Asia ex Japan is on the cusp of a growth surge, according to Baillie Gifford Pacific co-manager Roderick Snell. He cited a “triple growth scenario” underpinned by cheap valuations, structural resilience and rapid economic expansion.

“Two of the five largest economies in the world, China and India, are based in Asia and the region accounts for 60% of all GDP growth, about a third of all GDP and yet only around 8% of global indices,” Snell said.

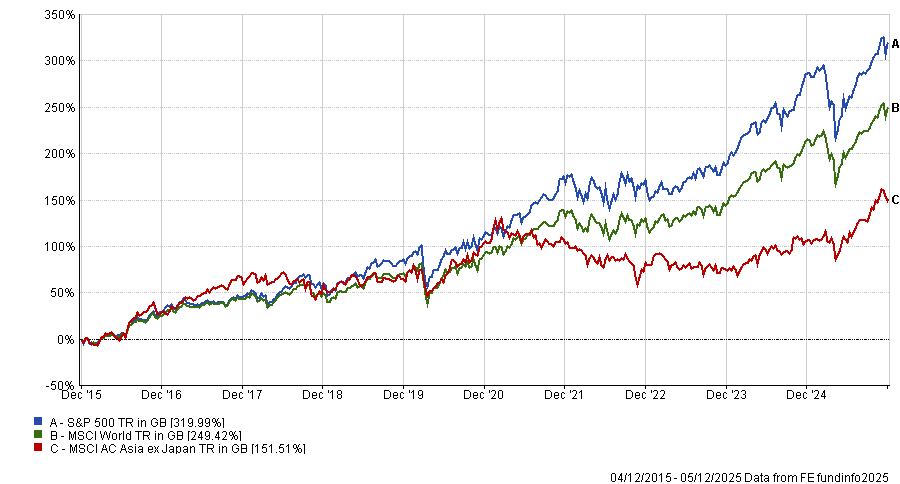

“It has admittedly been a pretty poor place to invest for the past decade. If you had invested anywhere else in developed markets or the US, you would have made two or three times your money. It has been a disappointing place to be.”

Performance of MSCI Asia ex Japan vs MSCI World and S&P 500 over 10yrs

Source: FE Analytics

Despite a long period of underperformance, Snell said Asia ex Japan is now at a “major inflection point where we are going to have a golden period for the region” over the next five to 10 years.

He noted that valuations remain near-record discounts compared to developed markets, even as the International Monetary Fund forecasts faster growth for 90% of Asian economies.

In addition, despite a challenging multi-decade backdrop of aggressive US rate hikes and a strong dollar, the region has avoided crises thanks to low reliance on foreign capital and years of net outflows, Snell said.

Structurally, Asia is set to become the centre of global consumer demand, he predicted, with 80% of the world’s new middle class emerging from its domestic markets.

While the backdrop looks compelling, Snell warned that not every market will benefit equally – making selectivity critical.

As such, Baillie Gifford Pacific has leaned into Vietnam and China while taking a more cautious stance on India.

China: Capitalising on the resurgence

China has been “very weak” for the past three to four years, according to Snell, but he argued that conditions have now stabilised.

A couple of years ago, the Baillie Gifford fund was underweight China but Snell said he has been adding “significantly” over the past 18 months. It currently makes up around 40% of the fund.

“It’s a $17trn economy growing at 5% per annum,” he noted, adding that the government has shifted toward pro-growth policies and private sector backing – particularly in tech.

“China is now leading in many pivotal areas, such as electric vehicles, batteries and solar,” he said. “While there have been issues with the Chinese economy, we are past the worst.”

At the stock level, there are also lots of affordably priced opportunities. Snell pointed to coffee chain Luckin Coffee, which has outgrown Starbucks in China with 24,000 stores – 7,000 of which have been added in the past year.

“It knows how to grow but it has a pretty checkered past,” Snell said.

Upon initial public offer five years ago, Luckin faced a major accounting scandal and was subsequently delisted from the stock market. Snell said the company has since restructured and rebounded strongly.

“As it is not on the main exchange anymore, a lot of investors won’t even look at the company,” he said. “This means you can get China’s largest coffee franchise for a fraction of the price.”

Another example highlighted by Snell was Lufax, a wealth management and retail lending platform mostly serving small and medium-sized companies.

“At the moment, it’s trading on 0.1x price-to-book ratio and it has double its market capitalisation in cash – which it is paying out,” said Snell.

“Last year, investors got the entire market cap back in cash and we think that is going to happen again over the next 18 months. Plus, there is the chance this goes from 0.1x to 0.5x price to book.”

China also has world-leading businesses, particularly in areas such as new technology and green energy, with companies like hybrid car maker BYD Auto, battery manufacturer CATL, TikTok-owner Bytedance and online retailer Alibaba, he said.

Vietnam: The next Asian Tiger

The Baillie Gifford fund’s biggest overweight position is in Vietnam, which makes up around 10% of the portfolio’s assets.

Vietnam stands out to Snell as the strongest structural story in emerging markets because it has built a successful export manufacturing base – a foundation that historically enabled countries like Japan, Taiwan and China to ‘emerge’.

“It is the only country of any size that is doing that today, so we think it is likely to be the next Asian Tiger,” he said.

Domestically, the country is also at a major inflection point, Snell said, noting that the economy over the past few years has been “pretty weak”, largely due to Nguyễn Phú Trọng, General Secretary of the Communist Party of Vietnam until he died in August 2024.

“He could be described as a miserable Marxist as he put in place a big corruption clamp-down operation called ‘blazing furnace’,” Snell explained.

“This led to huge problems for the country, essentially prompting a mini property crash and a crisis in the bond and banking markets. Worst of all, no one was prepared to sign anything off in Vietnam which, when you were reliant on multinationals coming up to set up their exporting bases, was a big problem.”

He has since been succeeded by Tô Lâm, who Snell views to be “very much the opposite”, noting “he is all about the economy and growth and is far more business minded, [pushing] for 10% per annum GDP growth”.

“We are really starting to see changes on the ground as a result,” Snell said.

India: Too expensive

Over the past two years, Baillie Gifford Pacific has been funding its overweights in China and Vietnam by selling down India. It has gone from being an overweight in the fund – the second largest behind Vietnam – to being a “big underweight position in the portfolio”, said Snell.

India’s economy is growing steadily, but Snell warned that the lack of private sector investment to complement strong government spending could hinder its ability to sustain GDP growth.

But the big issue with India has been the valuation disparity, according to Snell.

“It has been one of the top performing markets over the past few years and we struggle to find stocks where we can realistically double our money over the next five years,” he said.

For example, he noted that Hindustan Unilever is growing at around 10% per annum in dollar terms but you have to pay around 50x price to earnings (P/E).

“For India’s largest supermarket chain DMart, it’s seeing similar levels of growth but is trading close to 100x,” Snell said.