Brazil has historically been one of Utilico Emerging Markets’ largest exposures, as the outcome of a bottom-up investment approach that has identified high-quality, attractively valued opportunities over the past 20 years.

The country continues to host companies that are resilient across cycles, are well managed, address critical infrastructure bottlenecks and often have clear competitive advantages.

While 2024 was a challenging year for Brazilian equities, with significant outflows from local funds amid economic and political disappointments, 2025 has brought a notable recovery as global capital has rotated towards emerging markets.

Brazil, in particular, has benefited from this shift given its extremely attractive valuations. The Ibovespa delivered a year-to-date total return of 32% in GBP terms, and our Brazilian holdings have outperformed the market, further amplifying portfolio returns.

Looking ahead, anticipated interest rate cuts from early 2026, together with a potential rise in expectations of a change in government in October 2026, are likely to be key catalysts for Brazil’s capital markets, reshaping the investment landscape and unlocking opportunities across sectors.

Complex economic landscape

Brazil’s economic activity has shown surprising resilience, with GDP growing by 3.2% in 2023 and 3.4% in 2024, supported by domestic demand, real wage gains and record agricultural harvests.

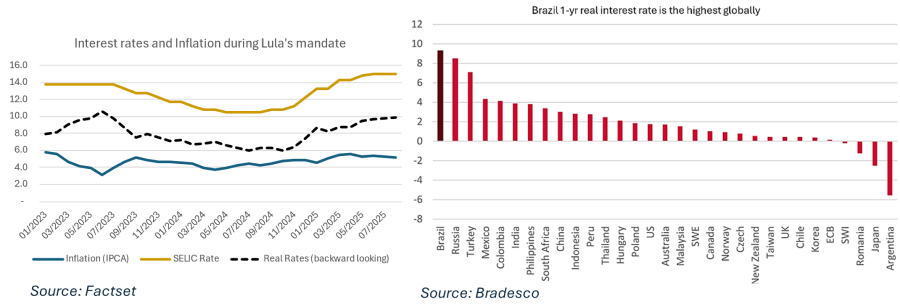

However, this apparent strength is set against a fundamental policy conflict: an expansionary fiscal agenda under the Luiz Inácio Lula da Silva administration aimed at sustaining popularity versus a restrictive monetary stance from the Central Bank to control inflation. This clash pushed the SELIC rate to 15%, the highest level in nearly two decades.

The resulting fiscal–monetary dissonance has created an unsustainable tug-of-war, leaving Brazil in a suboptimal equilibrium of higher-for-longer inflation and interest rates.

The impact is clear: in August 2025, 12-month inflation stood at 5.1%, well above the 3% target, with food prices particularly high and weighing on the administration’s traditional lower-income support base. Meanwhile, the lagged effects of tight policy are expected to slow GDP growth to 2.2% in 2025 and 1.9% in 2026.

Structural challenges compound these pressures. The fiscal trajectory is the most pressing risk, with gross debt rising from 76.5% of GDP in 2024 to 79.0% in 2025 and, if trends persist, expected to reach 84.3% by 2028.

The ‘arcabouço fiscal’ framework that replaced the previous spending cap lacks credibility, relying on optimistic revenue assumptions while systematically excluding expenses to meet targets.

Efforts to raise taxes via decree have met unprecedented resistance, with congress overturning a financial transactions measure for the first time in three decades. This setback underscores the executive’s limited leverage and the political difficulty of a revenue-led strategy.

The weakening of the left

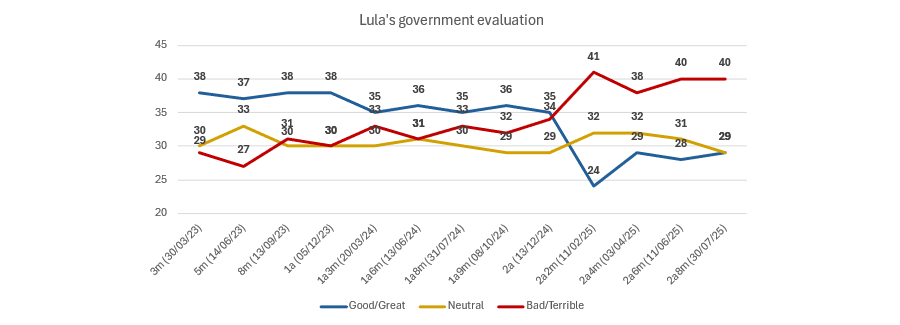

These strains are now reflected in the government’s declining support. Lula’s 2022 victory was the narrowest in modern Brazilian history, 50.9% to 49.1% against Jair Bolsonaro – a result driven more by a rejection of Bolsonaro than enthusiasm for Lula’s platform.

Since then, economic headwinds have eroded support further. Approval fell to an historic low of 24% in February 2025, before a brief rebound to 29% during US tariff tensions as Lula positioned himself as defending national sovereignty. This uptick appears temporary rather than evidence of sustained satisfaction with governance.

Source: Utilico Emerging Markets

Institutional constraints are significant. Bolsonaro’s Liberal Party holds the largest bloc in the lower house, conservative parties expanded in both chambers and the 244-member Evangelical Parliamentary Front now exerts growing influence.

Evangelicals have risen from 6.5% of the population in 1980 to 22.5% in 2022. Today, only 25% of them support the government versus 45% of Catholics, making religious identity a sharper political divide. Their embrace of prosperity, theology and entrepreneurship naturally aligns with pro-business policies.

This religious shift converges with broader cultural change. ‘Bolsonarism’ has gained traction among middle-class voters who prioritise self-reliance over state assistance.

Meanwhile, the left has struggled to adapt its narrative to a constituency that partly rose through its own past social programmes. The erosion of Lula’s party support in the northeast exemplifies this trend.

As the left weakens, the right is renewing. Bolsonaro is barred from running until 2030 and faces a 55% disapproval rate, catalysing a leadership transition and opening space for more pragmatic figures.

The standout is Tarcísio de Freitas, governor of São Paulo, who won Brazil’s largest and most economically important state in 2022 and has pursued a pro-market agenda.

He oversaw the successful privatisation of Sabesp, one of the world’s largest sanitation companies and among our trust’s top five holdings. Polls place him in a statistical tie with Lula in potential run-offs.

Tarcísio is not alone. A strong bench of pro-market governors – Romeu Zema (Minas Gerais), Ratinho Jr. (Paraná), and Ronaldo Caiado (Goiás) – maintain high approval ratings and could contend nationally.

Succession dynamics remain complex because Bolsonaro’s endorsement is pivotal. A candidate bearing the Bolsonaro surname would face high rejection rates in a run-off, whereas an endorsed alternative could have significantly stronger prospects.

It is important to highlight that, globally, incumbents are finding it increasingly difficult to win re-election, driven by factors such as the growing influence of social media i reshaping electoral dynamics.

In our view, an endorsement outside the family is key to maximising the right’s electoral chances, even if current polls do not yet reflect this dynamic so far from the October 2026 election.

Investment implications

Persistently high real rates, policy uncertainty and competition from tax-exempt instruments have driven sustained outflows from local equity funds, depressing sentiment and positioning.

Equities now account for only 10% of total investments, well below historical norms and sharply down from 26% in 2020/21. Conditions are, however, improving and have already supported strong year-to-date performance.

Valuations remain compelling. At 8.3x forward price-to-earnings (P/E) –one standard deviation below the historical average of 10.5x – Brazilian equities trade at discounts that reflect prevailing concerns and echo levels seen in 2015, when the country endured its deepest recession in a century.

Today differs meaningfully: corporate balance sheets are healthier; cash generation is robust; and fundamentals are stronger. Optimism is therefore more defensible, which helps explain why the equity risk premium is not as compressed despite high rates.

Within this context, our core sectors – infrastructure and utilities – stand out. Both benefit from established regulatory frameworks and typically feature inflation-linked revenues, providing defensive characteristics and visibility.

The growth need is substantial: the Critical National Infrastructure (CNI) projects over $50bn of infrastructure investment in 2025, roughly 70% private. While above depreciation, this represents only 2.2% of GDP, far below the c.4% widely considered necessary.

In our view, Brazil offers asymmetric opportunities in these sectors, combining relatively lower volatility with significant upside potential in asset prices as policy normalises and the political cycle evolves into 2026.

Eduardo Greca is head of Latin America at Utilico Emerging Markets. The views expressed above should not be taken as investment advice.