China was the main place to be invested in September, according to monthly performance figures from FE Analytics, with Chinese funds and trusts making more than three times the next best peer group.

The country has been in the doldrums for much of the year, with the MSCI China index moving sideways from January to mid-September. But it rocketed higher over the past two weeks after fresh stimulus from the government propelled the market.

The People’s Bank of China (PBOC) freed up around 1trn yuan in long-term liquidity by reducing the reserve requirement ratio for banks by 0.5 percentage points, allowing them to lend more and support the economy. It also reduced interest rates by 0.2 percentage points and lowered existing mortgage rates by 50 basis points.

Ben Yearsley, director at Fairview Investing, added: “There is also the possibility of some helicopter money at some point and the PBOC will essentially lend to banks and brokers to invest in the stock market.”

These measures triggered the best week in nearly a decade at China’s stock exchanges towards the end of the month, propelling all assets invested in the region, as well as ancillary benefactors such as Europe, which relies heavily on exports to the country.

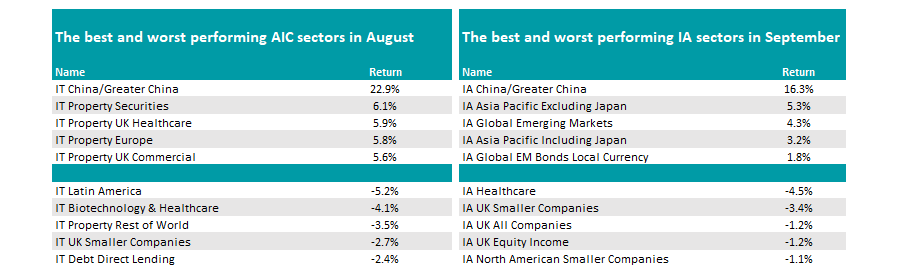

IA China/Greater China topped the best performing Investment Association (IA) sectors last month, up some 16.3%, while IT China/Greater China did even better, with the average trust in the Association of Investment Companies (AIC) peer group up 22.9%.

The top five IA sectors last month were dominated by the news, with IA Asia Pacific Excluding Japan in second with an average gain of 5.3% for its funds. It was followed by IA Global Emerging Markets, IA Asia Pacific Including Japan and IA Global EM Bonds Local Currency.

Source: FE Analytics

In the trust space, however, it was another asset class that caught the eye: property. Part of this could be because investors have finally agreed that inflation is now under control.

“Base rate cuts and a taming of inflation has led to investors rediscovering property as an asset class,” Yearsley noted.

In the UK, the consumer prices index (CPI) was flat in August at 2.2%, while in the US, one key measure of inflation fell from 2.9% to 2.5%.

Perhaps surprisingly, US funds and trusts failed to break into the top performers of the past month despite the Federal Reserve cutting rates for the first time in four years.

“The 0.5 percentage point cut was a bit of a surprise having only been trailed a week or two before. However, the US consumer continues to defy belief with retail sales increasing by 0.1% in August,” said Yearsley.

He suggested this could be because markets had previously priced in heavy rate cuts this year, before tempering their expectations. It is worth noting that the S&P 500 hit its 43rd record high of 2024 during the month.

Yearsley suggested, however, that the US rate cut may have been the key driver for the Chinese stimulus package. If true, this would make it indirectly responsible for the gains in Asia.

“China will occupy many column inches this month, but the Fed pivot was surely the catalyst. Without the slightly surprising 0.5 percentage point cut in September would Beijing have countenanced its multi-faceted approach? Will authorities there now wait for the next Fed cut, probably in November, before unleashing further measures?” he said.

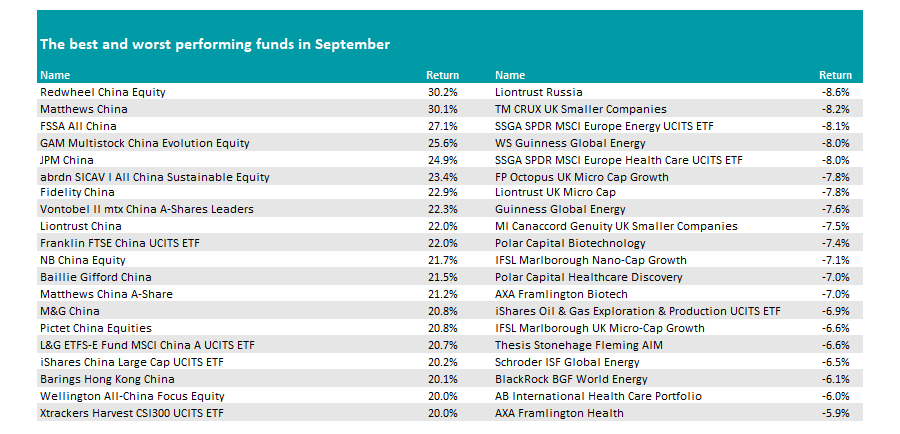

Turning to individual funds, the roll call of top performers was dominated by China. It is the first time that the top 20 funds in the list below have all come from the same asset class.

Topping the table was Redwheel China Equity with an impressive 30.2% rise, while Matthews China was up 30.1%. These were the only two on the list to cross the 30% threshold, with the remaining 18 making gains of between 20% and 27.1%.

Source: FE Analytics

Among investment trusts, JPMorgan China Growth & Income, Fidelity China Special Situations and Baillie Gifford China Growth all made more than 20%, leading the way.

At the other end of the spectrum, it was a poor month for UK funds, with the IA UK Smaller Companies, IA UK All Companies and IA UK Equity Income sectors all among the worst performers in September.

Market commentators are expecting a tough autumn Budget from chancellor Rachel Reeves later this month, while the Bank of England was the only of the major three central banks to opt against cutting rates in September.

Additionally, the Office for National Statistics has revised down GDP, with the second quarter growth this year reduced by 10 basis points to 0.5%.

Yearsley said: “The pace of growth has faltered with [Keir] Starmer and Reeves being blamed for talking the UK down. Growth has now stalled for two months, and the third quarter could see no growth at all.

“UK flash PMI fell from 53.8 in August to 52.9 last month. At the same time, borrowing has overshot with debt to GDP now over 100% for the first time since the 1960s.”

IA Healthcare however took the top spot, with the average fund down 4.5%, while in the trust space, IT Latin America led the way lower, losing 5.2% on average.

In terms of individual funds, Liontrust Russia propped up the standings down 8.6%. “There didn’t seem any particular reason except the ongoing/never-ending war in Ukraine,” said Yearsley.

“The only real theme was UK micro-cap funds, especially those exposed to AIM. Rumours abound that the chancellor will remove the IHT break from AIM shares, which would be a devastating blow to the junior market and at complete odds with the Labour Party’s promise to be pro-growth.”

Energy funds also featured near the foot with the oil price falling near the $70 mark over the course of the month.