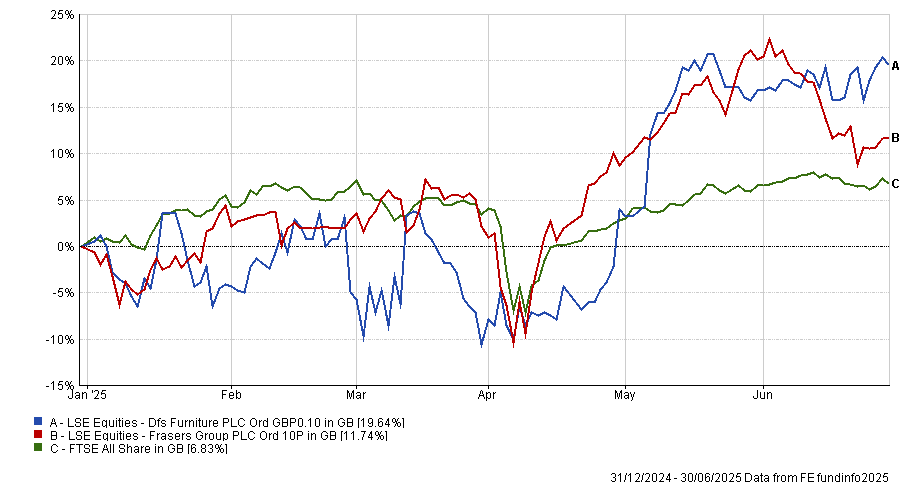

Playing on this, one of the biggest recent additions to the portfolio is Frasers Group, formerly known as Sports Direct.

Trading at a price-to-earnings ratio of just 6x, despite a strong balance sheet, it is an “exceptional value” opportunity. Additionally, Frasers Group is “very different” to its average competitor because it has stakes in many other retail companies, such as Hugo Boss and ASOS.

Another domestic stock Wright favoured this year is sofa retailer DFS. It rallied after some very depressed market sales and is benefiting from challenges to some of its more direct competitors, such as SCS.

Share prices vs the index year to date

Source: FE Analytics. Share price in sterling

“These more UK domestic areas have been a theme for us this year,” Wright said. “It’s been out of value and out of favour and therefore has good valuations. We can buy into those.”

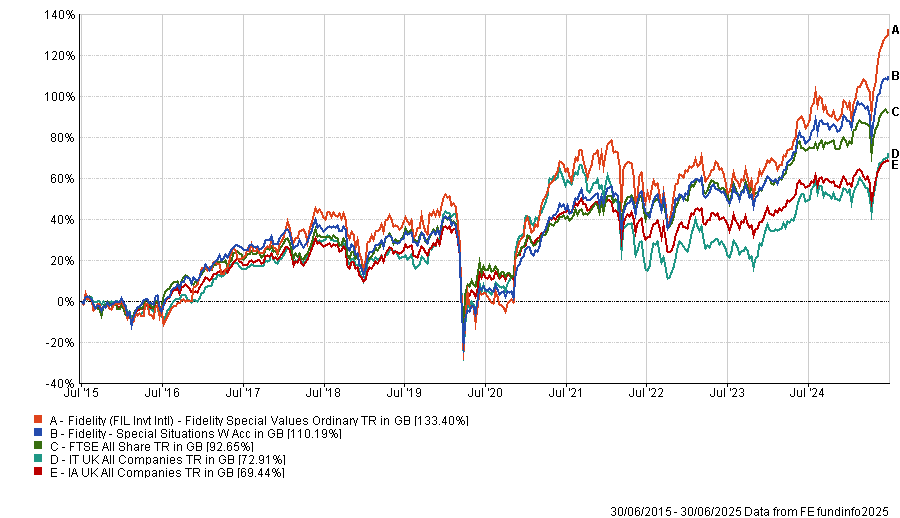

Over the past one, three, five and 10 years, Fidelity Special Situations and Fidelity Special Values have delivered top-quartile returns in the IA UK All Companies and IT UK All Companies sectors, respectively.

Performance of strategies vs sectors and index over the past 10yrs

Source: FE Analytics