Managers and shareholders of investment trusts have been searching for a catalyst to bring in discounts for some time and one may finally have arrived in the shape of activist investor Saba Capital Management.

Peel Hunt expects Saba’s campaign against seven trusts to encourage boards of other investment companies to take proactive steps to narrow their own discounts. Furthermore, if Saba amasses a large stake in other trusts, its buying activity could push up share prices.

Anthony Leatham, head of investment trust research at Peel Hunt, said: “From an investor perspective, we believe the opportunity is to get ahead of this activism, buy equity trusts on discounts and benefit from the discount narrowing – either by activist buying or the company itself seeking to narrow its discount to fend off a similar activist approach.”

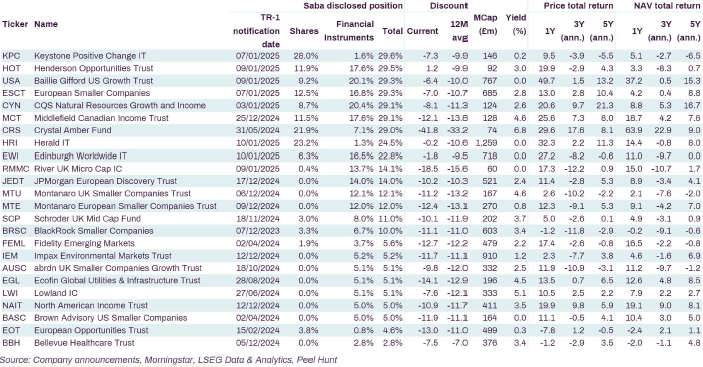

As Trustnet revealed last week, Saba has disclosed holdings in 24 trusts, listed below. Leatham thinks these trusts will be under pressure to narrow their discounts before activists strike.

Saba’s disclosable holdings in investment trusts

Peel Hunt has identified a further 20 companies in which Saba has not yet declared an interest but which have all the hallmarks of Saba’s targets: trading on a persistent double-digit discount; underperforming their benchmark; investing in listed equity; and a shareholder register that might be vulnerable to low voter turnout and lacks significant shareholders who might vote against proposals. Leatham did not name any of these companies in his report.

For investment trusts themselves, “the best form of defence can be attack”, he counselled. Boards could use buybacks to defend a single-digit discount target, thus making their trust a less appealing prospect than peers, as there would be less discount compression opportunity.

All seven of the trusts Saba is currently targeting (Baillie Gifford US Growth, CQS Natural Resources Growth & Income, Edinburgh Worldwide, European Smaller Companies, Henderson Opportunities, Herald and Keystone Positive Change) have seen their discounts narrow from their 12 month averages, so much so that Baillie Gifford US Growth and Edinburgh Worldwide are trading close to their net asset value (NAV).

Investec analysts Alan Brierley and Ben Newell agreed that boards should proactively try to narrow discounts. “The ongoing actions of Saba send a clear message that more needs to be done to narrow discounts and control discount volatility,” they said.

Even trusts with strong investment performance could fall victim to activism if they trade on a substantial discount, Investec’s analysts pointed out. European Smaller Companies is amongst Saba’s “miserable seven” despite delivering top-quartile returns over one, three and five years; “therefore almost any investment company trading on a wide discount is potentially vulnerable.”

Across the board, Brierley and Newell think boards should review buyback parameters, both in terms of quantum and levels.

“While this may adversely impact the marketability of these companies in the short term, the NAV enhancements must be more palatable than ultimately having to deal with a hostile attack, the associated costs, and perhaps then having no alternative other than to provide an exit on a much narrower discount, which would also have to be offered to all shareholders,” they explained.