The new year will likely be another one of uncertainties, with geopolitical risks remaining high in Europe and the Middle East, the introduction of trade tariffs and rising tensions between the US and China. In times like these, it is important to carefully consider how much risk is best to take.

Below, we asked experts which funds they would recommend for a ‘balanced’ investor, or someone who is open to an element of risk but also cares about downside protection.

Equities generally offer the highest potential returns but are inherently riskier. For those who are comfortable with this, the Mid Wynd trust, which has a FE risk score of 114, could serve as a core holding in a portfolio, according to Kepler Partners analyst Jean-Baptiste Andrieux.

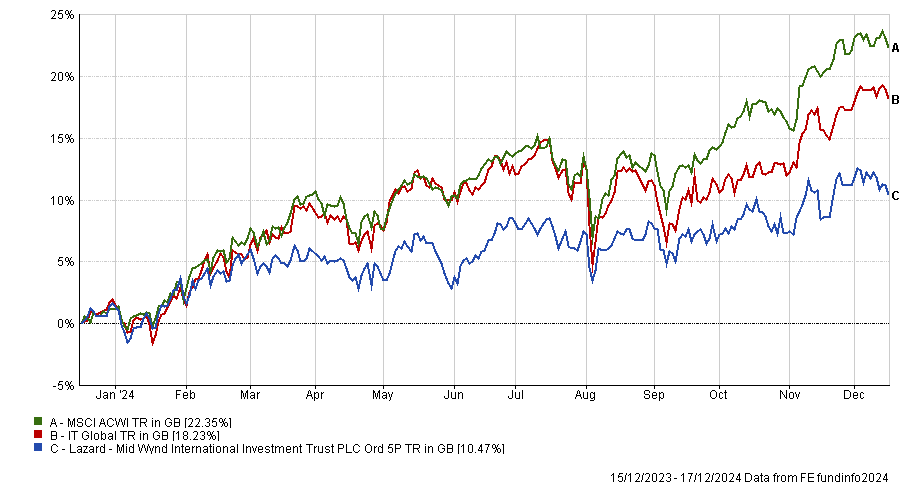

Performance of fund against sector and index over 1yr

Source: FE Analytics

Lazard’s Louis Florentin-Lee and Barnaby Wilson, who took up the management of the trust from Artemis in October 2023, focus on companies that benefit from competitive advantages and can generate high returns on capital which can be maintained long into the future. From its inception in 2011 to the end of September 2024, the strategy returned 12.8% per annum on a net basis, outperforming the 10.6% of the MSCI All Country World index.

At the same time, it maintained a lower systematic risk than the market, as shown by its beta of 0.96 (less volatile than the S&P 500, which has volatility of 1). It also has a down capture ratio of 91%, as Andrieux noted, meaning it has historically declined less than the index during downturns.

“The managers maintain a disciplined approach, ignoring market noise and avoiding taking risk for short-term gains that may not be sustainable. For example, they have not invested in Nvidia on a lack of conviction in the company’s ability to sustain its current return on capital,” the analyst said.

“Mid Wynd is not likely to shoot the lights out over the short term and may lag when the market chases specific trends, as it has in recent years. The team aim for steady, incremental relative gains over time as well as resilience in falling markets, which could lead to long-term outperformance of the benchmark.”

For a holding that could act as a desirable counterweight to equity exposure, Charles Stanely chief analyst Rob Morgan picked the multi-asset Ruffer Investment Company.

With a risk score of 87, it is designed to be an ‘all-weather’ vehicle and its managers Duncan MacInnes and Jasmine Yeo dynamically express their views by combining conventional asset classes (global equities, bonds, currencies and gold) with the use of derivatives that serve as protection in market downturns.

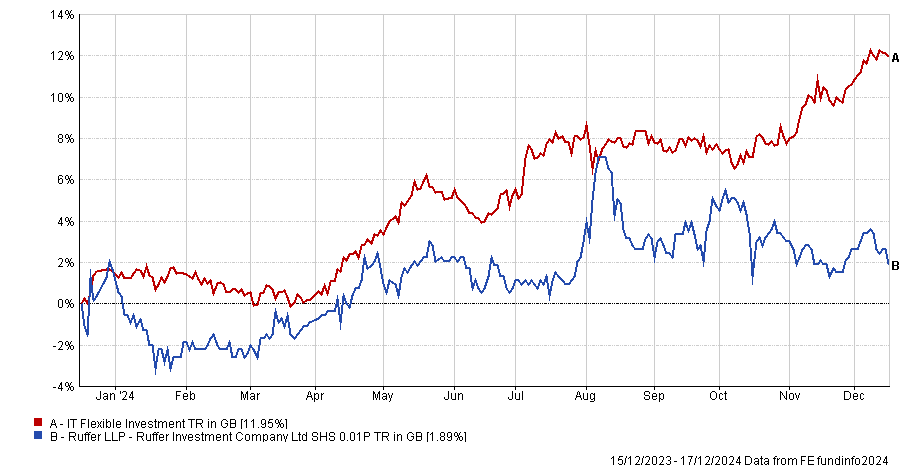

Performance of fund against sector over 1yr

Source: FE Analytics

The overall aim is to protect as well as grow, so the balance of different assets is designed to pay off in a variety of economic scenarios. Currently, the trust is positioned to be resilient to a second wave of inflation and a more negative scenario for economic growth, making it “an important diversification tool” or, more generally, a more stable core holding in a portfolio, said Morgan.

The managers believe investors aren’t being rewarded well for the risks in US shares given current valuations and suggest there are better opportunities elsewhere, including in the UK and China, and in other asset classes such as bonds and gold.

Morgan also appreciated the ability to hold cash to deploy later as well as the use of protection strategies that can offset market falls.

“Following a poor couple of years for the managers, a bumpier period for global markets could see them return to form,” he concluded.

Fairview Investing director Ben Yearsley pointed to Troy Trojan, a wealth-preservation portfolio that aims to protect wealth in real terms. With an FE risk score of 42, it is the most cautious vehicle in the list.

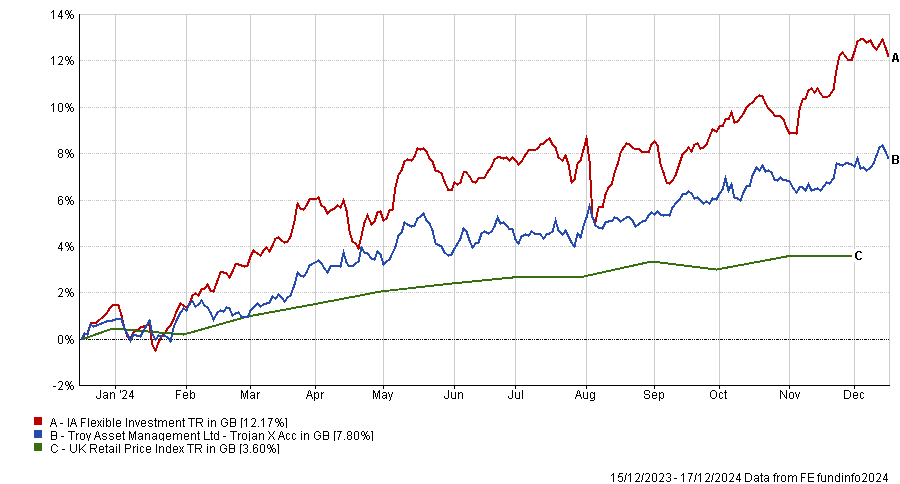

Performance of fund against sector over 1yr

Source: FE Analytics

Yearsley blamed the unpopularity of quality equities for the fund’s tough few years, but he continued to back it as a core holding for long-term investing. Recently, the fund also featured in Hargreaves Lansdown’s list of ‘funds to watch for 2025’.

The fund is focused around four 'pillars'. The first contains large, established companies the managers think can grow sustainably over the long run. The second is made from bonds, including US index-linked bonds, which could shelter investors if inflation rises. The third pillar consists of gold-related investments, including physical gold, which has often acted as a safe haven during times of uncertainty. The final pillar is cash, which provides protection when markets stumble but also a chance to invest in other assets quickly when opportunities arise.

Hargreaves Lansdown’s head of fund research Victoria Hasler particularly liked the gold element.

“In times of uncertainty one investment which tends to do well is gold. It has had a fantastic run in 2024, rising 28.43% in the 11 months to the end of November 2024. Whilst we wouldn’t necessarily expect returns to continue at this pace, the uncertain outlook combined with increased buying from central banks, particularly in emerging markets, means that the commodity could continue to enjoy support,” she said.

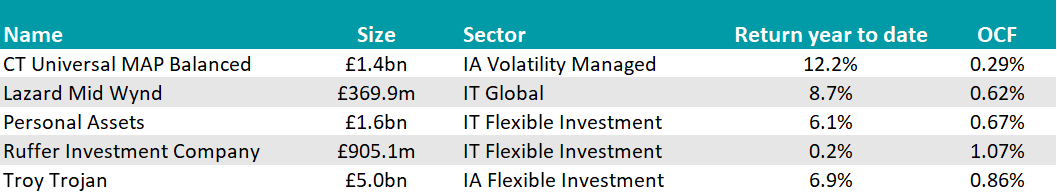

As alternatives, Yearsley suggested the Personal Assets investment trust, which is run by the same team and “nearly identical for a multi-asset fund that has equities, inflation-linked government bonds and gold”, and CT Universal MAP Balanced, a “good core low-cost multi-asset option that happens to be actively managed – unusual for a fund with such a low cost.”

Source: FE Analytics

This article is part of Trustnet’s fund picks for 2025.