The ‘Santa rally’ is a phenomenon which suggests that stocks tend to do well in December, with investors in festive spirits and therefore less likely to punish the market.

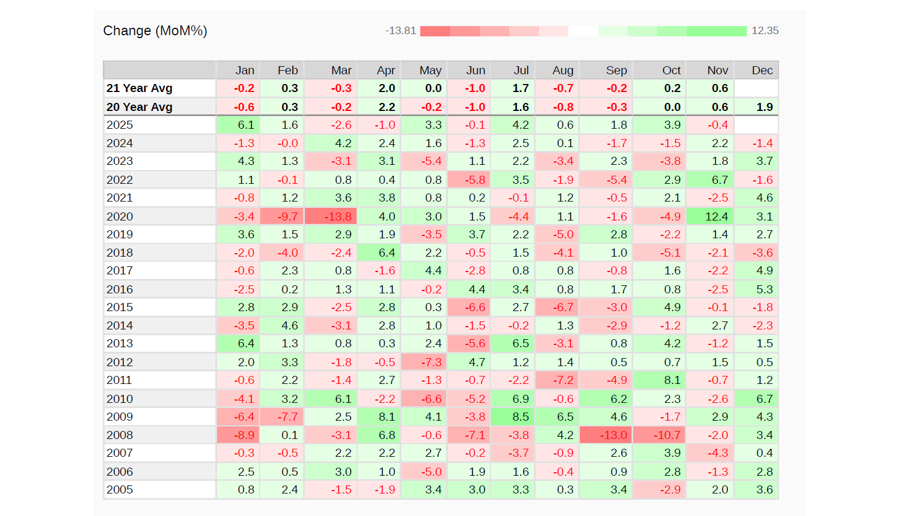

Over the past 20 years, the FTSE 100 has averaged a 1.9% gain in December, the second-highest month of the year behind April. In fact, over two decades, there have only been five Decembers when the UK market lost money.

Investors may have some reservations about this statistic, however, as two of these negative final months of the year came in recent memory: 2024 and 2022.

Jemma Slingo, pensions and investment specialist at Fidelity International, said: “No year is the same for the stock market. However, history suggests that December is a good month to be an investor – particularly if you hold UK equities.”

FTSE 100 monthly returns over 20yrs

Source: Fidelity International

Are there stocks that tend to benefit more than others?

Some companies tend to benefit far more from the festive spirit than others. For example, companies with a consumer focus tend to fare particularly well in the final quarter of the year.

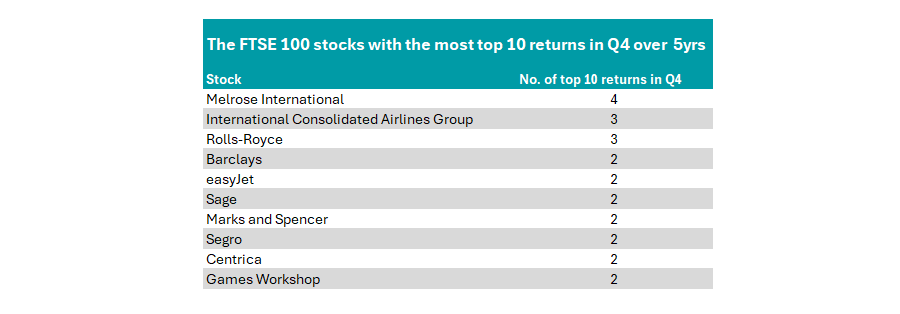

Trustnet looked at the 10 best performers in the final quarter of each year between 2020 and 2024. In this five-year span, several companies appeared on the list more than once.

Source: Fidelity International

A particular beneficiary is the travel sector, with International Consolidated Airlines Group in the top 10 in three different years (2024, 2022 and 2020). Also making the list is easyJet, with two appearances in 2023 and 2020. Both are “helped by holiday travel trends”, said Slingo.

This seemingly has a knock-on effect on other parts of the aerospace sector, with aerospace components maker Melrose International and plane engine maker Rolls-Royce appearing at the top of the above list.

“A diverse set of retailers have also enjoyed strong gains, boosted by festive spending,” noted Slingo. Games Workshop and Marks & Spencer both appear on the list above, with two separate top-10 fourth-quarter returns, while others such as luxury clothing brand Burberry and supermarket giant Sainsbury’s also have one top-10 return in 2024 and 2023 respectively.

Although it has not made a top-10 return over the past five years, Guy Anderson, portfolio manager of The Mercantile Investment Trust, said another that “naturally benefits from higher festive-season demand” is Cranswick, the UK’s leading food producer, supplying premium pork and poultry to major supermarkets.

However, he noted that the company is a “stock for all seasons” as it is “resilient, well-managed and built for steady growth”.

Shares are up 66% on a total return basis over the past five years, but he said there is more room to run.

“Beyond the seasonal strength, the company’s investment in automation and efficiency has allowed it to expand while at the same time improving profitability. That discipline has given it a strong competitive edge, especially as rising labour costs have squeezed peers that are more highly leveraged,” he said.

Will December be a bright month once again in 2025?

The big question is whether companies will soar in the next month or if the top 10 will be dominated by stocks that were able to protect on the downside.

Slingo said: “This year’s ‘Santa rally’ risks being overshadowed by the autumn Budget. Wage inflation remains a key issue for retailers, and higher levels of tax could impact consumer spending as we head into 2026.”

This view was echoed by Nigel Yates, portfolio manager at AXA IM, who said much will hinge on whether the upcoming Budget is “an early Christmas present”.

“Traditionally, the market might anticipate increased spending in the run-up to Christmas, pushing the consumer discretionary areas of the market. This year, however, consumer confidence has been weighed down by the possibility of income tax increases.

“The delay to the timing of the Budget has also been unhelpful, given it is set to be delivered at a time that is usually peak selling season for retailers. Whatever happens on 26 November, a blowout Christmas is unlikely to happen this year.”

If the Budget avoids putting inflationary costs and higher taxes on businesses, it could give the Bank of England confidence to cut interest rates throughout 2026.

In this scenario, while some stocks on the FTSE 100 have performed well in the final quarter, he would expect the biggest gains to be made further down the market capitalisation spectrum, specifically the FTSE 250 mid-cap index.

“In this scenario, interest rate-sensitive stocks such as real estate and housing-related names could be material beneficiaries, and retailers could be due a catch-up too,” he said.