With president-elect Donald Trump poised to return to the White House in under a week, investors may be wondering whether to adjust their US equity exposure.

Paul Angell, head of investment research at AJ Bell, cautioned investors to remain focussed on what they know rather than speculating on stock market performance and political shifts. Nevertheless, he identified four US focussed funds that stand out.

Artemis US Select:

First, Angell pointed to the £1.6bn Artemis US Select strategy, led by Cormac Weldon and Chris Kent.

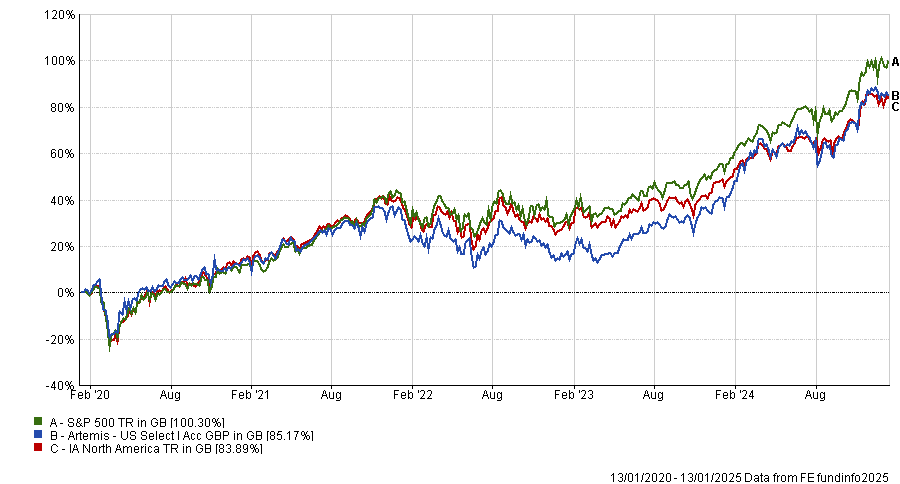

Following a third-quartile performance of 85.2% over five years, the fund has rallied recently, with a first-quartile performance of 33.4% last year. Angell attributed this resurgence to beneficial stock selection, particularly ownership of six of the Magnificent Seven within its top 10 holdings.

Fund performance over 5yrs

Source: FE Analytics

Over the past 10 years, it was among the few US portfolios to beat the S&P 500 index.

Angell praised the fund for its experienced leadership and analytical team. Weldon and Kent have worked on US-focused strategies for around two decades, and Weldon has been with the strategy since its launch in 2014, managing it during Trump's first term in office. Moreover, the managers are well supported by a broader equity team of six analysts, who conduct frequent trips to the US to meet with companies and assess if they are a good fit for the portfolio.

As a result, the fund has achieved a significantly “higher growth profile than the index”. Indeed, in the past three years, the fund generated 3% alpha, a top-quartile performance in its peer group.

Artemis US Smaller Companies

For investors looking for lesser-known US opportunities, Angell pointed to its cousin strategy, the £1.2bn Artemis US Smaller Companies fund.

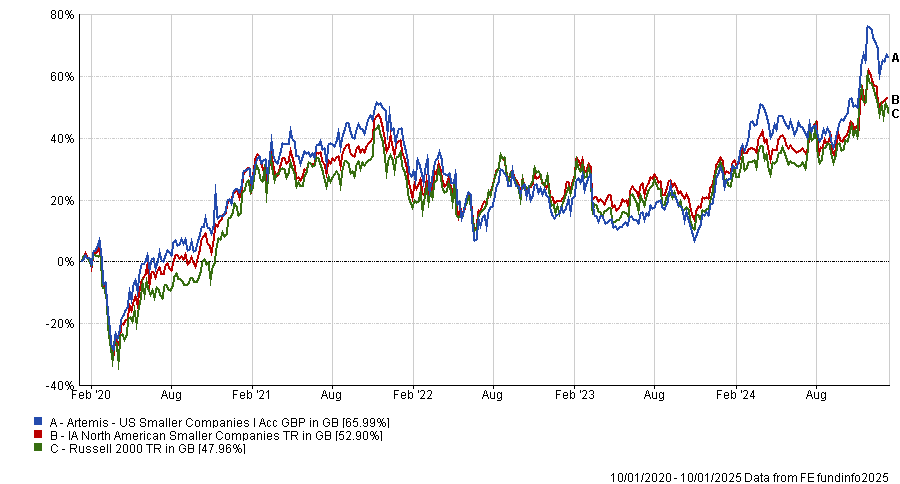

Also managed by Weldon but co-managed by Olivia Micklem as of 2022, this strategy has delivered a top-quartile result of 66% in the past five years. While it did slide into the second quartile over three years, it rallied last year and returned 25%, the second-best result in the peer group.

Fund performance over 5yrs

Source: FE Analytics

Source: FE Analytics

While this fund benefits from the same qualities as its larger counterpart, Angell also highlighted its benchmark agnostic approach. Because stock selection is guided by business fundamentals, there is "more of a quality bias in this fund versus the market, as well as a lower exposure to cyclical companies and loss makers".

Analysts at Square Mile Investment Consulting & Research, who have given the fund an AA rating, praised its “investment style that combines detailed company analysis with an appreciation of the wider economic environment”. The fund has proven broadly successful across a range of different market conditions, they said.

Over the past five years, the fund generated 2.9% alpha and last year, it ranked as one of the top IA North American Smaller Companies portfolios for rolling 1-year alpha generation.

JPM US Equity Income

For investors who want to emphasise dividend growth and yield, Angell flagged the £3bn JPM US Equity Income strategy.

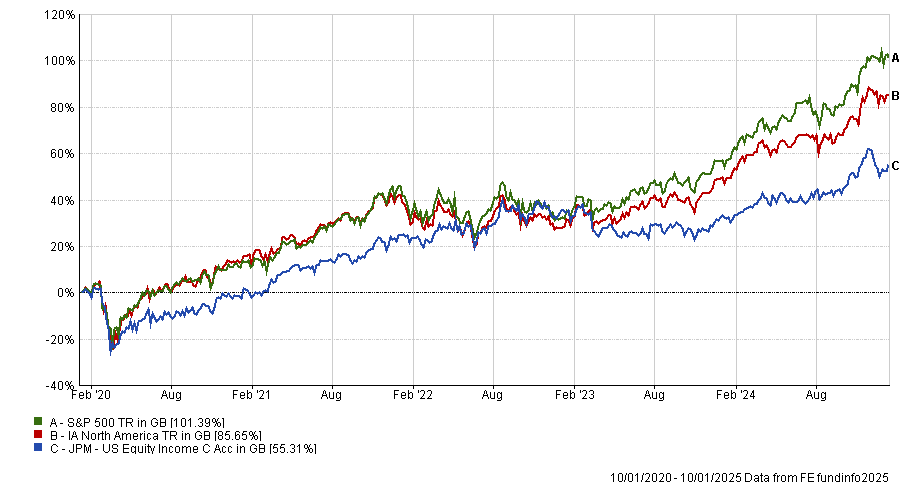

The portfolio has struggled recently, languishing in the bottom quartile over the past one, three and five years. Over five years, the portfolio was up by 55% compared to a sector average of 84.2%.

Fund performance over 5yrs

Source: FE Analytics

Angell attributed this relative underperformance to the fund’s focus on attractively valued businesses with at least a 2% dividend yield. This has been a headwind for the fund’s performance because the market has “been led by zero or low-yielding technology stocks which the fund cannot purchase”.

However, Angell was swayed by the fund’s defensive credentials. An emphasis on sustainable and durable businesses at attractive valuations has made it one of the better funds in the sector for protecting investors’ money. Indeed, in the past five years, it achieved 15.1% volatility and 16.6% downside risk, making it one of the least risky funds in the sector.

Moreover, it was up by 8.3% in the 2022 bear market, making in one of the best performing IA North American funds during a year in which the average strategy in the peer group fell by 9.7%.

iShares Core S&P 500 ETF

Finally, despite active funds slightly outperforming their passive counterparts in the IA North America and North American Smaller Companies sector last year, Angell also identified the iShares Core S&P 500 ETF as a strategy that may be appealing for investors.

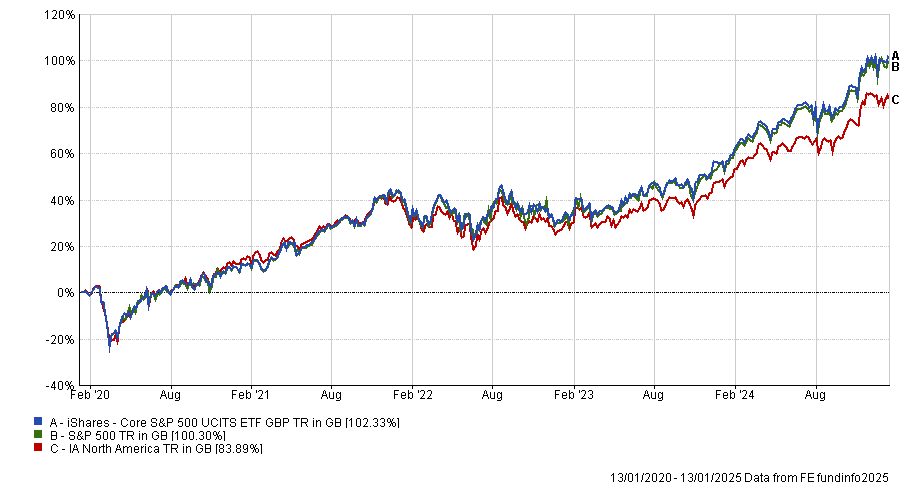

With almost £18bn in assets under management, this ETF has produced top-quartile results of 103.4% in the IA North America sector over the past five years.

Fund performance over 5yrs

Source: FE Analytics

For Angell, it represented a “cost-effective method of gaining exposure to the largest companies in the US”, most notably the Magnificent Seven.