Making the right asset allocation call would have made a colossal difference to ISA returns over the past quarter century but so too would picking the right funds. In many cases, an astute manager selection decision would have dictated whether the wealthiest ISA investors became millionaires or not.

Only one global equity income fund would have topped £1m if investors had put in the maximum ISA allowance on 6 April every year since 1999 (when the savings scheme was established). Fidelity Sustainable Global Equity Income takes that crown.

The fund has performed consistently well, leading the IA Global Equity Income peer group over 10 years to 10 March 2025 and staying within the top three performers over five years. It remained in the top 10 over one and three years as well. However, investors should note it has only been managed by Aditya Shivram since July 2021.

Aviva Investors Global Equity Income wasn’t far behind; it was the only other fund in the sector to make more than £900,000. Richard Saldanha managed the fund for more than 10 years before moving to Royal London Asset Management (RLAM) briefly in October 2024. He returned to Aviva two months later, retaking the reins of this fund. However, former colleagues Matt Kirby and Francois de Bruin, who jumped ship with Saldanha to RLAM, remain there.

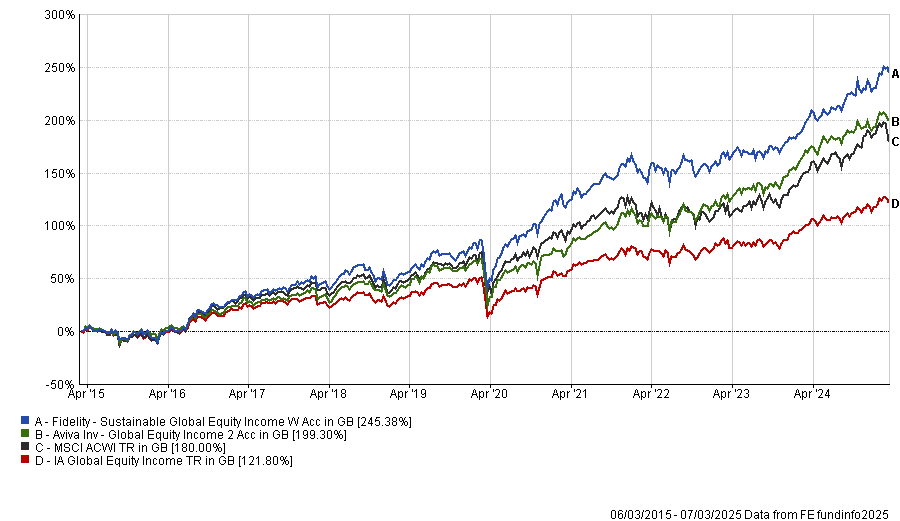

Performance of funds vs sector and benchmark over 10yrs

Source: FE Analytics

Investors backing China, India or Japan would also have needed to pick the right fund to amass £1m: Schroder ISF Greater China, Pictet Indian Equities and M&G Japan Smaller Companies were the only funds to achieve that feat in their respective sectors.

M&G Japan Smaller Companies has been led since 2019 by FE fundinfo Alpha Manager Carl Vine. The fund’s focus on faster-growing smaller businesses gave it an edge over its large-cap and all-cap sector peers, which have been grouped together since the IA Japanese Smaller Companies sector was closed on 30 September 2023 and merged into the IA Japan sector.

Most of the funds in the IA China/Greater China and IA India/Indian Subcontinent sectors had an insufficient track record to amass £1m; just three China and two India funds have been up and running for 26 years.

Louisa Lo has managed Schroder ISF Greater China since September 2002. Her fund is the third-best performer in its peer group for 10 years to 7 March 2024 and is fifth over five years, although it slipped into the second quartile over three years. This is a dollar-denominated fund so currency movements will have impacted the historical performance data.

Pictet Indian Equities has been managed by Prashant Kothari since 2012 and Venkatesh Sanjeevi since 2015. Although it was the best choice for the past quarter of a century, performance has been middle of the range over 10 years. Of the 15 Indian equity funds with a decade-long track record as of 7 March 2025, Pictet’s performance is in eighth place. Five-year performance is fourth quartile but the fund is third-best in its sector over 12 months and was one of the few Indian equity funds not to make a loss in the past year. It beat the peer group average over three years as well.

Invesco Pacific (UK) was the only fund in the IA Asia Pacific Including Japan sector to breach £1m. It has been led since 2013 by Alpha Manager William Lam and Tony Roberts.

ISA savers would have improved their chances of hurdling the magical million by avoiding Japan. Four funds in the IA Asia Pacific Excluding Japan sector achieved millionaire status (Invesco Asian (UK), Baillie Gifford Pacific, Jupiter Merian Asia Pacific and Ninety One Asia Pacific Franchise).

All emerging market equity funds fell below the £1m radar but Invesco Global Emerging Markets got close, turning the total pot to £943,460.

The final unique ISA millionaire fund is Pictet Water, which stands alone in the IA Commodity/Natural Resources sector. It was established 25 years ago so missed the initial £7,000 ISA contribution but still climbed to just above £1m.

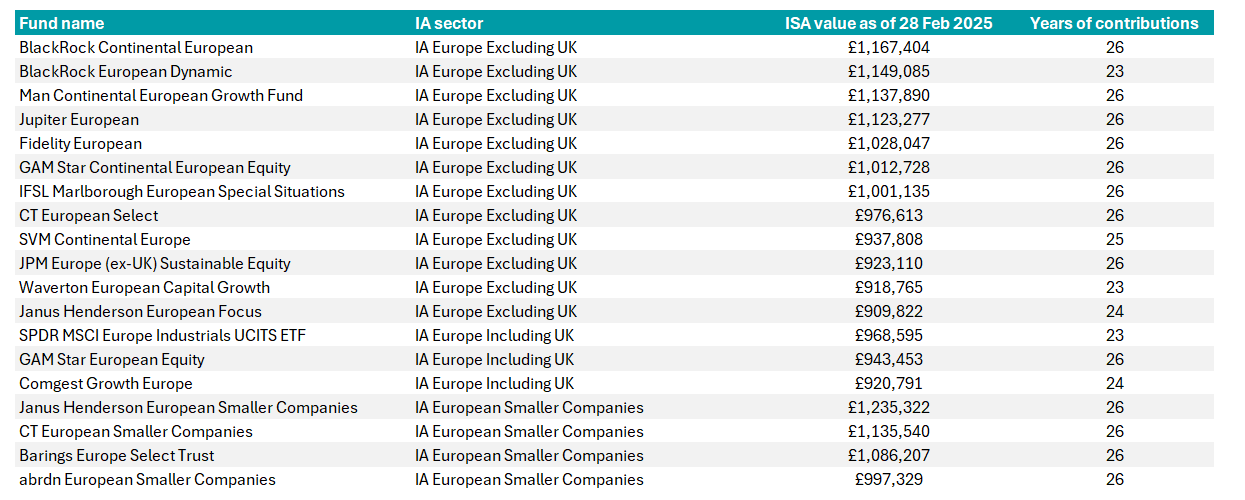

Moving to Europe, no funds in the IA Europe Including UK sector hurdled the £1m mark although three exceeded £900,000. By contrast, seven European equity funds that exclude the UK hit the magic million and another five breached £900,000. Three IA European Smaller Companies achieved ISA millionaire status and a fourth came close.

ISA millionaire European equity funds

Source: FinXL

UK stocks need not have been a detractor to performance over the 26-year period, however, as evidenced by the two ISA millionaire funds in the IA UK All Companies sector: IFSL Marlborough Special Situations and Artemis UK Select. The latter has been led by FE fundinfo Alpha Manager Ed Legget and Ambrose Faulks since 2015. It is the best-performing fund in its peer group over one and five years and second-best over three and 10 years.

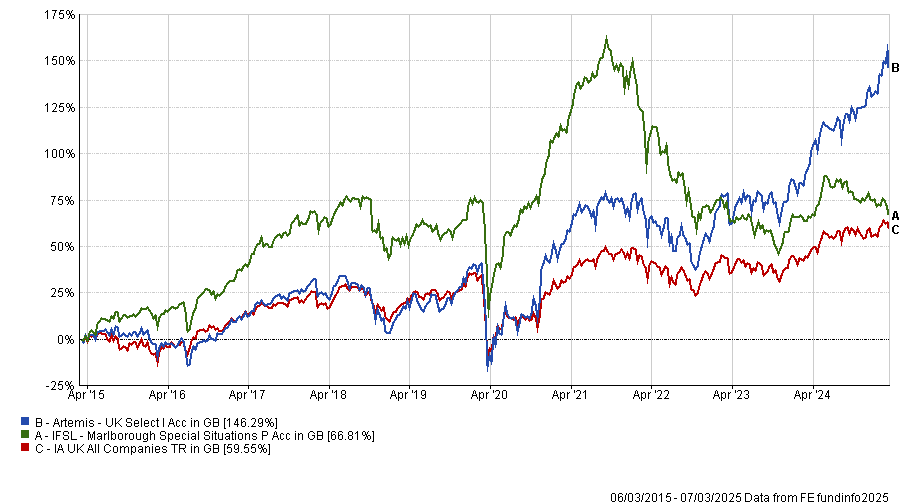

Performance of funds vs sector over 10yrs

Source: FE Analytics

Two UK small-cap funds also leapfrogged £1m: Liontrust UK Smaller Companies and abrdn UK Smaller Companies.

Liontrust UK Smaller Companies is a rarity for having the same manager since 1998 – FE fundinfo Alpha Manager Anthony Cross. He was joined for most of the period by Julian Fosh, who retired in January.

Abrdn UK Smaller Companies has been led since 2019 by Abby Glennie and Amanda Yeaman, who took charge from former veteran manager Harry Nimmo.

No UK equity income funds joined the millionaire club but Schroder Income amassed £921,421.