With US president Donald Trump shaking up trade, diplomacy and the post-war global order, Europe is set to benefit from investors’ rotation away from North America – and there are several funds that the experts think could benefit from this.

With European GDP projected to grow, inflation expected to decline and freshly tilled trade agreements with the world beyond the US, Trustnet has asked fund pickers for their favourite portfolios set to capitalise on European recovery.

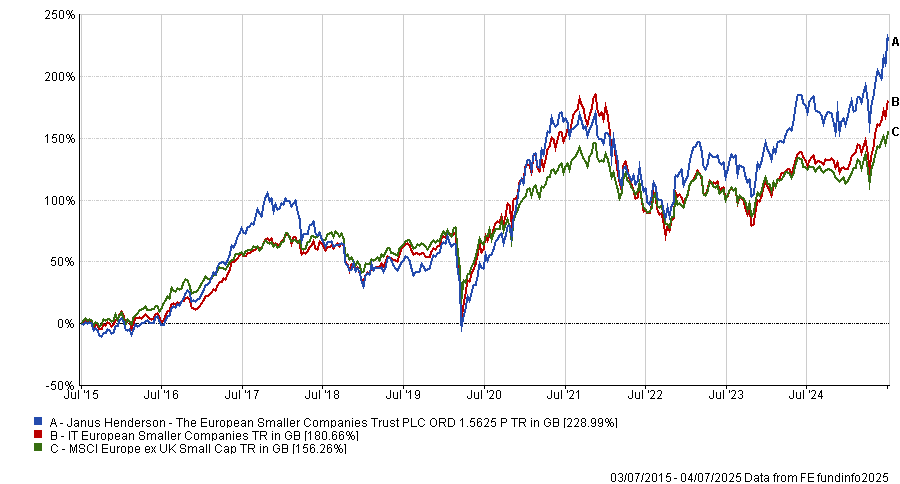

Alex Watts, senior investment analyst at interactive investor, noted that Janus Henderson’s The European Smaller Companies Trust has a strong track record investing in small- and mid-caps in Europe excluding the UK.

Managed by Ollie Beckett, alongside deputy managers Rory Stokes and Julia Scheufler, the trust spans 120 diverse companies – from early-stage to turnaround plays.

Industrials and telecom, media and technology make up nearly half of the portfolio. Although 2024 ended on a sour note for European industrials, 2025 so far has been a different story, with top holdings such as TKH and KSB demonstrating a solid performance, “tying into the story of an uptick in European manufacturing and industrial production”, Watts said.

Despite higher volatility than its benchmark (23.2% annualised), the trust has outperformed over 10 years.

Performance of trust vs sector and benchmark over 10yrs

Source: FE Analytics

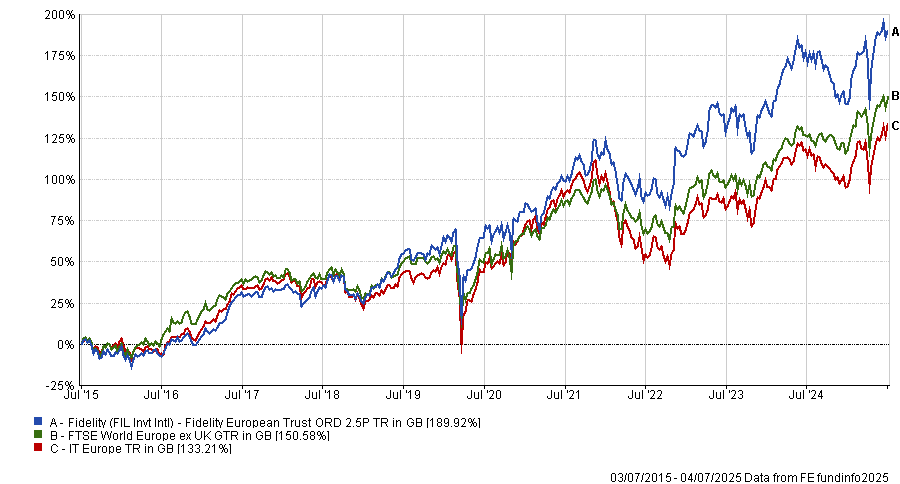

Matthew Read, senior analyst at QuotedData, flagged Fidelity European Trust as an attractive fund that “looks well-positioned to harness Europe’s long-awaited recovery”.

He noted that the trust has one of the strongest long-term performance records in its peer group, tending to target a blend of resilient European global champions, such as SAP and Novo Nordisk.

Performance of trust vs sector and benchmark over 10yrs

Source: FE Analytics

The trust’s planned merger with Henderson European Trust could create a £2.1bn powerhouse that is better resourced to capture US rotation flows, said Read.

“This should help keep the discount narrow, but shareholders also have the comfort of the trust’s policy to maintain the discount in single digits in normal market circumstances,” he added.

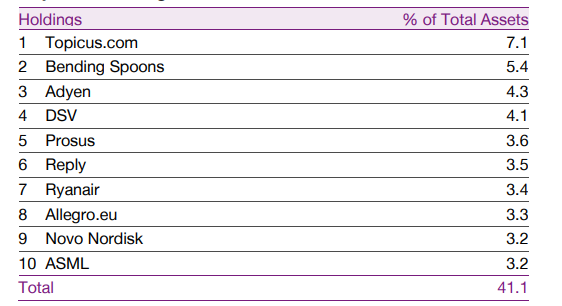

Read also flagged Baillie Gifford European Growth as well-positioned to benefit from Europe’s long overdue recovery.

“The trust is the most growth-focused of its peers and, following a bumper period during Covid, this has weighed on its performance during the last four years, leaving it on a circa 9% discount – the widest in its peer group,” said Read.

With the narrative around Europe shifting, Baillie Gifford European Growth offers a portfolio trading at a discount that is focused on high-quality franchises with underappreciated structural tailwinds that Read argued should be able to surprise on the upside.

Baillie Gifford European Growth’s top ten holdings as of 31 May 2025

Source: FE Analytics

“If the recovery doesn’t play out, shareholders also have the comfort of a 100% tender offer if [the trust] fails to outperform its benchmark over the four years to the end of September 2028,” Read noted.

For a more concentrated portfolio, Jason Hollands, managing director at Evelyn Partners, picked Liontrust European Dynamic – a fund with up to 35 holdings, managed by James Inglis-Jones and Samantha Cleave.

“The managers believe that cash flow is a far more reliable guide to profit forecasts,” said Hollands, noting that this approach is often underappreciated by investors who instead put too much store on profit forecasts.

The fund blends cash flow screening with proprietary indicators like investor anxiety and corporate aggression to target either growth or value, Hollands explained.

“This approach has delivered very strong results and, importantly, delivered outperformance in both value and growth-led markets.”

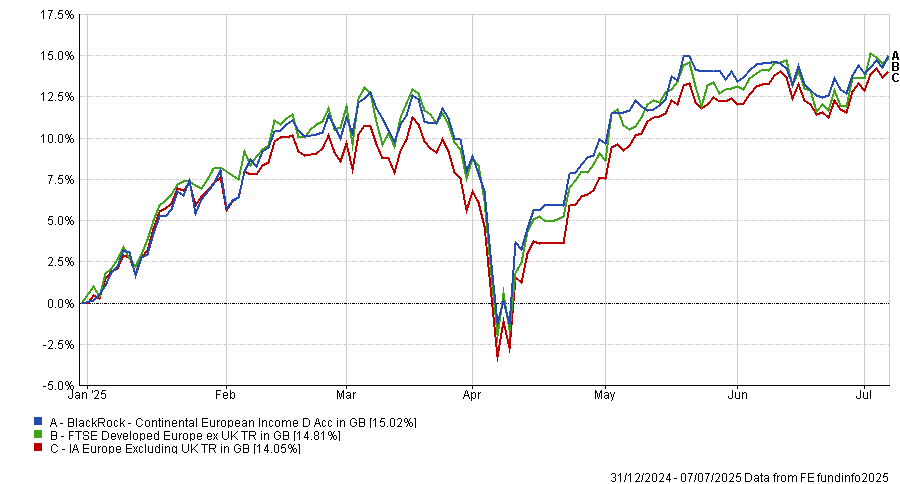

Hargreaves Lansdown senior investment analyst Kate Marshall has earmarked BlackRock Continental European Income as an attractive choice.

“It isn’t your typical value fund, but its focus on income does mean it leans towards value at times,” Marshall said.

Co-managed by Brian Hall and Andreas Zoellinger, the fund aims to provide investors with an attractive income alongside growth in their investment, targeting both growth and value stocks.

It currently invests around 60% across financials and industrials businesses, which has helped the fund’s performance so far this year.

Performance of fund vs sector and benchmark YTD

Source: FE Analytics

With so much geopolitical and economic volatility and uncertainty, dynamism holds its appeal. As such, Hollands also favours BlackRock European Dynamic.

The fund is managed by Giles Rothbarth, who Hollands labelled “one of the best younger fund managers in the City of London”.

Rothbarth has built the portfolio around a core of European high-quality stocks he believes can provide growth over the long term. “But he will rotate the portfolio into different types of companies depending on his shorter-term view of the market,” Hollands said.

BlackRock European Dynamic is ‘A’-rated by Square Mile, with the research house’s head of fund origination Amaya Assan also pointing to its flexibility.

“The fund is not constrained to a particular style of investing and its manager can dramatically change its stylistic, investment sector and market capitalisation positioning to take advantage of any opportunities that may arise,” she said.

Hargreaves Lansdown’s Marshall is also of the opinion that smaller companies often “do better” during economic recoveries because they are more flexible and typically more closely tied to the domestic economy.

“Barings Europe Select Trust is different from many other European funds,” she said.

It invests in small- and mid-sized companies with a ‘growth at a reasonable price’ investment style – meaning the managers, led by Nick Williams, are investing in companies they believe can grow earnings steadily but where the shares can be bought at a lower price than the earnings potential suggests they should be, she said.

With over three decades of experience investing in Europe, Williams has an “expert knowledge of the wider European market”, Marshall said.

The trust holds a ‘AA’ rating from Square Mile.

“Historically, the smaller cap segments of the European stock markets have provided plenty of opportunities for active managers to add value and this area should further benefit as and when investor sentiment starts to turn in its favour,” said Assan.