Last year was one that confounded many investors – including the Trustnet editorial team. At the start of the year there were concerns over a recession, hopes for a rebound in China and belief that inflation would be transitory.

Fast forward 12 months and the world is a different place. Few predicted the market rising on the back of an artificial intelligence (AI) boom, while we now know that the post-Covid rebound in China underwhelmed and a recession never came. Meanwhile inflation remained persistent, causing central banks to hike interest rates aggressively.

With all that being said, the fund picks from the team were not an abject disaster – in fact quite the opposite (for the most part).

Taking the top spot of 2023 was reporter Matteo Anelli, who selected the Royal London Sustainable World Trust run by FE fundinfo Alpha Manager Mike Fox and his team.

“Without a particularly strong conviction in any segment of the market, making a specific choice of market, style or theme would mean that I’d be buying into the hope that my crystal ball is better than everyone else’s,” he said at the time.

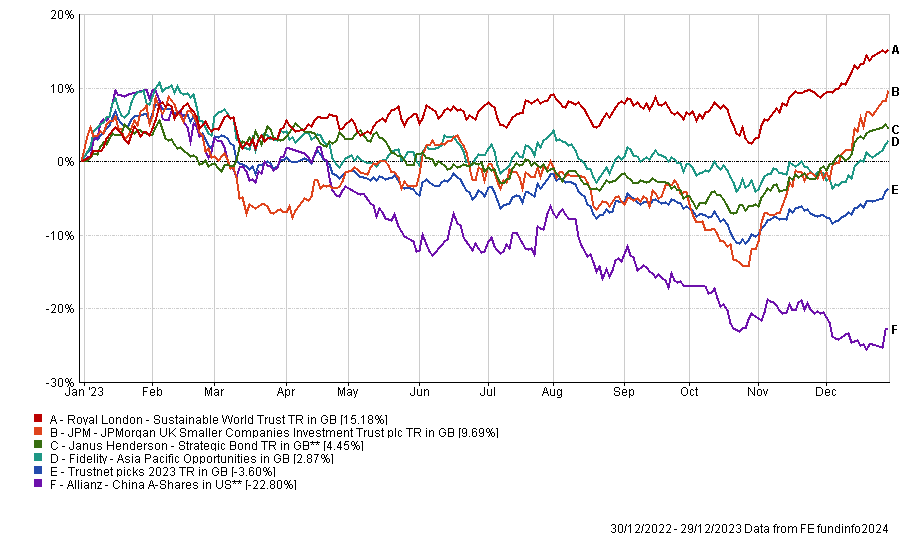

This strategy proved most prudent. The fund made a 14.9% return in 2023, the best among our picks by a wide margin. The fund was a top-quartile performer in the IA Mixed Investment 40-85% Shares sector.

It benefited from the AI boom, with technology the largest sector weighting (22.1%) and the likes of Microsoft and Alphabet – two of the ‘Magnificent Seven’ stocks that have dominated the market this year – as its largest holdings.

Performance of funds and the entire portfolio in 2023

Source: FE Analytics

In second place was former Trustnet Magazine editor Anthony Luzio who, at the third time of asking, finally enjoyed a smaller companies revival. He selected a small-cap trust in each of the past three years, more often than not landing him at the foot of the performance tables, but not in 2023.

Despite the uncertainty throughout much of the year, smaller companies rallied towards the end of 2023 as investors began to look ahead to lower inflation and interest rate cuts. This should be a welcome environment for smaller companies, which should rally, according to some managers.

His selection – JPMorgan UK Smaller Companies Investment Trust – was a strong option, making investors 9.3% over the year, an above-average effort in the IT UK Smaller Companies sector.

In third position was FE fundinfo head of editorial Gary Jackson with his selection of Janus Henderson Strategic Bond netting a 4.5% return over the year.

At the time he anticipated a bond rally on the back of a potential recession. While there was no recession, bonds held up well last year despite rising interest rates as investors moved down the risk scale, picking up attractive yields.

Fixed income particularly rallied towards the end of the year as investors looked ahead to lower rates, deciding to lock in high yields now rather than waiting.

Despite being a bottom-quartile performer in the IA Sterling Strategic Bond sector for the year, the Janus Henderson portfolio still made a positive return for investors.

In fourth place, Trustnet editor Jonathan Jones’ Fidelity Asia Pacific Opportunities eked out a 2.4% gain on the year. It was an above-average performer in the IA Asia Pacific Excluding Japan sector over the course of the year, but was hampered by its 26.8% exposure to China.

Speaking of which…

In last place, former reporter Tom Aylott had a disastrous year, picking the Allianz China A-Shares fund. Like many, he believed the prospects of a post-Covid rebound would propel the economy and boost the domestic market.

This did not happen and the Chinese market tanked during the year. His selection fared even worse, down some 22.8% and dragging our overall return down to a 3.6% loss. It was the eighth worst fund in the entire Investment Association universe.

He did note at the time that this was a long-term holding and one that could have a poor year if things did not go right – which ended up being more true than he perhaps hoped.

We will keep our fingers crossed that our fund selections for 2024 provide a clean sweep of positivity, after falling one short in 2023. However you invest, we wish you the best of luck.

Please note, these selections are an exercise and should not be viewed as financial advice.