Gold’s relentless climb toward $4,200 an ounce is forcing investors to reconsider how much of the precious metal they might want to hold in their portfolios.

After a 60% rise in dollar terms this year alone, questions of exposure, valuation and diversification are front and centre, with investors split between those who are still buying and the more price-aware.

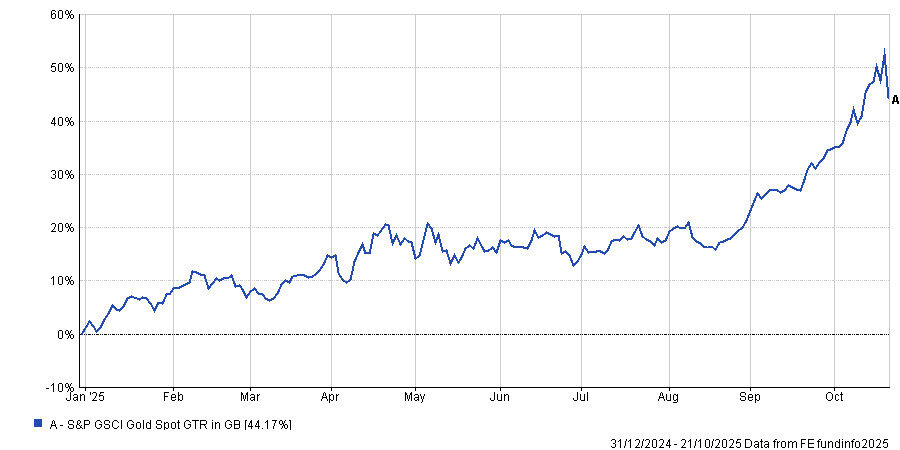

Performance of gold index over the year to date

Source: FE Analytics

Alexandra Symeonidi, senior corporate credit and sustainability analyst at William Blair Investment Management, pointed to central-bank and ETF (exchange-traded fund) buying as supporting the rally.

“The rally was explained partly due to strong ETF gold purchases which seem unstoppable, closely following the gold price action,” she said. “The recent gold rally had some strong catalysts which might continue to support prices. Investor and central bank demand remained resilient despite added costs to further accumulate gold.”

Central banks returned to buying gold in August after a brief pause in July, adding about 15 tonnes, reflecting what Symeonidi describes as “more structural” demand this time around.

Geopolitical uncertainties are also a driver. France’s political crisis, snap elections in Japan and concerns over tech stock valuations means investors seek hedges in what is broadly considered a safe-haven asset.

Symeonidi also observed that gold has remained largely unfazed by dollar strength, which has been driven more by international than domestic factors.

AJ Bell investment director Russ Mould, however, warned that prices can’t grow indefinitely.

“Gold bugs will be beside themselves but the more investors buy in, the more of a consensus position gold becomes and the more of a consensus position it becomes, the fewer incremental buyers there are to drive up the price,” he said.

“True believers will continue to warn of the dangers of debt, inflation and geopolitics. Others may at least think about a portfolio rebalancing to ensure they do not become over exposed to an asset that is devilishly difficult to value.”

The challenge lies in gold’s inherent characteristics: it generates no earnings or cash and offers no yield, making conventional valuation metrics largely irrelevant.

One reference point for downside risk is the all-in-sustained cost of production, which for major miners such as Newmont and Barrick Mining sits around $1,400 to $1,500 an ounce. Yet even that metric cannot indicate potential upside. Mould suggested investors might instead consider gold’s value relative to other commodities.

“The CRB Commodities index stands close to its highest mark since spring 2011. This suggests that the price of other ‘hard assets’ is starting to motor and looking at how much utility gold can buy may be one yardstick to see whether the precious metal is still cheap or not,” he said.

Historic comparisons underscore this point. One ounce of gold has on average bought 17 to 18 barrels of oil since 1970. It currently buys 69 barrels. While these price-relative ranges offer no guarantees, they help investors assess whether gold remains a rational allocation versus other physical assets.

Gold’s purchasing power also has implications for household and real-estate exposure, with another way to assess its fair value being to measure how much metal a household can buy.

“If bullion moves beyond the reach of the average worker, or, dare one say it, private investor, that could at least crimp one source of incremental buying,” Mould said.

Gold currently represents nearly 7% of the average US household’s annual disposable income and requires 97 ounces to purchase the median US house – well below the extremes of the late 1970s and early 2000s.

Gold’s rally has a knock-on effect across the wider precious-metal complex as well. Gains in bullion have lifted other metals and Mould noted that relative underperformance in silver, platinum and palladium may encourage portfolio reallocations beyond gold itself, signalling that investors are increasingly managing exposure across real assets rather than focusing on a single commodity.