Last year was a strong one for almost every asset class, with just 10 of the 57 Investment Association sectors making a loss.

Of all equity markets, the S&P 500 was the top performing in 2024, making 29.9% in sterling terms, pulling the MSCI World up 23.9% and the MSCI AC World, which includes the emerging markets, up 22.6%.

But there were good gains elsewhere too. The MSCI Emerging Markets index rose 11.5%, the UK’s FTSE All Share gained 11% and the Japanese Topix index was up 9.7%. In last place among the major global equity markets, Euro STOXX made 7.9%.

Almost every fund selected by the Trustnet team at the end of 2023 made a positive gain last year, although none were able to come close to the returns of the S&P 500 or MSCI World.

In a year in which the US market continued to thrive, no one on the team thought to back the American tech juggernauts that had powered ahead in 2023 and continued their ascent last year.

Our best performer was Royal London Sustainable World Trust, selected for the second year in a row by senior reporter Matteo Anelli. Having topped the charts in 2023, the fund came out on top once again over the past 12 months, delivering 11.3%.

While this was less than half the returns of the MSCI World, it was the best of our crop of fund picks. Sitting in the IA Mixed Investment 40-85% Shares sector, the fund is less gung-ho than a global equity tracker, but was a top-quartile performer among its peers over the year. It was our only selection to make it to the top 25% of its sector over the course of the year.

Managed by FE fundinfo Alpha Manager Mike Fox alongside George Crowdy and Sebastien Beguelin, the fund has around 84% in equities and 14% in bonds, with the remainder in cash. It benefited from top holdings including Amazon and Microsoft, as well as Alphabet, but its diversified nature held back returns from matching global markets more generally.

Another taking the diversified approach was former Trustnet reporter Matthew Cook, who selected Troy Asset Management’s Trojan fund. Known as a defensive holding that comes good in times of market strife, this was not its year.

With all markets up, the fund made a respectable absolute return of 6.6%, but was in the bottom quartile of the traditionally more risky IA Flexible sector.

In the second spot was editor Jonathan Jones’ selection of WS Gresham House UK Micro Cap, which rose 8.7% in 2024, a second-quartile effort in the IA UK Smaller Companies sector.

Managed by Ken Wotton and Alpha Manager Brendan Gulston, the fund was a steady performer, peaking around September before falling back a bit in the final quarter of the year.

Former Trustnet reporter Jean-Baptiste Andrieux was in third with his pick: Fidelity China Special Situations. The Chinese market had little place to go other than up following a disastrous post-Covid run.

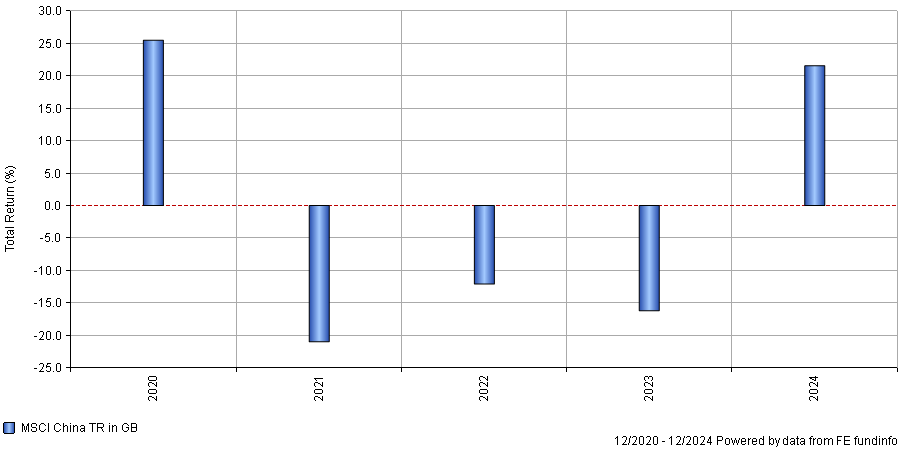

Performance of MSCI China over 5yrs

Source: FE Analytics

The MSCI China index dropped 21% in 2021, 12.1% in 2022 and 16.2% in 2023, but finally came good last year, with the index up 21.6%. The Fidelity trust couldn’t match these returns, but made 8.6% in 2024, making it the second best trust in the three-strong IT China/Greater China sector.

Andrieux said a year ago: “the picture for Chinese equities is all but rosy and the market is, therefore, not expecting much (if anything) from China in 2024. As a born contrarian, this is precisely the reason why I am keen on backing a Chinese equity fund this year.”

While his thesis was right, his fund selection was unable to take full advantage of the market rebound in 2024.

The last of our positive performers was news editor Emma Wallis’ RTW Biotech Opportunities trust, which made just 1.2% on the year. It was a volatile selection, however, dropping in the first quarter before surging ahead by the mid-point of the year.

A disappointing second half of the year meant its returns were whittled away to a paltry gain by the end of December, despite the increased buzz around weight loss drugs. It was the fourth-best trust in the IT Biotechnology & Healthcare sector last year.

In last place – and our only negative performer – was head of editorial Gary Jackson’s Janus Henderson Strategic Bond fund, which lost 40 basis points. Like Anelli, Jackson kept his selection from the previous year, when the fund made a 4.5% return.

It was the third year in a row that the fund has languished in the bottom quartile of the IA Sterling Strategic Bond sector and the second year in three that it made a loss.

Managed by the retiring John Patullo alongside longtime co-manager Jenna Barnard and newly appointed Nicholas Ware, at the time Jackson said he agreed with their pessimistic view on the world and was heartened that the portfolio was positioned for a ‘hard’ landing, or recession.

He was “maintaining some scepticism that central banks can pull off using aggressive rate rises to curb inflation without tipping into recession” but, so far at least, they have done exactly this.