Gilt yields have climbed to their highest levels in decades as investors fret that the UK’s finances are in a weakened state, creating the risk that the country could tip into stagflation or recession.

The yield on 10-year gilts has reached its highest since the 2008 financial crisis while the 30-year yield is at the highest since 1998. At the start of Friday 10 January, the 10-year gilt was yielding 4.83% (up 102 basis points in the past 12 months) and the 30-year 5.39% (up 99 basis points), according to Bloomberg.

Many mainstream explanations for the rise in yields have focused on Labour chancellor Rachel Reeve’s first Budget, which will lead to an increase in government borrowing and is seen as being marginally inflationary.

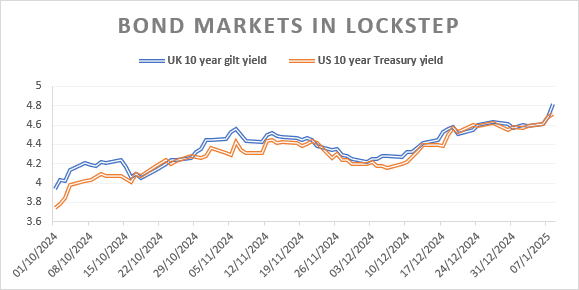

Mike Riddell, portfolio manager at Fidelity International, thinks that investors need to look wider than just home shores to understand what’s really happening in the bond market, as rising government debt is a common factor in the UK, the US and elsewhere.

“The gilt sell-off of the past few days has inevitably grabbed the headlines, where a common conclusion is to point fingers at the government. But this would miss the point; it is mainly a global fixed income story,” he explained.

“UK gilt yields are broadly moving with US treasuries, where 30-year gilt yields have risen by no more than 30-year US treasuries over the past couple of months. And there has been a similar sized move even in long-dated German government bonds in the past month.”

Source: AJ Bell, Refinitiv, to 8 Jan 2025

However, Riddell added that a “worrying development” in recent days has been gilt yields rising more than those in other markets, at the same time sterling has sharply weakened. Typically, higher gilt yields relative to other countries would push the pound stronger.

“The combination of a weaker pound and higher relative gilt yields has eerie echoes of August-September 2022 and, if this continues, could potentially be evidence of a buyer’s strike or capital flight,” he warned.

Laith Khalaf, head of investment analysis at AJ Bell, thinks the impact of US politics on the global bond market needs to be kept in mind. US president-elect Donald Trump has said he will implement trade tariffs and restrict immigration, which are seen an inflationary and could be pushing up yields in both the US and the UK.

However, the likely impact of higher yields will be different for the two countries. The fact that the dollar is the world’s reserve currency is a benefit, as it underpins demand for dollar-denominated assets such as US treasuries.

“Here in the UK higher yields put pressure on government finances and increase the risk that Reeves will come back with another tax raising Budget,” Khalaf said.

“A big saving grace is that the new chancellor has limited herself to one Budget per year, and so while we will get an updated set of forecasts from the OBR [Office for Budget Responsibility] in March, which will lay bare the state of government finances, we don’t expect Reeves will have to balance the books through tax policies until the back end of the year. That gives plenty of time for the bond market to calm down, though that in turn will of course depend on whether global inflation actually rears its head again in 2025.”

Oliver Faizallah, head of fixed income research at Charles Stanley, agreed that the gilt sell-off is more than a UK story, pointing to global factors such as elevated inflation, volatile politics, inflationary policy and rising government debt.

However, he conceded that the UK has been punished more than the rest of the world, seemingly around concerns that sticky inflation will cause the Bank of England to keep interest rates higher for longer. Higher gilt yields from here could have a significant impact.

“Higher gilt yields have increased borrowing costs, which has eroded most, if not all, of the UK government's fiscal headroom. With poor growth numbers the Labour government may be forced to reduce spending, increase taxes, or increase borrowing,” Faizallah said.

“We are potentially looking at a stagflationary environment (higher inflation and poor growth) or a recessionary environment (growth falling to such an extent that inflation drops as well) in the UK.”