Investors would have been rewarded by holding European stocks, banks and funds investing in gold over the opening half of 2025, research by Trustnet shows.

The first half of the year has been more turbulent than investors would have liked, with US president Donald Trump’s new administration sparking a cycle of market sell-offs and rallies through its upheaval of the global order in areas such as trade, defence and diplomacy.

Below, we look at the market from a range of viewpoints to find out which asset classes, stocks and funds made the highest returns over the past six months.

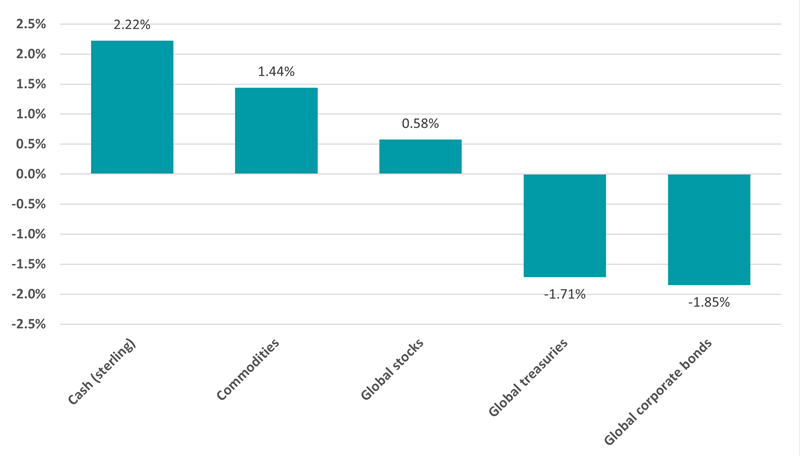

Performance of asset classes in 2025’s first half

Source: FinxL. Total return in sterling between 1 Jan and 30 Jun 2025

Cash has been the best-performing asset over the past six months, followed by commodities. Global equities, represented by the MSCI AC World index, eked out a small positive return in sterling terms.

However, this headline figure conceals the widely different performance of equities in the first and second quarters of the year: the MSCI AC World fell 4.3% in the first quarter but was up 5.1% in the second.

The opening quarter was especially weak because investors pulled back from the so-called Magnificent Seven (Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia and Tesla), which had led the market for several years.

But sentiment recovered in the second quarter as markets shook off the initial ‘Liberation Day’ tariff shock and rallied when Trump later paused or reduced them.

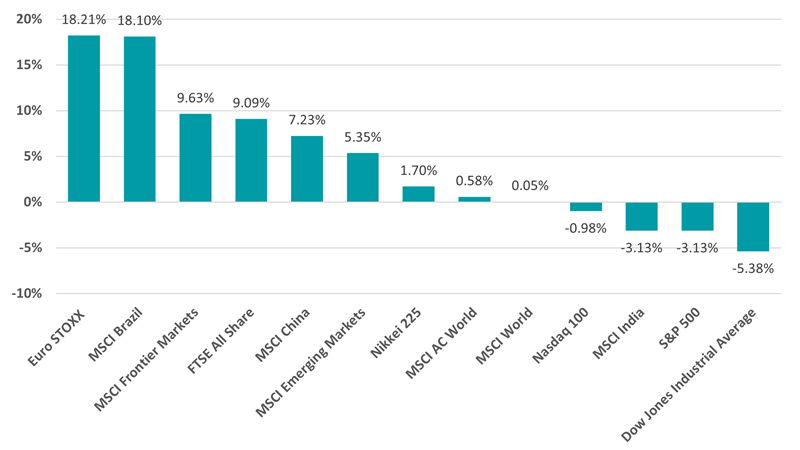

Performance by region in 2025’s first half

Source: FinxL. Total return in sterling between 1 Jan and 30 Jun 2025

Ben Yearsley, director at Fairview Investing, described the opening half of 2025 as “generally good”, pointing to the strong performance of European equities and “creditable” showing from UK stocks.

“The interesting one is the US, where despite a fresh record high for the S&P, the year-to-date gain of 5.44% has been more than wiped out by currency losses – very few investors hedge their equity exposure,” he added.

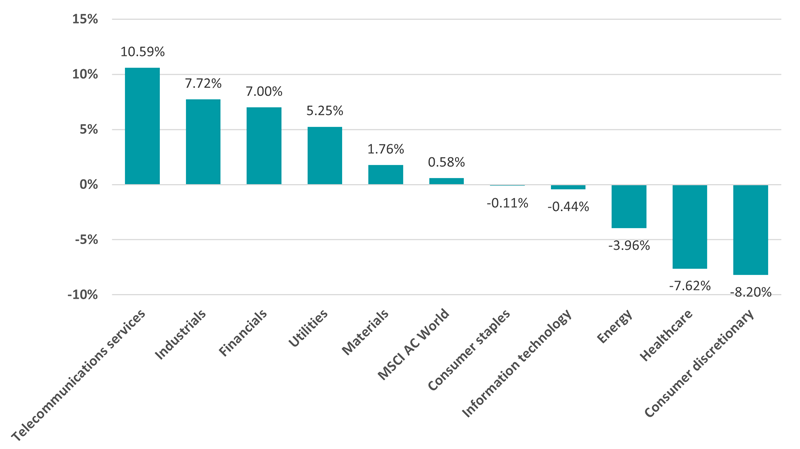

Performance of equity sectors in 2025’s first half

Source: FinxL. Total return in sterling between 1 Jan and 30 Jun 2025

Telecommunications topped the list of equity sectors, returning over 10% in sterling terms, as they benefited from resilient cash flows and growing investor appetite for stable yield. Industrials, financials and utilities also outperformed the wider global index.

Conversely, there was sharp underperformance from consumer discretionary and healthcare stocks. Discretionary companies struggled with subdued consumer demand on the back of inflation worries and real wage stagnation, while healthcare’s headwinds include regulatory uncertainty, pricing pressures and patent cliffs.

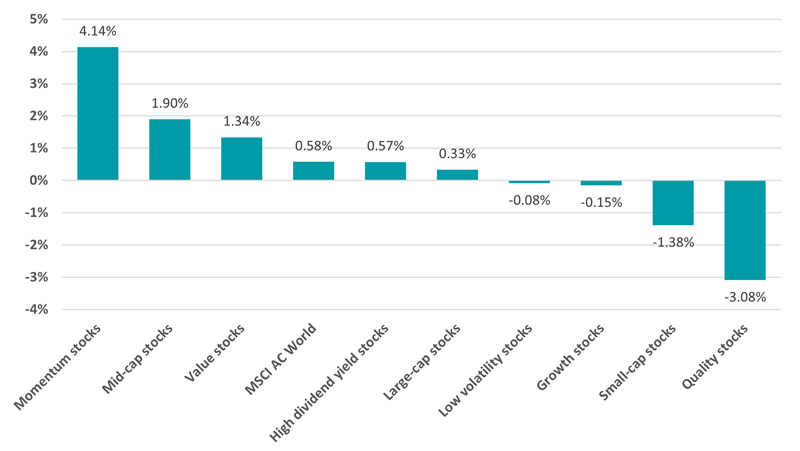

Performance of investment factor in 2025’s first half

Source: FinxL. Total return in sterling between 1 Jan and 30 Jun 2025

This environment favoured momentum stocks as investors moved towards recent winners, while quality stocks suffered from little new upside to justify higher prices.

A look at the composition of the underlying indices – MSCI ACWI Momentum and MSCI ACWI Quality – also helps explain their performance in 2025’s first half. The momentum index has a lower allocation to areas like the US, tech stocks and healthcare than the quality index, with more in financials, industrials and utilities.

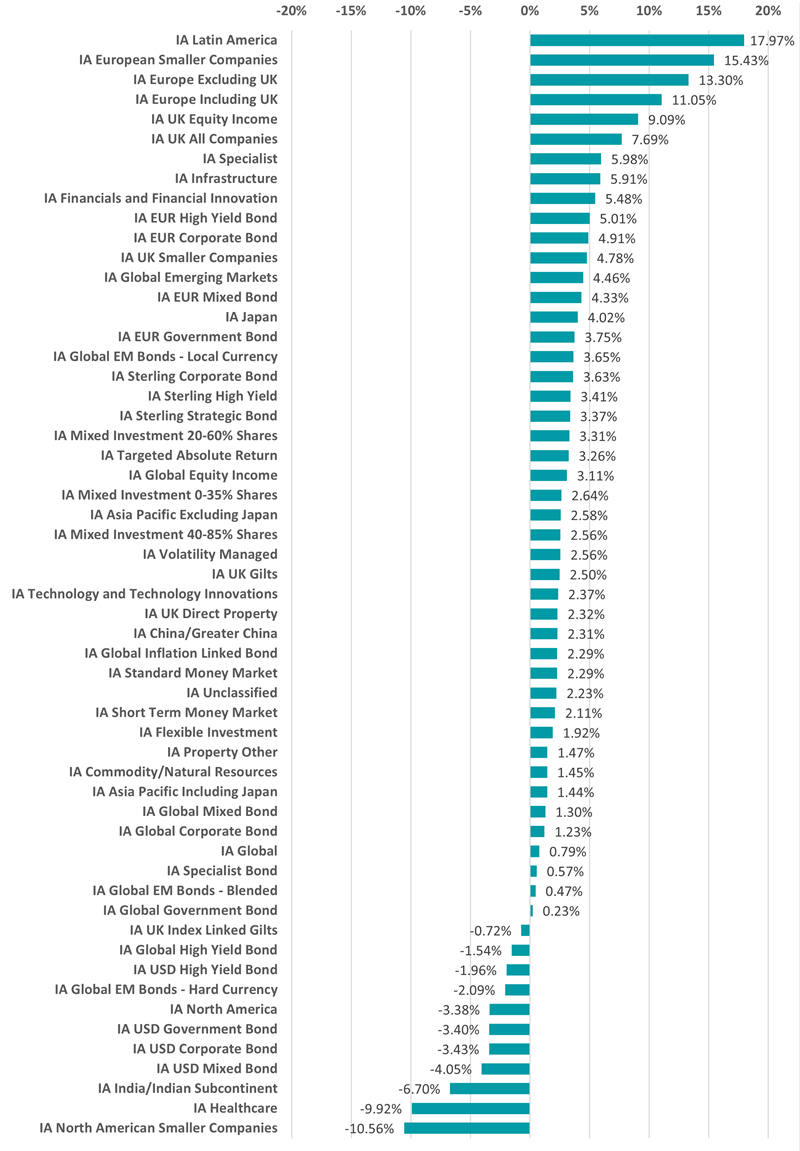

Performance of fund sectors in 2025’s first half

Source: FinxL. Total return in sterling between 1 Jan and 30 Jun 2025

Within the Investment Association sectors, IA Latin America was the best-performing peer group over the past six months with an average return of just under 18%. BlackRock GF Latin American made the highest return here, up 24.8%, followed by iShares MSCI EM Latin America UCITS ETF (18.5%) and Barings Latin America (18.5%).

As geopolitical tensions and valuations have risen elsewhere, investors turned their focus to Brazil and Mexico. Both countries’ stock indices are at record highs, yet still trade at a steep discount to developed peers.

The macro environment has been supportive, with a softer dollar lifting local currencies, rate cuts gaining traction and sovereign bond yields remaining appealing. This combination of relative political calm, favourable carry trades and historically discounted stocks has sharpened the appeal of Latin America in 2025.

The three European fund sectors followed, all making double-digit average returns. European equities have gained significant traction in 2025 as investors pivot away from the uncertainty surrounding US policy.

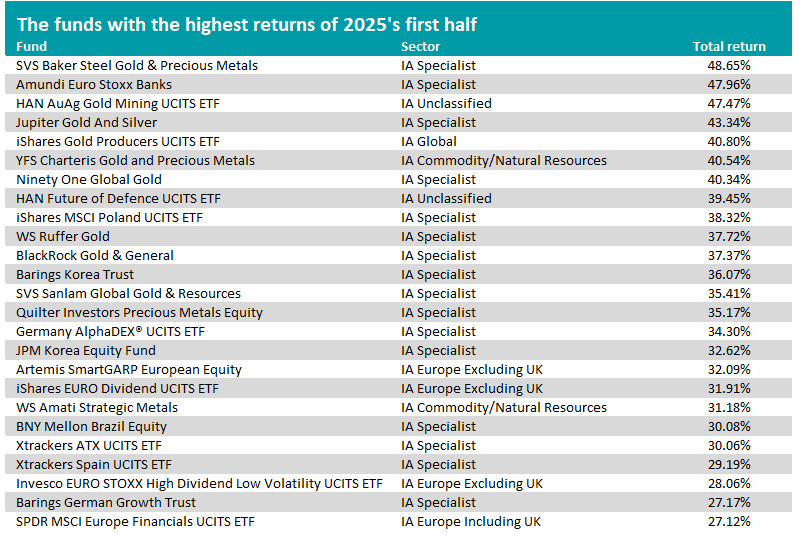

Source: FE Analytics. Total return in sterling between 1 Jan and 30 Jun 2025

When it comes to individual funds, however, gold was the main theme. As the chart above shows, seven of the 10 best-performing funds over the past six months are gold strategies, with SVS Baker Steel Gold & Precious Metals making 48.7%.

Investors have increasingly turned to gold in 2025, driven by a blend of geopolitical shocks and persistent economic uncertainty. Tensions in the Middle East, renewed US tariff threats, and ongoing trade disputes have rekindled demand for safe-haven assets like gold, contributing to its climb to record highs.

At the same time, a weakening US dollar and expectations of rate cuts from the Federal Reserve have bolstered gold’s appeal relative to non-yielding assets. Central banks, notably in China and Russia, have maintained aggressive gold buying to diversify reserve holdings, reinforcing upward pressure on prices.

Several other themes are represented in the table above, including Europe’s outperformance (Artemis SmartGARP European Equity, iShares EURO Dividend UCITS ETF), strong banks (Amundi Euro Stoxx Banks, SPDR MSCI Europe Financials UCITS ETF) and higher spending on defence (HAN Future of Defence UCITS ETF).