The US market has been breaking record highs while credit spreads are near historic tights, despite all the risks around including inflation, tariffs and even war. This indicates that markets think everything is going to be fine, said Jasmine Yeo, investment manager at Ruffer.

“And it might be true,” she said. “But you have to ask whether you're being properly rewarded for that risk.”

Yeo believes investors are leaning heavily on a “just right” scenario – one where the US economy slows gently, rate cuts arrive in time, policy risks remain contained and geopolitical flare-ups don’t escalate.

But, she warned, the number of things that need to go right is growing, while the margin for error is shrinking.

Recent market behaviour suggests many investors are unconcerned. US equities continue to hover near record highs. Credit spreads remain compressed and sentiment indicators have rebounded sharply from their April lows.

Chris Beauchamp, chief market analyst at IG, said Nvidia’s $4trn valuation and global equity gains reflected a “prevailing ebullience”, despite new US tariff threats and renewed inflation risks. “Perhaps most notable is the market's apparent indifference,” he added, pointing to how Trump’s latest 50% tariff on copper imports was largely shrugged off by both investors and the media.

Michael Stiasny, head of UK equities at M&G, framed the response more bluntly: “The market is getting used to crying wolf, and that desensitisation is itself a risk.”

According to Yeo, the core problem isn’t that markets are unaware of the risks – it’s that they’re assuming everything will resolve in the right order and on the right timeline.

“There’s a lot that needs to go just right,” she said. “Growth needs to slow enough for the Fed to cut rates, but not so much that it hurts earnings. Trade tensions can’t escalate. Deregulation needs to come through. And liquidity needs to stay supportive.”

But several of those assumptions are already fraying. With the debt ceiling now lifted, the US Treasury has resumed issuance, draining liquidity as it rebuilds its general account. “That creates a headwind,” said Yeo. “Liquidity had been supportive during the debt ceiling standoff. That’s now reversing.”

Meanwhile, policy support remains more rhetoric than reality. “Bank deregulation is being talked about, but it hasn’t been legislated,” she said. “It’s unlikely to arrive in time to offset a slowdown, if one materialises.”

And easing inflation – the market’s core justification for rate cuts – may prove less benign than hoped. The Federal Reserve’s June meeting minutes struck a dovish tone, but also acknowledged rising price pressures. Beauchamp said the inconsistency points to “a labour market weighing more heavily on policymakers than previously assumed” – and could complicate their ability to ease quickly.

Sentiment, too, is starting to look stretched. Yeo noted that much of the equity market’s resilience over the past two months came not from improving fundamentals but from a reversal in positioning.

“Back in April, sentiment had fallen a long way. People had de-risked,” she said. “But we’ve seen that come all the way back. Whether you look at the Morgan Stanley Global Risk Demand index or the American Association of Individual Investors’ (AAII) Investor Sentiment Survey, there’s now a lot of optimism – maybe not euphoric, but it’s on its way.”

That optimism may not leave much room for disappointment. “If you do get evidence of a growth slowdown, and you’re at a point where positioning is full and policy support hasn’t yet arrived, that creates a risky window,” she said.

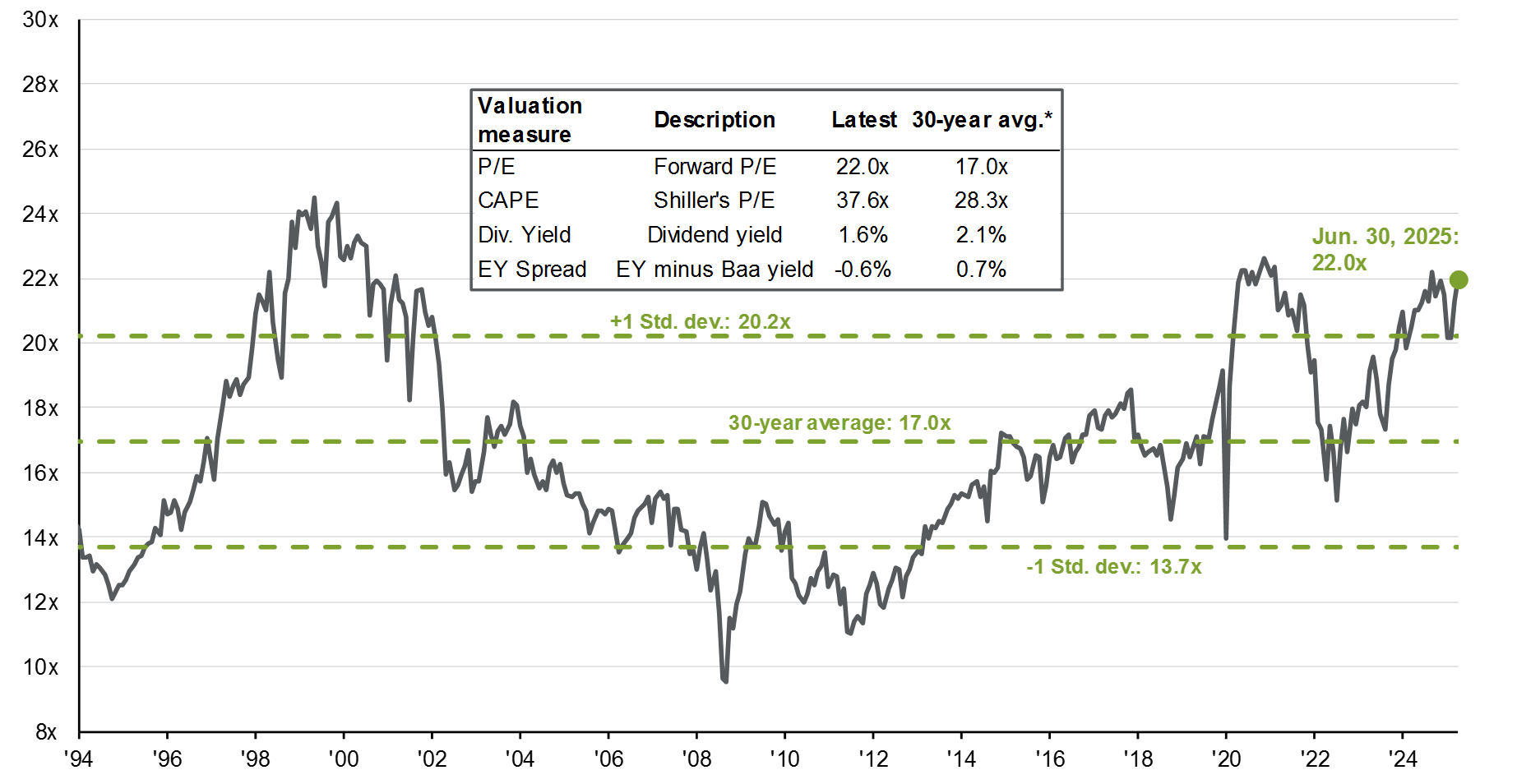

S&P 500 forward price-to-earnings ratio Source: Bloomberg, FactSet, Moody’s, Refinitiv Datastream, Robert Shiller, Standard & Poor’s, J.P. Morgan Asset Management.

Source: Bloomberg, FactSet, Moody’s, Refinitiv Datastream, Robert Shiller, Standard & Poor’s, J.P. Morgan Asset Management.

This matters for the Ruffer Investment Company not because it is trying to predict every policy move or geopolitical twist, but because it focuses on capital preservation. “We are always looking for assets that can deliver protection – and ideally positive returns – even in a correction,” said Yeo.

One such opportunity has emerged in credit markets. With investment-grade spreads trading near their tightest levels in years, Ruffer has taken the opposite view. “Being short corporate credit – long spreads – is a really attractive source of protection right now,” she said. “It’s unconventional, but when markets come under stress, spreads usually widen. That’s what we saw in April and it helped us deliver a positive return through that volatility.”

The trust's managers used that same episode – the April wobble – to take profits on some of its protection strategies and redeploy capital into distressed assets.

“We saw real yields on 10-year US inflation-linked bonds climb to nearly 2.5%. There was significant selling pressure, and that was an opportunity for us to step in,” said Yeo. “A week later, yields were well below 2%, and we were able to sell again at a profit.”

These short windows require agility, she noted, and are a reminder of the need for flexibility. “In a regime defined by higher inflation volatility and more policy uncertainty, the old portfolio protections – like bonds and the dollar – just aren’t as reliable anymore,” she said.

To account for that, Ruffer is diversifying with a basket of commodities. “Gold has been good, but not 100% consistent, with some rate-inflation regimes in the past where gold hasn't delivered positive real return," Yeo said. "So the basket should be diversified with perhaps oil, copper, aluminium.”

Ruffer has also been gradually reducing its exposure to China, after adding to it in late 2023. “At the time, valuations were extreme, sentiment was very negative, and stimulus announcements were starting to come through,” she said. “We’ve taken profits as Chinese equities rallied on further stimulus, but we’re confident that if geopolitical risks there do resurface, we have other assets in the portfolio that will perform in that environment.”

The challenge now, she argued, is not spotting the risks – it's positioning for what happens if they’re priced in all at once.

“Investors aren’t blind to inflation or geopolitics. But if you look at how portfolios are built, you can see the assumptions,” she said. “That the dollar will protect you. That bonds will protect you. That the US will always be the safe haven. But those assumptions don’t look as solid anymore – and we think people need to diversify differently.”