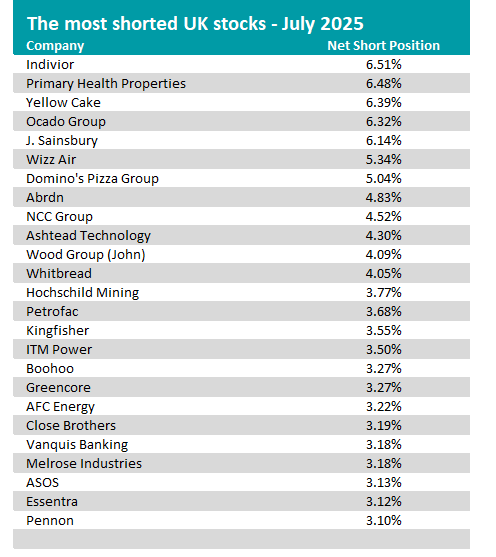

Short-sellers are still betting heavily against the UK consumer, data from the Financial Conduct Authority (FCA) shows, although the biggest short on the UK market is a pharmaceutical firm that specialises in treatments for addiction.

Investors must publicly report short positions in UK-listed stocks that exceed certain thresholds to the FCA, to increase transparency and allow potential manipulation or systemic risk to be monitored.

Any short position that reaches or exceeds 0.1% of a company’s issued share capital must be privately reported to the FCA while positions of 0.5% or more must be publicly disclosed via the FCA’s website.

This regime allows market participants to see which stocks are being heavily shorted and by whom, offering a window into institutional sentiment and positioning.

According to the FCA’s data, mid-cap pharmaceutical company Indivior is currently the stock with the most disclosed shorts against it: 6.51% of its shares. Millennium International Management, Arrowstreet Capital, Numeric Investors and Qube Research & Technologies each have short positions of more than 1%.

Indivior focuses on treatments for addiction and mental health disorders, particularly opioid use disorder, and its core products include Suboxone and Sublocade, both used in medication-assisted treatment (MAT) for opioid dependence.

Source: Financial Conduct Authority, as at 7 Jul 2025

The firm was spun-out from Reckitt Benckiser in 2014 and has a secondary listing on the London Stock Exchange, but this will end on 24 July to maintain a sole listing on Nasdaq. This reflects that most of its revenues and shareholders are in the US.

The company’s latest results show net revenue fell 6% in the opening quarter of 2025, while net income was down 23%. Other issues likely eyed by short-sellers include US litigation and legal exposure from past Suboxone marketing practices, generic competition to Suboxone, challenges to the growth of its Sublocade injectable treatment and a relatively narrow product base.

The second most-shorted stock is Primary Health Properties, according to the FCA’s disclosure data. Some 6.48% of its shares are being shorted by the likes of Glazer Capital, Mirabella Financial Services, Clearance Capital and Sand Grove Capital Management.

Primary Health Properties is a real-estate investment trust that owns and manages a portfolio of primary care medical centres, typically leased to GPs, the NHS or health authorities. Its long-term, government-backed leases provide predictable income and make it popular among income-focused investors, although its bond-like characteristics have made it vulnerable in a rising interest rate environment, as higher yields elsewhere reduce its relative appeal.

The REIT is in a bidding war against US private-equity firm KKR and infrastructure investor Stonepeak to take over rival Assura, which has a similar mandate. If the deal went through, it would create a £6bn healthcare property portfolio.

However, the Competition and Markets Authority said last week that it is investigating the anticipated acquisition to determine whether it could lead to “a substantial lessening of competition” in the space.

In third place is uranium investment firm Yellow Cake, which was the most-shorted stock last month. Uranium is volatile and sensitive to sentiment, although it has been rising in recent weeks, and funds exposed to the commodity were some of the best performers in 2025’s second quarter.

Other commodity names on the most-shorted list include Hochschild Mining and Petrofac.

But a recurrent theme among the FTSE’s biggest shorts in recent years has been the UK consumer under pressure. Several companies on the above list are tied to the health of the consumer, such as Ocado, Boohoo, ASOS, Kingfisher, Domino’s and J Sainsbury.

The UK retail and consumer discretionary sector is facing a squeeze from both ends: stubborn inflation has eroded real wages while interest rates remain high, dampening non-essential spending from consumers. As a result, footfall and basket sizes are down, particularly in mid-market and online-focused segments.

At the same time, cost pressures, especially from wages, energy and logistics, have compressed margins across the supply chain. Retailers have limited pricing power in this environment, forcing them to discount or absorb costs, which undermines profitability.

In Ocado’s case, persistent losses and an unclear path to profitability amid high capital intensity and tech execution risk have long attracted scepticism. Boohoo and ASOS continue to suffer from margin compression, excess inventory and weaker online apparel demand.

In a similar vein, UK travel and hospitality stocks like Wizz Air and Whitbread are being shorted. While demand has rebounded since the Covid pandemic, input costs such as fuel and wages, capacity constraints and the consumer squeeze still affect them.

Wizz Air recently reported a significant drop in profits on the back of longstanding supply chain issues grounding a large share of its fleet and conflict-related disruption to the routes it operates in Ukraine and the Middle East.

Meanwhile, Whitbread recently reported a 3% fall in UK like-for-like sales at the start of its financial year amid a “challenging” UK market. The group started a restructuring in April last year that involves converting 112 branded restaurants into new hotel rooms while selling another 126 restaurants.