The multi-asset teams at investment management heavyweights Fidelity International and Pictet Asset Management have both upgraded their equity positions to ‘overweight’ in the past few weeks.

This year has been one of contrasting patterns, with markets starting strongly on the back of artificial intelligence (AI) enthusiasm, before falling away following US president Donald Trump’s ‘Liberation Day’ tariffs.

In the past few months markets have climbed higher again, with investors seemingly getting on board with taking on more risk.

Luca Paolini, chief strategist at Pictet Asset Management, said the global economic prospects are improving with central banks cutting interest rates at a time when “corporate profit and revenue growth remain healthy”.

“All this suggests to us that there is upside in riskier asset classes in the medium term,” he said.

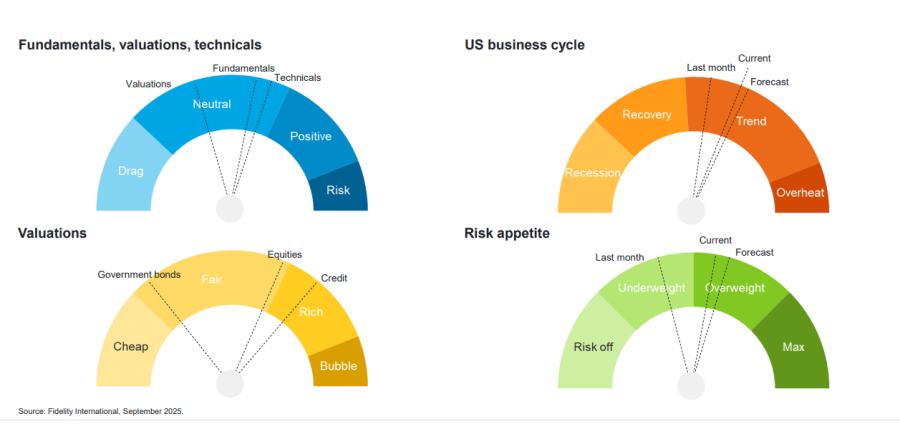

This view was echoed by the multi-asset team at Fidelity International, which said the Federal Reserve’s rate pivot and an easing of inflation and policy risks has led to a “more constructive stance on equities”.

“The global economic cycle may be slowing, but it is still positive. Inflation is elevated; however we are past the peak of concern about it. We could be at the start of a Goldilocks period for risk assets where growth is supportive if not headline-grabbing, inflation is moving in the right direction and Fed policy is accommodative,” they said.

Cycle gauges

Where Fidelity is investing

While positive on equities overall, Fidelity stayed neutral on the US because of elevated policy uncertainty means “US exceptionalism remains in question”.

It is also neutral on Europe, where “valuations are no longer cheap” and warned a strengthening euro “could start weighing on large-cap equity earnings”.

Meanwhile, the UK is neutral despite “uninspiring” earnings revisions, with the team noting that the market is trading at a discount and arguing that a weaker pound could support multinational large-caps.

The biggest overweight is to the emerging markets, where the multi-asset team has a higher conviction in particular to China. It expects “further consumption targeted stimulus to boost demand and involution policy to enhance industrial profitability”.

The DeepSeek AI model that came to prominence at the start of the year has also reignited interest in Chinese internet stocks, which remain “relatively cheap compared to their US peers”.

Other areas of note include Japanese banks. Although the team is neutral on the Japanese market as a whole – arguing that positive earnings and rising dividends are balanced out by policy uncertainty – it likes banks due to “solid wage growth” and “above-consensus” second quarter GDP figures. This should support a more hawkish Bank of Japan path, it said, which is positive for banks.

“We continue to have conviction in Japan banks due to solid fundamentals, healthy credit conditions in Japan, and the continuation of BOJ normalisation,” the team said.

The multi-asset team is also constructive on Korean equities, where newly elected president Lee Jae Myung has “strongly advocated for corporate reforms”, primarily through the revision of the Commercial Code.

Since the election, the KOSPI index’ price-to-book ratio has risen to 1x, although valuations remain “attractive” as they are trading at a “substantial discount” to other countries.

Lastly, the firm likes South African equities, noting domestic reforms, its link to Chinese tech through Naspers’ link to Tencent and the high concentration of precious metal miners in the country, which gives the South African market exposure to the gold price and commodities.

Where Pictet prefers

Paolini’s geographic allocations match Fidelity’s above, with neutral weightings to all major regions apart from the emerging markets, where he said companies have benefited from a falling dollar and remain on “attractive valuations”.

“Emerging market stocks overall have strong momentum and inflows into the asset class are accelerating too. We are also overweight Chinese stocks as they benefit from attractive valuations and the headroom authorities have for implementing further self-help measures,” he said.

Instead, his team has shifted its sector allocations, rather than its geographic ones. In particular, Pictet has gone overweight technology. Although the stocks “look expensive on valuation metrics and in some instances are looking ebullient”, Paolini does not believe the market has hit bubble territory.

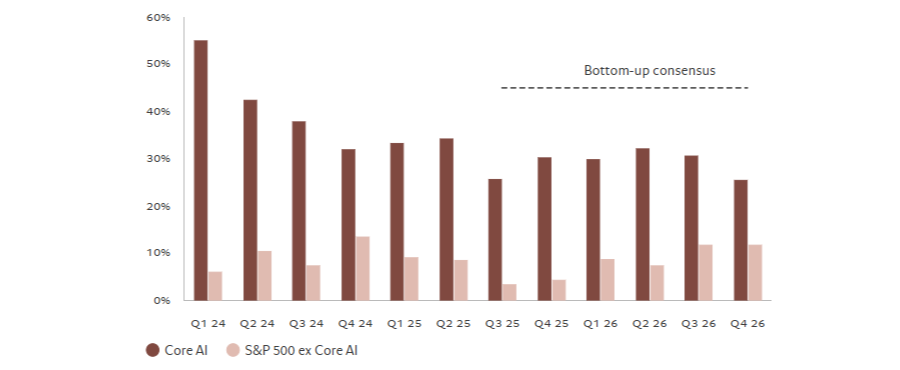

“That is because earnings have continued to grow at a steady pace. In fact, the latest results outstripped consensus expectations in a way that tends only to happen when markets are pulling out of recession. Nowhere is this more apparent than in IT,” he said.

Earnings are growing at around 20% year-on-year with multiples below 30x forward earnings, which compares to nearly 50x at the peak of the dot-com bubble, he noted.

AI knocking it out of the park

Source: LSEG Workspace, Pictet Asset Management. Bottom-up consensus estimates as of 15.09.2025.

Core AI: NVIDIA, Microsoft, Broadcom, Oracle, Palantir, AMD, Arista, Micron Tech, Applied Materials, LAM, KLA, Synopsys, Intel, Cadence Design, Marvell, Monolithic Power, Dell, HPE, Pure Storage, SMC, Teradyne, Entegris.

“We’re optimistic about earnings prospects, particularly in companies that have a strong artificial intelligence (AI) footprint – in fact AI is already making an increasingly positive impact on their revenues,” said Paolini.

“Given that some 60% of the IT sector is already part of the AI ecosystem according to our calculations, that bodes well for its continued strong performance.”

The firm also remains overweight communication services stocks, where valuations are “a little stretched” but earnings are stable.

Financials are also in favour at Pictet, with Paolini suggesting the sector could benefit from a steepening of yield curves as future US rate cuts bring down yields at the front end of the curve.

“Banks typically benefit from the differential between deposit rates, which tend to be tied to official rates, and lending long, such as mortgages which are linked to long-dated bonds,” he said.

However, he downgraded utilities to neutral as the sector has bond-like characteristics (his team is negative on bonds as policy rates are “approaching the floor” and therefore should limit their upside).