Average variable savings rates in the UK have plunged to their lowest levels since mid-2023, according to Moneyfacts’ July 2025 Savings Trends Treasury Report.

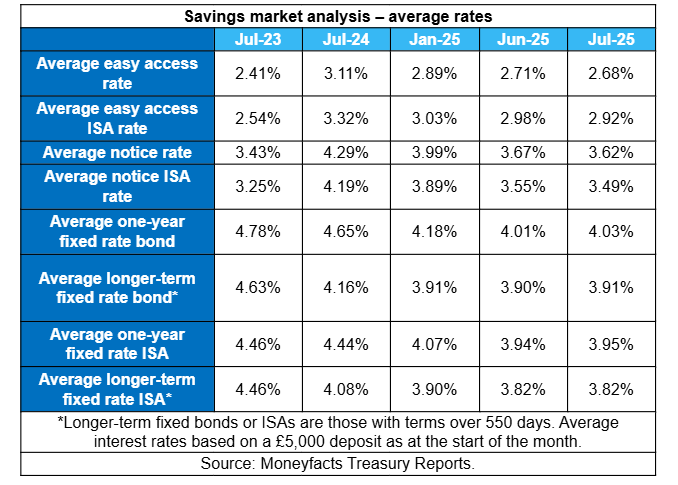

The average easy-access rate declined to 2.68%, down from 2.71% in June and falling to its lowest since the 2.41% of July 2023. Notice-account rates also fell, with the average notice rate decreasing to 3.62%, also the lowest since July 2023.

ISA rates followed the same trend. The average easy access ISA rate dropped to 2.92% and the average notice ISA rate fell to 3.49%. Both represent their lowest levels in approximately two years.

Rachel Springall, finance expert at Moneyfacts, said: “Savers will be disappointed to see variable savings rates plunge to a two-year low. The downward momentum is an inevitable turn of events, with providers adjusting their rates following four cuts to the Bank of England base rate since last summer.”

She noted that nearly 90% of accounts now pay below the Bank of England’s 4.25% base rate. She also highlighted an increase in the use of upfront bonuses by providers to attract new savers, with the average bonus rate equalling the record high of 1.20%.

In contrast, fixed savings rates were more resilient, with the average one-year fixed-bond rate rising 4.03% – its first increase since April. The average one-year fixed ISA rate also increased to 3.95%.

Longer-term fixed bond and ISA rates remained stable or posted marginal gains.

Springall said: “The fixed rate market demonstrated its resilience in comparison to variable rates, despite swap rate volatility. This led to a multitude of providers readjusting their rates in response during June. However, the marginal rises to the average one-year bond and ISA rates might not be worth celebrating, particularly as the longer-term outlook for interest rates looks uncertain.”

The Moneyfacts Average Savings Rate, which covers all on-sale core market savings and cash ISA accounts, fell to 3.51%. This is down from 3.52% last month, 3.91% in July 2024 and 3.77% in July 2023.

Product availability increased to a record 2,253 live savings deals, made up of 1,612 savings accounts and 641 cash ISAs. The number of active providers fell by one to 152.