Trustnet readers have been paying more attention to trusts in the global equity income, UK smaller companies and tech sectors this year, with one rapidly closing the gap with Scottish Mortgage.

The Baillie Gifford managed investment trust is the most heavily researched investment company among Trustnet users this year, accounting for 4.26% of the pageviews in the investment trust universe. As one of the biggest and best-known funds in the country, this should come as little surprise and the trust is always the most-viewed on Trustnet whenever this research is carried out.

JPMorgan Global Growth & Income, Alliance Trust, Polar Capital Technology Trust, F&C Investment Trust and City of London are other trusts with some of the highest factsheet pageviews on the website in 2024 so far.

However, a more interesting exercise is to find out the relative changes in research activity, to discover which trusts are receiving a higher or lower share of views than in the past.

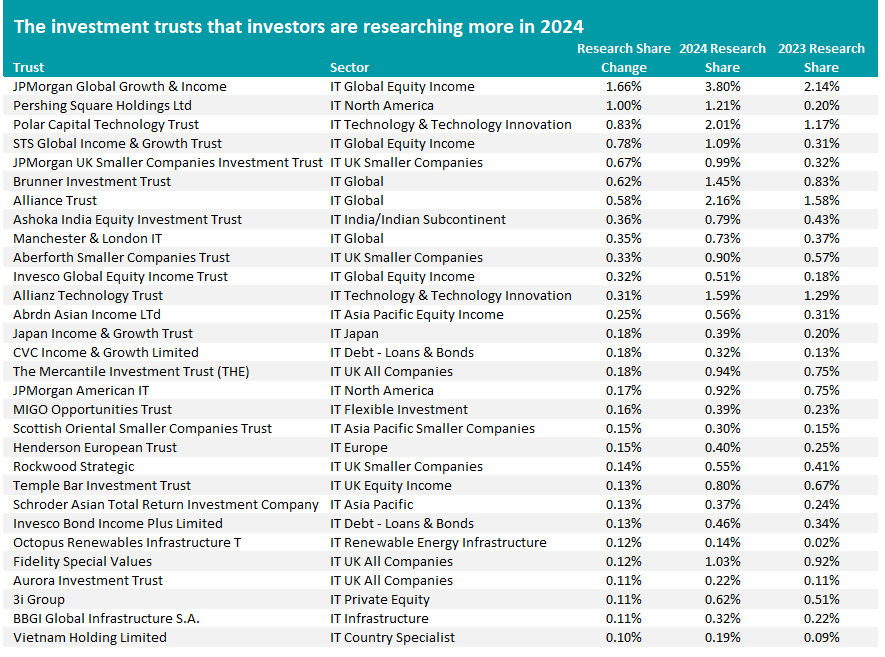

To do this, we took all the factsheet pageviews in Trustnet’s investment trust section for 2024 so far and the whole of 2023 then worked out the percentage share of total research that each trust won. The difference between the two years indicates if a trust has been getting more or less research.

Source: Trustnet, Google Analytics

This table shows the 30 trusts with the largest increase in popularity along with their research shares for 2023 and 2024 to date and the change between these years.

JPMorgan Global Growth & Income comes in first place. In 2023, it accounted for 2.14% of the investment trust research on Trustnet but this has grown to 3.80% in 2024 so far; this moved the trust from being the ninth most popular last year into second place this year.

Indeed, the £2.6bn trust is closing the gap with Scottish Mortgage in terms of Trustnet pageviews on a scale we haven’t seen for some time.

In 2023, there were more than 2 percentage points between Scottish Mortgage and the second-most researched trust (F&C Investment Trust); there are just 46 basis points between JPMorgan Global Growth & Income and Scottish Mortgage.

Managers Timothy Woodhouse, Helge Skibeli and James Cook use a bottom-up approach to build a high-conviction portfolio of between 50 and 90 stocks. Top holdings include Microsoft, Amazon, Nvidia, Apple and Mastercard.

The trust has a strong track record – sitting at the top of the IT Global Equity Income sector over five and 10 years – and recently announced a significant increase in the dividend to be paid in the 2025 financial year (its 2025 dividend will be 23.6% higher than 2024’s).

Thomas McMahon, head of investment companies research at Kepler, said: “JPMorgan Global Growth & Income has delivered strong dividend growth as well as highly attractive capital returns in recent years thanks to the simple, yet effective strategy of asking the managers to invest in high-quality growth stocks without reference to their yield, while paying a dividend from capital where necessary.

“Investors have therefore arguably got the best of both worlds: index-beating total returns as well as a healthy dividend yield. Those who don’t want to draw an income from the strategy can simply reinvest the dividends back into the shares.”

But the move towards global equity income trusts is not confined to just this one. STS Global Income & Growth Trust and Invesco Global Equity Income Trust are another two with noticeable increases in factsheet pageviews.

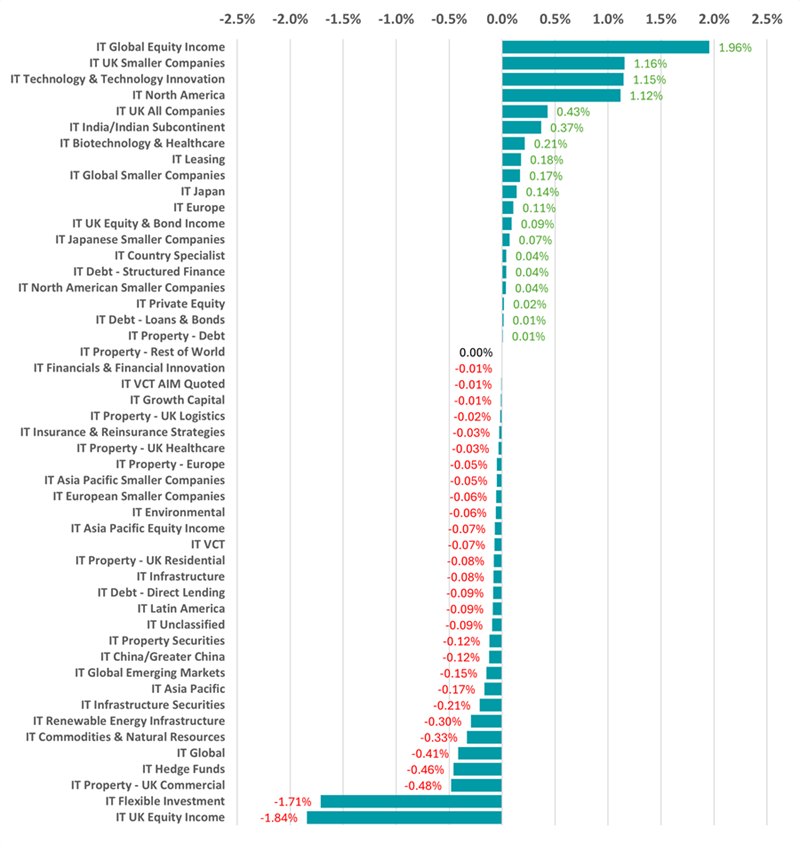

Change in investment trust research on Trustnet between 2023 and 2024

Source: Trustnet, Google Analytics

Other broad trends can be seen when the Trustnet research numbers are collated by the Association of Investment Companies sectors.

Investors have been paying more attention to trusts in the IT UK Smaller Companies and IT UK All Companies peer groups than they did last year. This might reflect the growing hope that the UK could end its long spell of underperformance as investors respond to a stable government, attractive valuations and interest rate cuts.

However, there has been less research into IT UK Equity Income trusts as Trustnet users look to the global stage for equity income.

The IT Technology & Technology Innovation and IT North America sectors are also being researched more than in 2023, on the back of continued hype around artificial intelligence and the 'Magnificent Seven' stocks, while IT India/Indian Subcontinent trusts are benefiting from the very strong gains being seen in the Indian stock market.