China is the largest weighting in the MSCI Emerging Markets index, but the Ashoka Whiteoak Emerging Markets trust is keeping its direct exposure relatively low – and not because of a bearish macro view.

Loong Lim, investment director at the trust, said that both corporate governance and country-level concerns were holding them back from building a significant position in Chinese stocks.

“There are a lot of companies out there, but corporate-level governance is quite poor on average,” he said. “They just don’t understand what shareholders are and the purpose of them, even though they’re listed companies.”

Its authoritarian regime also makes China too unpredictable.

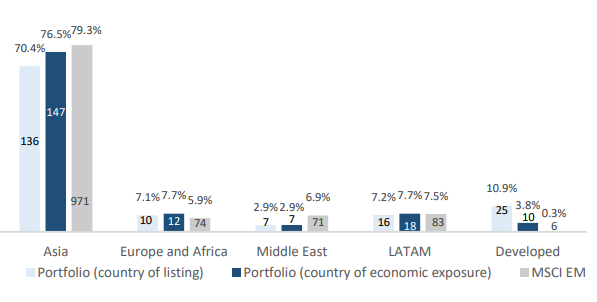

As a result, the trust’s allocation to China and Hong Kong stands at 23.1%, over six percentage points below its benchmark, the MSCI Emerging Markets index. Of that 23.1%, only 2% is invested in state-owned entities, versus 8% of the benchmark.

Instead, it looks for economic exposure to China through developed-market companies that generate a high share of their revenues in the region.

Regional composition of Ashoka WhiteOak Emerging Markets Source: Ashoka, Bloomberg.

Source: Ashoka, Bloomberg.

“We said, is there a way to get economic exposure to China without taking on either country-level or corporate-level governance risk?” Lim explained.

Names like LVMH and Hermès (combined, they make up a 0.8% weighting in the trust) get most of their revenues from emerging markets, and within that, China is by far the biggest part.

“This also applies to their international revenues – just go down to Bond Street and look at the people queuing up to go into LVMH and Hermès,” he said. “They are Chinese tourists most of the time.”

The same logic applies to other parts of the portfolio. Ashoka White Oak’s exposure to Taiwan, for instance, is below the benchmark (14.4% versus 17%) not because of concerns around Taiwanese companies, but due to geopolitical uncertainty. “The issue with Taiwan for us is geopolitical risk. It happens to be across the street from China, and every morning Xi Jinping thinks about reunification,” said Lim.

At 7.9%, Taiwan Semiconductors is the largest position in the portfolio but remains below the 10.2% allocation of the MSCI Emerging Markets index. The decision to hold less than the benchmark reflects opportunity costs, not any negative view on the company, Lim explained.

“If our analyst felt the risk/reward in TSMC was particularly attractive, we’d be open to taking it up to 10%,” he said. “But right now, it’s a trade-off. We like the business a lot but allocating more would mean 1.8% less to invest elsewhere. It’s not about TSMC itself – it’s just that we’re seeing other compelling opportunities too.”

So the trust seeks indirect exposure where possible. “What way is there of gaining semiconductor exposure without taking on that risk?” the investment director asked.

“[Dutch semiconductor companies] ASM International and ASML, as well as the Japanese Disco, for example, sell mostly to Taiwan and Korea, giving you that emerging markets exposure and that economic theme, but without taking on the geopolitical risk.”

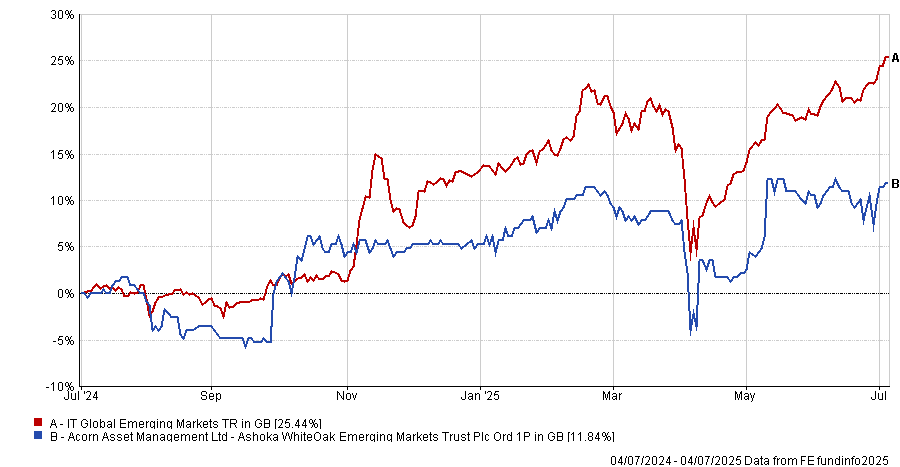

Performance of fund against index and sector over 1yr

Source: FE Analytics

Developed-market stocks make up 10.9% of the trust, with each one having to meet three criteria: at least half of its value must come from emerging markets (typically via revenues or profits), it must be an alpha opportunity in its own right, and it must help reduce a portfolio risk that can’t easily be managed through direct emerging market holdings.

“We’re not just going to buy a developed-market company for the sake of it,” said Lim.

Despite these high-level considerations, the fund relies entirely on bottom-up stock selection, not macro calls, to drive returns.

“We’re not macro guys. We’re not economists. We have no ability to forecast any kind of macro event – election, oil price, anything like that,” Lim said. “All our alpha comes from stock picking. Everything else is a factor risk we try to mitigate.”

Last week, Ashoka WhiteOak Emerging Markets featured on Trustnet among the trusts worth their premiums.