The gilt market is fairly priced ahead of the autumn Budget, but chancellor Rachel Reeves’ pending decisions could spark volatility if they fall short of market expectations, according to Ales Koutny, head of international rates and manager of Vanguard’s Global Core Bond and Global Strategic Bond funds.

After a sharp sell-off pushed gilt yields to multi-decade highs in the summer, prices rebounded strongly in the early autumn as investors bet on Bank of England rate cuts and hopes for tighter fiscal policy in the Budget.

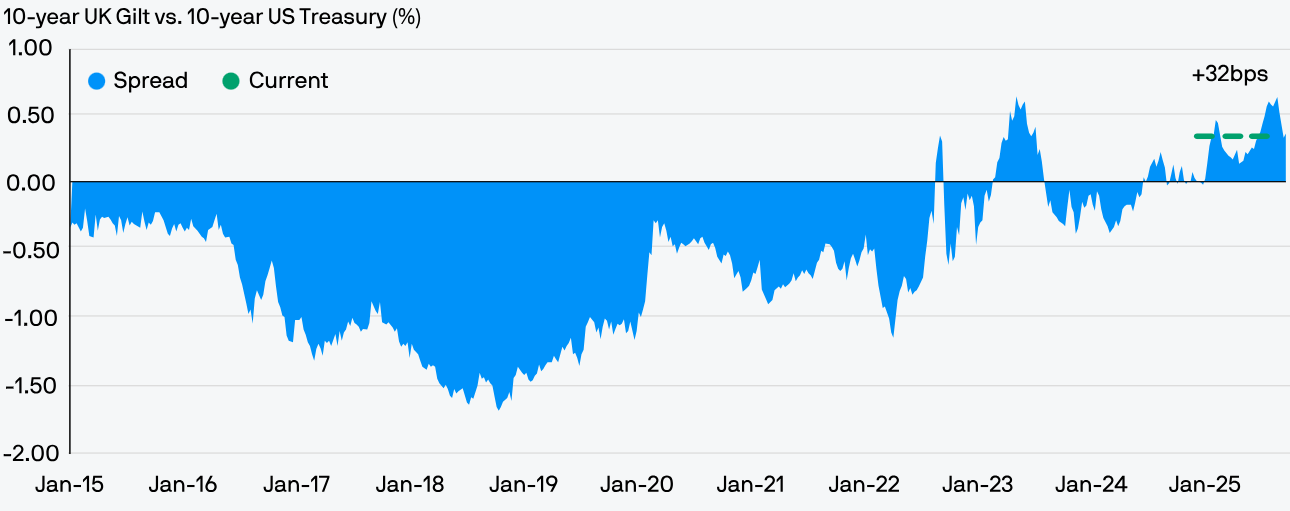

As shown by JPMorgan in the graph below, a sustained combination of sluggish growth and high inflation in the UK has ultimately undermined investor confidence, with gilts across different maturities trading at a premium compared to last year and relative to other markets.

JPMorgan demonstrated this by comparing the 10-year gilt and 10-year US treasury spread, which was still elevated at 32 basis points as of 11 November 2025, defying the negative spread which has been the norm over the past decade.

10yr gilt vs 10yr treasury spread over a decade

Source: JPMorgan, Bloomberg. Data as of 11 November 2025

“We were buying gilts [this year] because we were happy with the offering and those with an overweight – including ourselves – ultimately did well when gilts rallied,” said Koutny.

“However, the Budget is still hanging over the end of the month as a big risk event for the [bond market].”

The outcome of the Budget will be critical as it will determine whether the rally will hold or reverse, he said. In particular, markets are hoping for fiscal consolidation and headroom of around £10bn. “Any shortfall against this could trigger volatility and higher yields,” Koutny noted.

One of the best ways for the government to ensure it has the headroom bond markets are looking for is to raise income tax – a lever the Labour government has pledged in its manifesto to leave well alone.

Despite rumours that Reeves was planning to break the manifesto pledge, it has subsequently been confirmed that income tax will remain untouched. Instead, she will be looking to pull multiple, smaller levers to try and raise the cash.

This prompted a gilt sell-off, with the 10-year gilt yield jumping 13 basis points to 4.57% and the two-year gilt by six basis points to 3.82%.

“Markets did get a bit confused,” said Koutny. “However, what ultimately matters for gilts is a combination of reasonable growth, fiscal discipline and inflation under control. We do not think recent announcements or market moves have disrupted the marginal improvements we are seeing for the UK.”

Should Reeves manage to balance the books, the UK will go into 2026 in a stronger, more attractive position, with the Budget instead “being more of a non-event”, Koutny added.

“The problem is that this requires drastic measures and is going to be a big tug of war between spending versus taxation,” he said.

James Lynch, investment manager at Aegon Asset Management, suggested the fiscal rules should be relaxed, noting that maintaining a headroom of £10bn based on Office for Budget Responsibility (OBR) forecasts for inflation, growth and interest rates “does seem restrictive, given the fact small tweaks in the assumptions have big consequences”.

However, if these rules were loosened, or OBR assumptions ignored, the gilt market would likely interpret this as a signal for more borrowing, thereby pushing yields higher and increasing debt servicing costs even further, Lynch said.

No easy trade in the UK

Koutny said he has been long duration in UK bonds “but the easy trade is done now”.

“Markets previously priced in almost no rate cuts from the Bank of England and a high risk premium,” he said. “Now we are in an environment where both of these things have moved in favour of gilt holders.”

As such, he has been reducing his position at the margin on the basis that there is going to be much more volatility around the Budget – good or bad.

Koutny said: “We still like yields [in the UK]. Once the Budget is done and dusted, there is going to be an opportunity to get the term premia out. If you look at the changes the DMO [UK Debt Management Office] has done, it has, in the past, been very slow in moving its issuance profile.”

The DMO’s decision to reduce around half of the debt issuance versus the previous year on the long end has translated into a shift in the supply and demand of long-dated gilts, he said.

The UK in a global context

Despite reducing his exposure, gilts nonetheless still have a role to play when thinking of his portfolios on a global basis. Koutny noted that term premiums are rising globally, which is a concern.

To counteract this, he said he “still owns flatteners in the UK” – meaning he is betting long-term yields will stay low relative to short-term. But he has paired these with steepeners in regions like Europe.

When looking to the eurozone, he flagged the expected big impact of the Netherlands, with Dutch pensions set to shift from defined benefit to defined contribution pensions from January 2026 and January 2027.

This will change how Dutch pension funds hedge interest rate risk, likely reducing demand for long-duration bonds, he said, which could affect term premiums globally and make steepening trades attractive – not just in Europe.

“Then when you look at Germany, which should be doing over two times the net issuance of bonds next year to finance fiscal spending,” Koutny added.

“These bonds need to be absorbed somewhere, so we are trying to see where that will come from – will it come from credit or equities? Or is there just enough money sat on the sidelines that it can pick up the slack and really power the growth movement in Germany and spill over into the rest of Europe.”