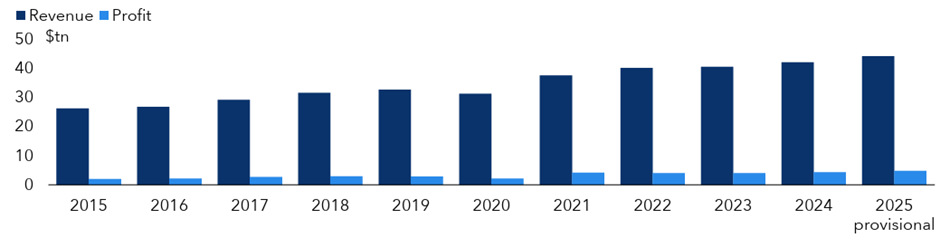

The world’s 1,600 largest listed companies made projected profits of $4.85trn in 2025, according to Capital Group’s Profit Watch report, up 12.2% year-on-year and more than double the level recorded nine years ago.

Global revenues reached $44.2trn in 2025, up 5.3% year-on-year. This revenue growth explains just under half the profit increase, with lower one-off costs and favourable exchange rates accounting for the remainder.

Technology and media sectors drove profit growth, with technology profits rising close to one-third and a quarter respectively on the back of lower one-off costs. Semiconductor manufacturers delivered one-third of global earnings growth in 2025.

Revenue vs. net profit, $trn

Source: Profit Watch – Capital Group Global Equity Study 2026

Companies returned $3.5trn to shareholders through dividends and buybacks in 2025, up 7.7% from $3.25trn in 2024. This figure has doubled since 2016.

Profits covered dividends and buybacks 1.39x in 2025 while cashflow exceeded payouts by at least one-fifth.

Earnings have grown 143% since 2015, outstripping revenue growth of 69%. Profits and shareholder distributions have expanded twice as fast as global inflation since 2016.

Christophe Braun, equity investment director at Capital Group, said: “This long-term growth has driven up share prices, bringing large capital gains and generating trillions of dollars in cash to return to shareholders.”

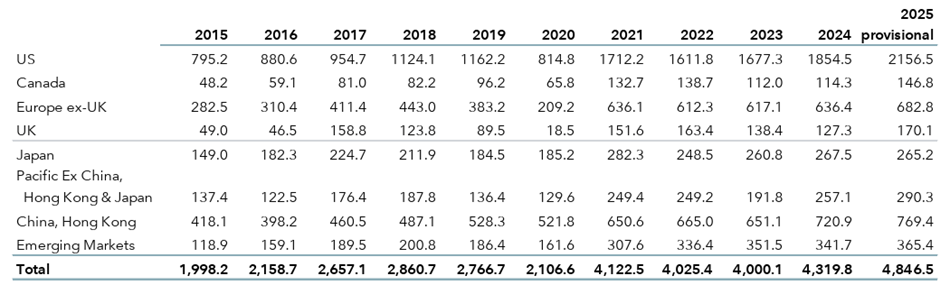

UK companies generated projected profits of $170.1bn in 2025, up one-third year-on-year. The financial sector and industrials drove this growth following flatlined revenues between 2022 and 2024.

Net profit, $bn

Source: Profit Watch – Capital Group Global Equity Study 2026

UK cashflow cover of dividends and buybacks stood at 1.34x in 2024, slightly above the global average that year, and is likely to have remained so in 2025. This suggests UK companies generated enough cash to fund their payouts.

The US and Canada recorded the strongest profit growth in 2025. US growth remains heavily reliant on a handful of large companies, while banks provided more than half the growth in Canada.

Chip makers drove gains in Taiwan and Korea. Struggling car manufacturers held back European growth.

Braun said: “Corporate balance sheets are stronger than they were pre-pandemic and the discipline of capital return has spread beyond the US. For investors, this underscores the importance of focusing on companies with durable profitability and strong fundamentals.”

Looking forward to 2026, consensus earnings estimates have improved, according to Capital Group, as declining interest rates, government stimulus and trade agreements have reduced uncertainty.

Emerging markets are expected to lead earnings growth at 18%, aided by structural corporate governance reforms in Asia to enhance shareholder value, particularly in Japan and Korea.

The US is forecast at 15.6% and Europe at 12.2%.

Earnings momentum and strong cashflow generation should help mitigate downside risk, the group said.

However, intermittent volatility and valuation-driven corrections remain possible as persistent inflation, elevated sovereign debt, geopolitical uncertainty and potential policy missteps remain risks in 2026.