Close Brothers Group became one of the UK’s 10 most-shorted stocks last month.

FTSE Russell announced on 26 November that it expects to delete Close Brothers from the FTSE 250 index when it rebalances after the market closes on 4 December. Marshall Wace and Qube Research & Technologies placed bets against the merchant bank the following day, perhaps anticipating forced selling by passive funds.

Prior to that, Caius Capital disclosed a short position to the Financial Conduct Authority on 15 November. Basswood Capital Management bet against the merchant bank on 31 October and Qube did likewise the day before.

These bets came just after Close Brothers lost a legal battle over motor finance commission disclosures on 25 October, known as the Hopcraft case.

The Court of Appeal upheld complaints from three people who claimed they had been mis-sold motor finance. Brokers are required to obtain fully informed consent from customers before receiving a commission and this did not happen in these three cases, the court ruled.

Close Brothers referred to the Hopcraft case in its trading update for the first quarter of its 2025 financial year, published on 21 November. Mike Morgan, group finance director, said: “New business volumes were lower in retail [banking], primarily driven by the temporary pause in new lending in our UK motor finance business following the Court of Appeal judgment. We have now resumed writing new business for a significant portion of our UK motor finance book.”

The quarterly results included a £0.7m operating loss for subsidiary Winterflood Securities, which was less than the £2.5m loss in the first quarter of the 2024 financial year. “Winterflood continued to experience unfavourable market conditions [but] it remains well positioned to benefit when investor appetite returns,” Morgan said.

Meanwhile, Close Brothers’ banking division benefitted from healthy customer demand alongside a strong net interest margin and a resilient credit quality, he continued.

The firm is working through a cost management programme and is on track to deliver annualised savings of £20m.

Back in September, Close Brothers agreed to sell its wealth management business, Close Brothers Asset Management (CBAM), to funds managed by Oaktree Capital Management. The transaction is due to complete early next year.

Short sellers had another financial services firm in their sights last month – Vanquis Banking Group, which caters to financially underserved customers and used to be called Provident Financial.

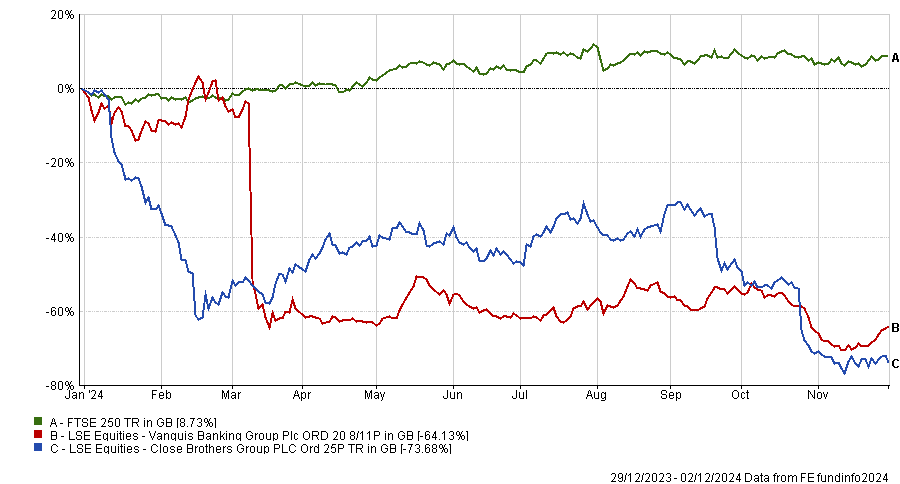

Performance of stocks vs FTSE 250 ytd

Source: FE Analytics

Earlier this year, Vanquis conducted a balance sheet review that resulted in write-downs, including the development costs for a redundant mobile app. Consequently, Vanquis lowered its yearly guidance in July.

The firm is going through a turnaround, with a technology transformation programme that should deliver significant cost savings.

John Wood Group, known as Wood, was another new entrant to the most-shorted UK stocks list and, like Vanquis, is progressing through a turnaround.

The FTSE 250 engineering and consulting business had a mixed third quarter, chief executive officer Ken Gilmartin announced last month. “We saw strong year-on-year growth in operations and margin expansion in consulting,” he said.

“Our projects business delivered a disappointing quarter, impacted by delayed awards in our chemicals business and our continued weakness in minerals and life sciences. As such, we continue to take actions to redress this underperformance.”

Wood’s half-year results in August included exceptional contract write-offs, owing to its exit from lump-sum turnkey and large-scale engineering, procurement and construction contracts. The board recently commissioned Deloitte to perform an independent review of its reported positions on contracts.

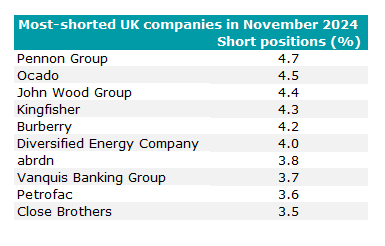

Meanwhile, the most-shorted UK stock was water company Pennon Group, followed by Ocado, ranked by the percentage of their share capital in the hands of short sellers.

Source: Financial Conduct Authority