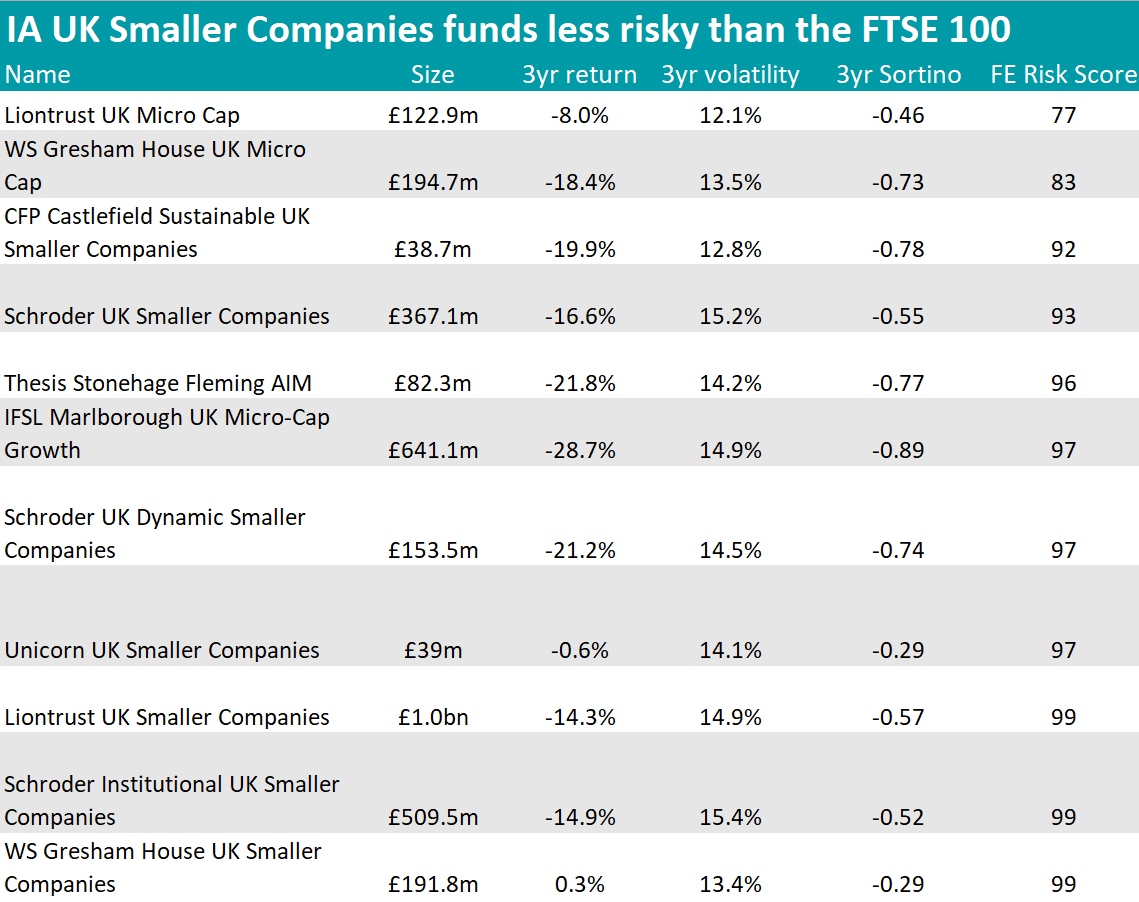

Eleven funds in the 47-strong IA UK Smaller Companies sector are less risky than the FTSE 100 index, data from FE Analytics has shown.

While smaller companies are usually thought of as more volatile and therefore riskier than larger, more established businesses, there are exceptions to the rule, with eleven small- and micro-cap portfolios achieving an FE fundinfo Risk Score lower than 100.

This is a measure of relative risk, whereby the FTSE 100 is given a risk of 100 and cash a risk of 0, and using these as reference points, funds are placed on a scale according to their performance in the past 18 months to three years.

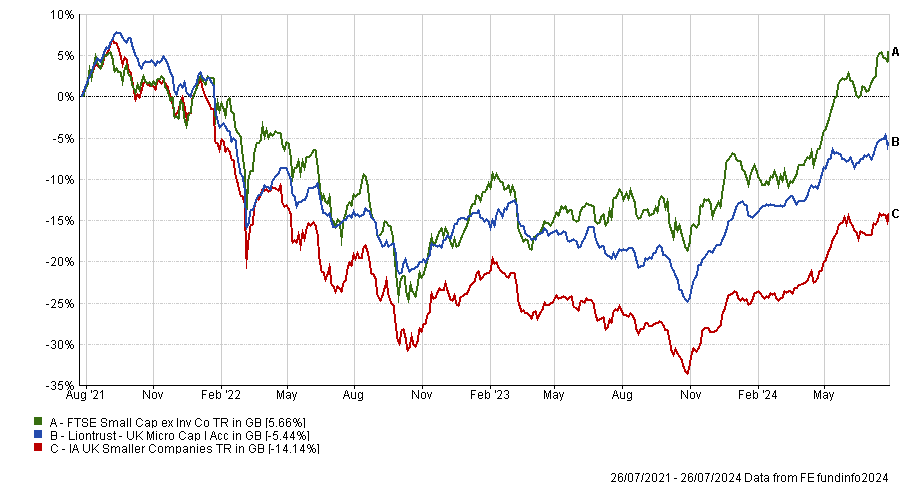

The lowest-risk fund in the IA Smaller Companies sector was that of Liontrust UK Micro Cap, which achieved a score of 77 by returning -8% over the past three years – well above the rest of the sector, as the chart below shows.

Performance of fund against sector and index over 3yrs

Source: FE Analytics

The fund is co-managed by FE fundinfo Alpha Managers Anthony Cross and Julian Fosh, together with Matthew Tonge, Victoria Stevens and Alex Wedge. FE Investments analysts praised the team for its timely removal of stocks over £275m, making this “a true micro-cap strategy”.

Its higher-than-average costs (1.25%) and its preference for companies listed on the alternative investment market (AIM) make it suitable for long-term investors only, they said.

To account for other measures of risk, its three-year Sortino ratio was the third-best in the list, meaning that it is more likely to protect investors on the downside, and its volatility was the lowest in the group (12.1%).

Source: FE Analytics

Liontrust featured twice in the table, with the UK Smaller Companies fund managed by the same team, also maintaining a FE risk score below 100 (by just one point).

WS Gresham House UK Micro Cap, managed by Alpha Manager Brendan Gulston and Ken Wotton, was the second-best fund by risk score (83).

FE Investments analysts emphasised the “thorough” research process and the “extensive network of industry specialists and brokers” around Wotton, whose process combines private equity elements with an emphasis on protecting capital and achieving long-term growth.

“To offset some risk inherent in investing in smaller companies, the team avoids more volatile areas of the market such as real estate, mining, and oil and gas, as well as early-stage and pre-profit companies,” they explained.

“Of the remaining companies, it then isolates those that generate cash, are profitable and are attractively priced, resulting in a fund that protects particularly well when markets are under pressure.”

The Sortino ratio of this fund was on the higher side (-0.73%), but the volatility was only 13.5%.

Just like Liontrust, it was a double whammy for Gresham House too, which managed to rank with the WS Gresham House UK Smaller Companies fund as well, led by Wotton alone.

Performance of funds against sector over 3yrs

Source: FE Analytics

At -0.29, the latter portfolio had the best Sortino ratio of the funds here, in a tie with Unicorn UK Smaller Companies, making these two strategies the best of the list at protecting investors from downside volatility.

Unicorn’s small vehicle (£39m) has a FE fundinfo Crown Rating of five (the maximum) and is managed by Simon Moon and Fraser Mackersie, who was added in February 2024.

Speaking to Trustnet recently, Moon suggested real estate might be a good place to be in when interest rates will be cut.

Other funds worth mentioning are Schroder’s triplet – UK Smaller Companies, its institutional version, and UK Dynamic Smaller Companies.

All three have a similar risk score and volatility, but the IA UK Smaller Companies fund has a better track record for only capturing volatility on the upside, avoiding it on the downside, thus achieving a better Sortino ratio than the Dynamic fund.

It is managed by Andrew Brough, who maintains an overweight to industrials, consumer discretionary and technology stocks and a lower exposure to real estate, energy companies and financials.

James Goodman replaced Iain Staples as manager for this fund in December 2023, but Staples continues to co-manage UK Institutional Smaller Companies, together with Brough.