Global equities appeared to make little progress over the third quarter of 2024, data from FE fundinfo shows, although a closer look shows that plenty was going on just below the surface.

The MSCI AC World posted a slight gain over the past three months, after a V-shaped journey that saw the index slump on worries over the health of the global economy, lofty valuations among tech stocks and the unwinding of the yen carry trade.

Things then turned around with the publication of better economic data and the Federal Reserve making a 0.5 percentage point cut to interest rates. The recovery was then cemented when China launched an aggressive stimulus package, which ranged from rate cuts to fiscal support.

Below, Trustnet looks in closer detail at how markets moved over 2024’s third quarter.

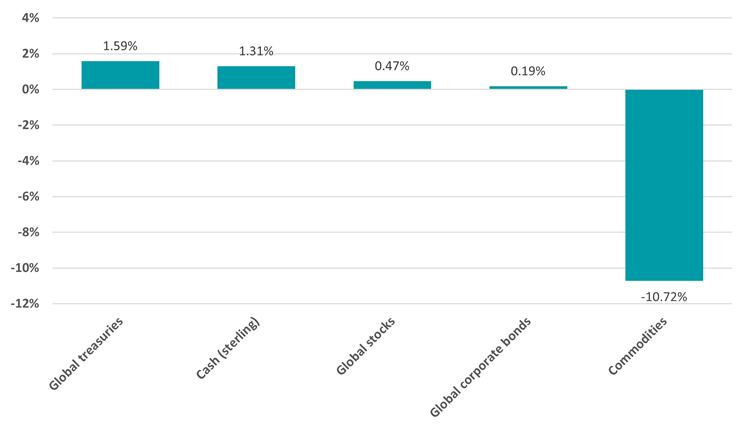

Performance of asset classes in Q3 2024

Source: FinXL

As noted above, global stocks performed mutedly, with the MSCI AC World making a total return of just 0.5% in sterling terms. This reflects a volatile quarter where concerns about a global slowdown and the unwinding of the yen carry trade weighed heavily on investor sentiment. However, the Fed’s rate cut and China’s stimulus in September helped stabilise markets towards the end of the quarter.

In comparison, global treasuries and cash in sterling performed better, delivering respective returns of 1.5% and 1.3% as investors sought safety in these assets amidst a mixed economic outlook. The anticipation of peak interest rates and concerns about economic stability led to a continued preference for lower-risk assets like government bonds and cash, while bonds were the beneficiaries of the Fed’s rate cut.

Commodities fared the worst, however, with a decline of 10.7% in the broad S&P GSCI index. Slowing growth in China put pressure on commodity prices during the quarter.

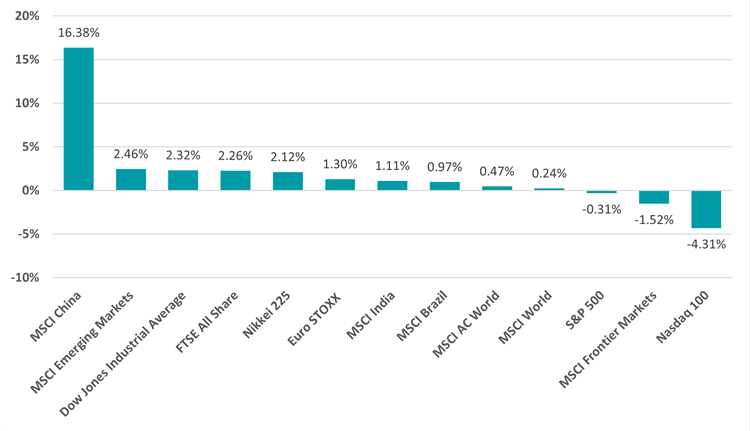

Performance of geographies in Q3 2024

Source: FinXL

Chinese equities – which have struggled for an extended period – were the standout performers of the quarter, with a 16.4% gain in the MSCI China index fuelled by the large-scale stimulus measures. These policy actions, aimed at spurring economic growth after a period of stagnation, sparked investor optimism, particularly in technology and consumer-driven sectors.

In contrast, the Nasdaq 100 fell by 4.3% as investors became increasingly wary of high valuations in US tech stocks and macro uncertainty. After several years of outperformance in technology and ‘new economy’ stocks, the market began to broaden out and shifted attention towards ‘old economy’ sectors in 2024’s third quarter, reflected in the modest rise in the Dow Jones.

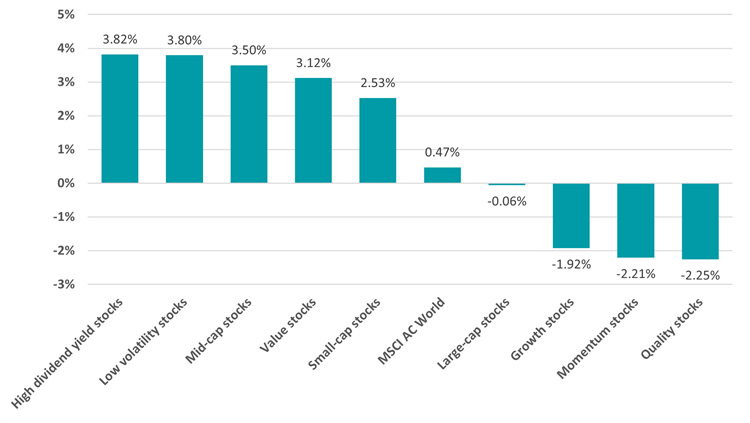

Performance of investment factors in Q3 2024

Source: FinXL

High-dividend yield and low-volatility stocks led the market as investors sought stability amid global economic uncertainties. Income stocks were favoured with investors looking for strong dividends as bond yields fall alongside interest rates.

On the downside, quality, growth and momentum stocks underperformed. This shift reflects investor caution around high-growth areas after several years of outperformance.

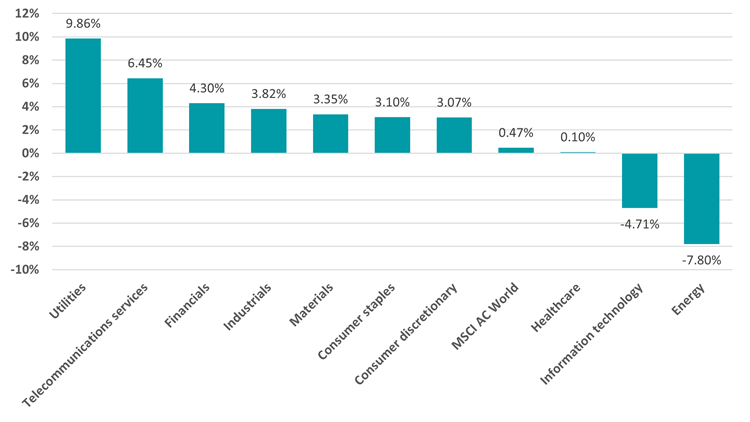

Performance of industries in Q3 2024

Source: FinXL

Utilities led the stock sectors in the third quarter with a 9.7% return, thanks to investor interest in defensive sectors amid economic uncertainty. These companies also tend to pay reliable dividends, which are tied to the demand for income noted above.

At the other end of the spectrum, energy stocks struggled with a decline of 7.8% on the back of weaker demand and falling oil prices. Information technology also experienced losses, falling by 4.7% in the broader market rotation away from high-growth sectors.

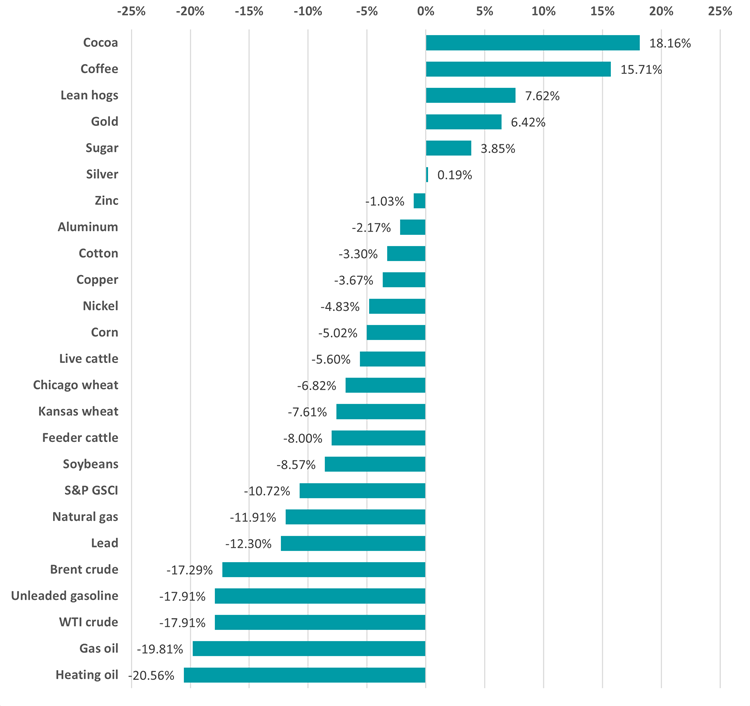

Performance of commodities in Q3 2024

Source: FinXL

Although commodities in general fell over the quarter, cocoa prices rose 18.2% while coffee was up 15.7%, following supply shortages and increasing demand. Lean hogs also performed well and gold climbed 6.4%.

Conversely, energy prices declined sharply, with heating oil down 20.6%, gas oil falling 19.8% and WTI crude off 17.9%. These losses were driven by a combination of lower demand, particularly as economic growth slowed in key regions like China and Europe.

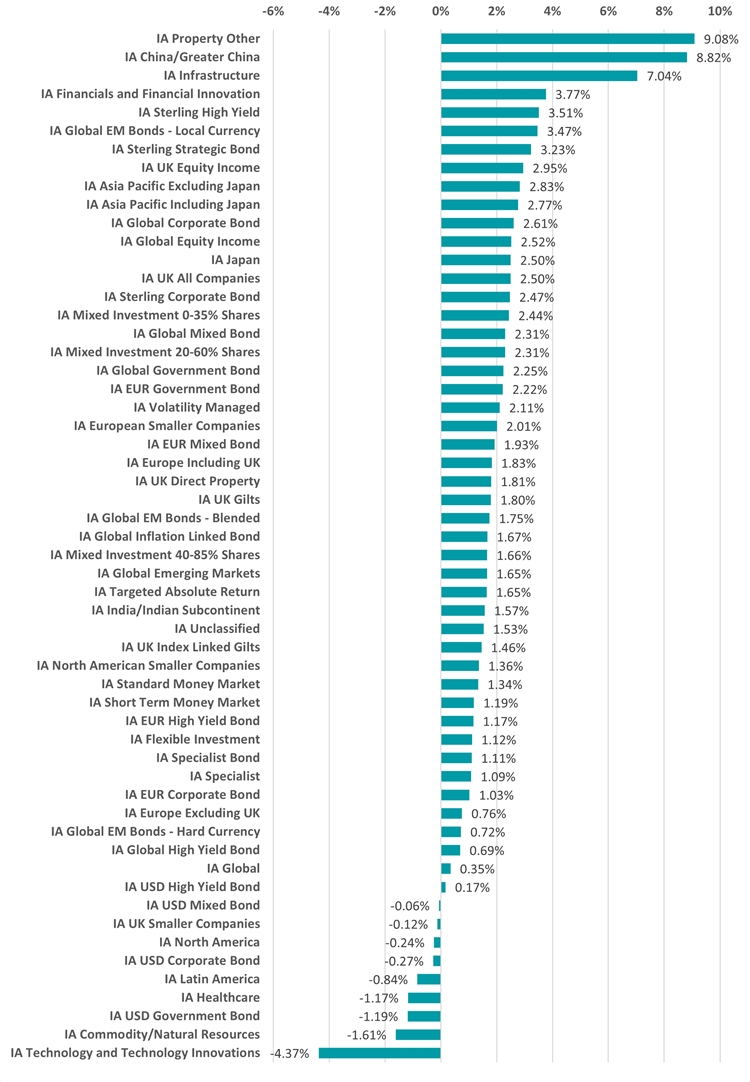

Performance of IA fund sectors in Q3 2024

Source: FinXL

When it comes to the Investment Association fund sectors, IA Property Other led the way with a 9.1% average return as falling interest rates made property investments more attractive.

The average IA China/Greater China fund gained 8.8% thanks to the stimulus package unveiled by Beijing. This represents a significant turnaround as Chinese equity funds were consistently at the bottom of the performance rankings because of slowing growth and recent regulatory crackdowns.

On the other hand, the IA Technology and Technology Innovations sector fell 4.4% over the quarter. This underperformance reflects broader market caution around high-valuation tech stocks, a recurring theme during the quarter as investors rotated into more defensive sectors.