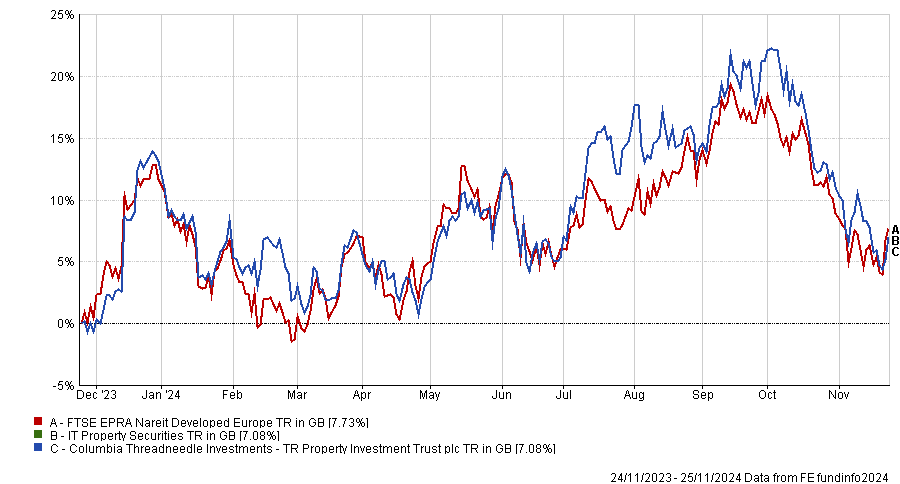

Every day is Black Friday for fans of investment trusts, with so many trading on discounts to their net asset value (NAV).

For investors hunting for a bargain, Alex Watts, fund analyst at interactive investor, has selected three vehicles on wide discounts that could experience an uptick in performance.

Fidelity Special Values

Currently trading on a “perplexing” 8.97% discount, Fidelity Special Values was Watts’ first pick, which he liked for its “differentiated and contrarian” approach to finding value opportunities across UK companies.

Led with “notable experience” by FE fundinfo Alpha Manager Alex Wright, flanked by deputy Jonathan Winton, it has a bias towards small and mid-cap UK businesses. The managers pick stocks via a bottom-up approach, looking for unrealised value and the potential to recover.

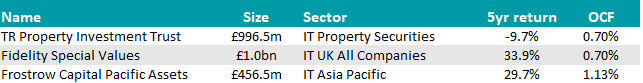

The trust has a proven capacity for outperforming the FTSE All-Share and its peers over various time periods.

While capital appreciation is the main goal, the yield of around 3% is “notable” and makes for a smoothing of longer-term returns, Watts said.

The trust has recovered well from the struggles it had in the first half of 2022, when small- and mid-caps trailed the large-cap heavy FTSE All-Share index.

Performance of fund against sector and index over 1yr

Source: FE Analytics

“The discount of just under 9%, while not as drastic as some peers, is a fair divergence from the five-year average of around -4.5%. Fidelity Special Values is a popular and sizable trust that not uncommonly trades near to, or above NAV,” Watts said.

“Coupled with the board’s aim to at least protect the discount from double figures, this could be viewed as an attractive point for new investors to buy into an already undervalued portfolio.”

Pacific Assets

The Pacific Assets trust invests in sustainable, quality businesses across Asian markets by following a “relatively defensive” quality-focussed approach.

This has led management to keep an overweight to India, with a 41% exposure versus 21% for its benchmark, the MSCI AC Asia ex Japan index, and an underweight in China (just 9% compared with 31% of the benchmark).

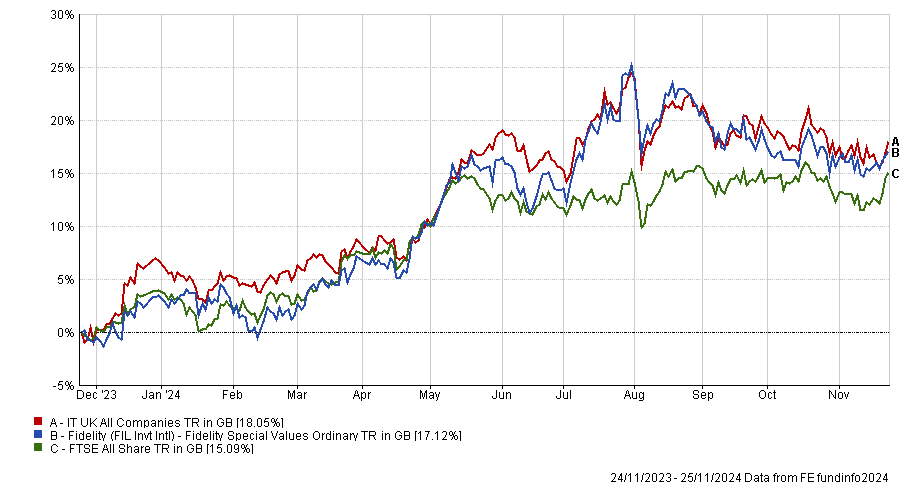

The widening discount, which has reached 12.04%, in tandem with the underweight to a Chinese market that rebounded through 2024, has caused the trust to lag its benchmark and peer group through the past year, as the chart below shows.

Performance of fund against sector and index over 1yr

Source: FE Analytics

However, Watts remained positive.

“Lack of leverage has led to lesser drawdowns in periods of weak emerging market performance, such as through 2022,” Watts noted.

“On top of that, the current discount of just over 12% is uncommon for the trust when compared with the last 10-year average discount of around -5%.”

TR Property

The TR Property Trust convinced Watts for its above-benchmark yield of over 5% and an impressive track record of growing distributions year-on-year.

This is achieved by occasionally paying distributions using revenue reserves, though this is “prudently managed, and a healthy reserve is maintained to deal with potential earnings shortfalls”, the analyst noted.

The trust invests in pan-European property securities and can allocate 15% to physical property, while the listed portfolio is diversified across sectors and holds roughly a third in the UK and two-thirds in Europe.

Manager Marcus Phayre-Mudge, who has been in charge of the strategy since 2004, looks for strong management teams overseeing quality assets and healthy balance sheets.

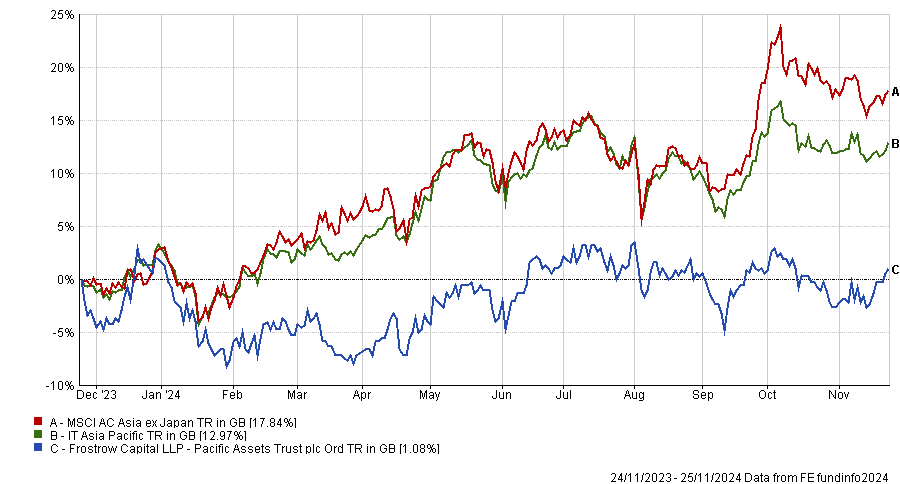

The property sector has been in distress since 2022, and unremarkable performance for the listed European property sector year-to-date means that returns over three years are negative.

However, Watts highlighted the “stellar” long-term track record of returning around 2-3% in excess of its benchmark over 10 and 15 years.

Performance of fund against sector and index over 1yr

Source: FE Analytics

“While narrower than most discounts of direct property peers, the discount of near 10% [9.94%] makes for relative cheapness versus its five-year average of nearer to -6%. Throughout its history, the trust is no stranger to trading at a small premium,” he said.

“The property sector has been under a lot of pressure in recent years, [so] an active and risk-managed approach is a good way to tap into the yield and potential upside for the sector.”