Investing in up-and-coming funds can have its benefits and its drawbacks. In some cases, the best returns come early, as managers aim to build a strong track record to entice more money into their fledgling portfolios.

However, taking a punt on an untested fund does come with its risks and a common rule of thumb is to wait three years until there is a proven track record to assess.

In this series, Trustnet looks at the funds launched in 2022 that turned three years old during 2025. To maintain consistency, we have looked at their performance over the three years from the start of 2023 to the end of 2025.

We start off in the US, where funds that launched in 2022 had an interesting first three years to navigate. In 2023 and 2024 the rise of artificial intelligence (AI) supercharged technology stocks, with the ‘Magnificent Seven’ of Alphabet, Apple, Amazon, Microsoft, Nvidia, Tesla and Meta leading the charge.

Last year, president Donald Trump derailed markets somewhat. Although the S&P 500 index ended the year higher, it lagged other areas as uncertainty around ‘Liberation Day’ tariffs and other policies persuaded investors to start to look elsewhere.

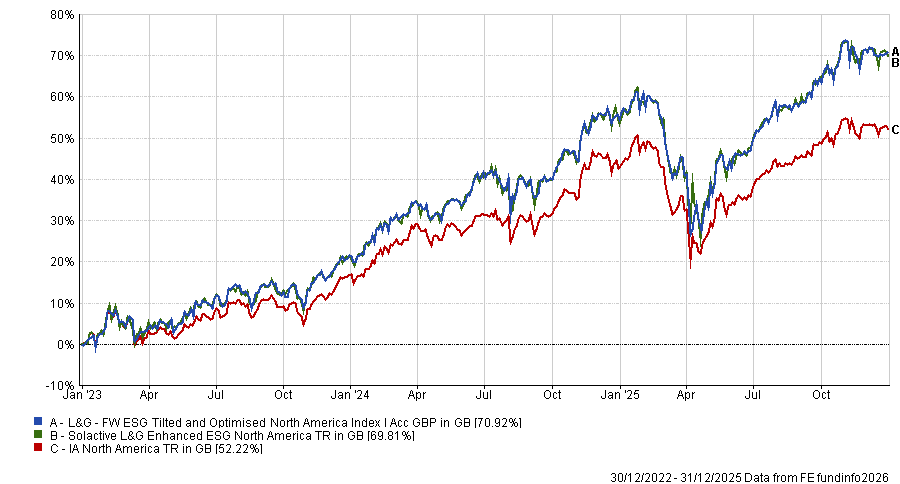

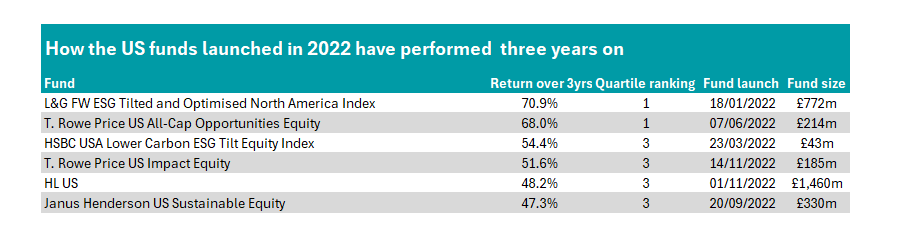

Two ‘young funds’ stood out, the first one being L&G FW ESG Tilted and Optimised North America Index, which made top-quartile returns over the three years to the end of 2025, up 70.9%.

Performance of fund vs sector and benchmark over 3yrs

Source: FE Analytics

In a relatively short time, it accrued £780m of assets under management (AUM) and gained recognition from both FE Investments (FEI) and Titan Square Mile.

Analysts at FEI highlighted the Legal & General (L&G) strategy as a “compelling” option for investors looking for environmental, social and governance strategies at a low cost.

“The sustainable process is centred around L&G's proprietary environmental, sustainability and governance (ESG) scores, relying on internal resources rather than external rating agencies that tend to be more reactive than proactive,” they said.

Meanwhile, Titan Square Mile analysts gave it a ‘Responsible Recommended’ rating, noting that much of this is due to the “suitability of the benchmark”.

The Solactive L&G Enhanced ESG North America Index is a custom index that excludes companies featured on L&G’s future world protection list, and companies with more than 10% of their revenue coming from military contracting, tobacco, thermal coal, adult entertainment or gambling.

It then overweights stocks that score highly on the firm’s ESG scoring system and underweights in stocks that score poorly. Top holdings include all of the Magnificent Seven, as well as Broadcom.

The other top-quartile performer was T. Rowe Price US All-Cap Opportunities Equity (68%), managed by Justin White. The fund is another with a high weighting to Magnificent Seven names, including Nvidia, Apple, Microsoft and Alphabet among its top holdings.

Source: Trustnet

However, it was not all good news. The four other US funds that launched in 2022 all made below-average returns.

Three have a sustainability tint: HSBC USA Lower Carbon ESG Tilt Equity Index, T. Rowe Price US Impact Equity and Janus Henderson US Sustainable Equity.

Last year, funds with a sustainable approach lagged their conventional peers on average, as Trustnet revealed earlier this month.

ESG investing was in favour during the early portion of the 2020s and was one of the hottest areas in the industry, but it has fallen in recent years as higher interest rates and political headwinds have impacted returns.

HL US was the only non-ESG fund among the underperformers. Managed by Roger Clark and Ziad Gergi, it uses external fund managers including Putnam, JP Morgan, William Blair and Alliance Bernstein, who all run a sleeve of the portfolio each.

“The external fund managers manage their own portions of the fund and we’ve given them clear boundaries on how to run them following their tried and tested strategies,” Hargreaves notes on its website.

The portfolio has taken the most assets of any of the funds on the list in its short lifespan, with an AUM of £1.5bn, despite returning just 48.2% over the past three years – below both the sector average and the S&P 500 index benchmark.