Markets have always moved rather quickly, but for some experts, the biggest challenge facing the market is investors' obsession with short-term results.

Certainly, no stock can rise forever and for investors hoping to make the most of their money, it is crucial to know when to get out to avoid a potential downturn in performance. However, for many experts, making investment decisions on the back of short-term price movements is a dangerous game and is one too many investors have begun to play.

Louise Kernohan, co-manager of the £1.4bn BNY Mellon Global Equity fund, said: “I think often stocks are moving away from fundamentals and valuations and being carried by momentum. I think it is the case that markets have become too fixated on the short term.”

As a result, investors have begun to lose sight of the long-term potential of companies and have let short-term performance dictate their evaluation of strong businesses with significant growth potential.

In such a market, there are a range of opportunities for the more adventurous investors who are willing to maintain faith in even the most ‘out of favour’ stocks.

Ben Needham, co-manager of the Ninety One UK Equity range, said: “Rome wasn't built in a day, a better tomorrow will not come without pain for today, and that’s for companies, that’s for society, that’s for everything.”

He admitted that investing in out-of-favour stocks can be like waiting for a bus, “you wait 10 minutes, you wait another 20 minutes, and you just walk off because you get bored, and then the bus comes, and you wish you had waited that extra five minutes”, meaning investors must have patience.

CMC Markets

Thomas Moore, manager of the £156.7m abrdn Equity Income Trust, agreed with this long-term approach and highlighted the online trading platform CMC markets as a great example of a stock that rewarded long-term investors who maintained faith.

The firm has struggled in recent years, with shares declining from £5.36 in April 2021 to a low of just 99p in December 2023. This coincided with a poor year for the firm when it reported net operating income had declined by £2m.

Share price of CMC Markets over 5yrs

Source: Google Finance

Despite this, Moore remains convinced of the stock's value and potential for a long-term resurgence and currently holds the share as the eighth largest position in the portfolio.

Indeed, the stock has enjoyed a resurgence this year, with the share price rising to £3.25. Moore attributed this turnaround to the long-term investment approach of chief executive officer Peter Cruddas.

“Yes, there have been wobbles and profit warnings that have tested investors' patience but the fact that he then goes on to deliver what he said he was going to, got people quite excited."

Marks and Spencer

Similarly, Ian Lance, co-manager of the £798m Temple Bar Investment Trust, advocated for a long-term approach. Too many investors decide to remove companies from their portfolios due to short-term trends, regardless of how cheap the valuations are, he said.

This offers opportunities for investors with a more long-term approach to thrive. As an example, he drew attention to Marks & Spencer(M&S).

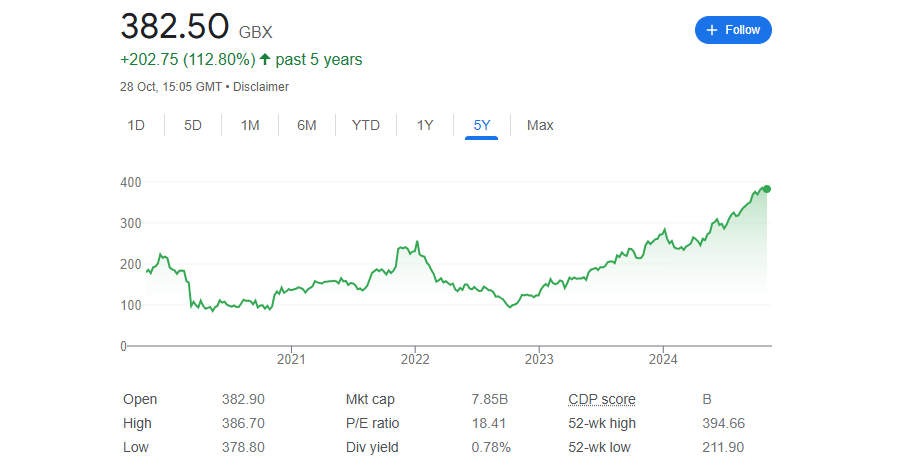

When the trust initially brought M&S, Lance said the firm paid no dividends making it particularly unpopular for many income investors. Moreover, the stock has had a turbulent five years, with the share price falling below a pound in 2020 and 2022, coinciding with the pandemic and the Liz Truss’ mini-Budget.

Share price of Marks & Spencer over 5yrs

Source: Google Finance

Despite this, Lance maintained faith in the stock, which is currently the 10th largest position in the portfolio, which has paid off this year, with shares up to £3.83, surpassing its former five-year peak of £2.56.

Lance attributed this turnaround to a change in leadership, which identified the problems with the company and started fixing them. As a result, the outlook was now much brighter, rewarding investors who had stuck with M&S when it was unpopular.