Donald Trump’s second stint in the White House has started tumultuously. His ‘Liberation Day’ reciprocal tariffs on 2 April kicked off a major equity market sell-off, as the global stock market shed $8.6trn in a single week.

His erratic policy-making and unorthodox behaviour – such as his recent attacks on Federal Reserve chairman Jerome Powell – have knocked investors’ confidence.

Susannah Streeter, head of money and markets at Hargreaves Lansdown, said: “He has already presided over an equity market meltdown, a mega bond strop out and a sharp slide in the dollar. He has picked trade fights with long-time allies, slapped irrational duties on unpopulated islands and ratcheted an economic war with China.”

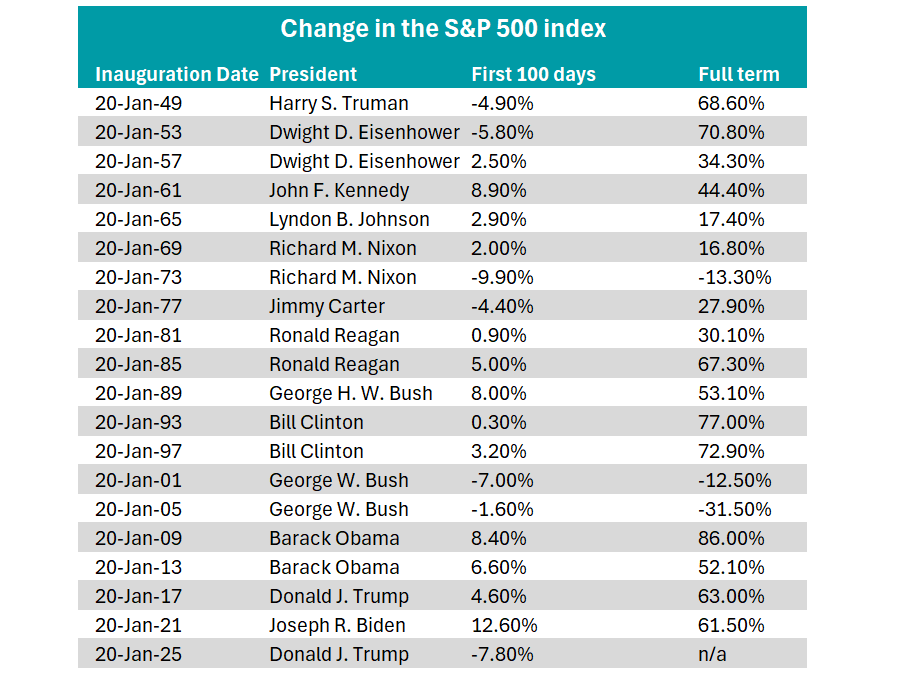

As a result, Trump first 100 days in office is one of the worst in history, as shown by the table below.

Source: FE Analytics, AJ Bell, LSEG. Data in price performance as of 28 April.

Russ Mould, investment director at AJ Bell, said there are “uncanny echoes” between the current backdrop and 2001, when the dot-com bubble burst.

US valuations were so expensive at the start of this year that “anything could have tipped over the S&P 500” – Trump was just the final straw, he explained.

Comparisons to Richard Nixon’s second term are even stronger. Nixon took the dollar off the gold standard, let the US currency slide and imposed tariffs in an attempt to reset the global financial system. This “ushered in an era of inflation, if not stagflation, and misery” for US assets, Mould said.

“Trump’s determination to lessen America’s trade deficit, weaken the dollar and reset global trade terms smacks of Nixon’s plan.”

Sky-high uncertainty

Paul Diggle, chief economist at Aberdeen, said Trump was initially expected to “unleash the animal spirit of corporate America”. The reality is far more sobering, he said. Trump has delivered even harsher tariffs than the market expected, creating fears of stagflation if weaker growth and higher inflation continue.

His colleague Ben Richie, head of developed market equities at Aberdeen, added that volatility is wreaking havoc on investors’ portfolios. “The first 100 days of Trump 2.0 has been a stark illustration that when government and markets collide, investors tend to be the losers.”

Sarah Ruggins, head of investment specialists at St. James’s Place, noted that Trump’s broader legislative policies could have a major impact on corporate earnings, tax and regulation. This could cause even further unease.

“Sky-high uncertainty” is not going anywhere, according to Streeter. Despite discussion of trade deals, the US president’s “capricious nature” means another market scare is likely. “The hope for a ‘Trump bump’ for the economy threatens to be more of a slump,” she explained.

Shep Perkins, chief investment officer of Putnam Investments, agreed. “No-one knows what the future holds because a lot of it is in the head of one person, frankly. I think that one person might not fully appreciate the second and third order implication of some of the policies.”

Trump has ‘tarnished the American brand’

Profound uncertainty about the future, Diggle said, is leading to a “a broader re-assessment of the attractiveness of US assets”.

Despite the recent sell-off, the US had attracted so much capital that it is still overvalued, according to Diggle. While concessions from Trump could cause a turnaround, uncertainty and high valuations could easily lead to further capital outflow from the US, he said.

Mould added that investors are now asking themselves if they are still comfortable owning dollar assets, given that they might still have further room to fall.

“If the world is different, with more inflation, higher and more volatile interest rates and less predictable growth, is it not logical to expect different asset options to outperform?” he said.

Greg Eckel, portfolio manager at Canadian General Investments, was more damning. “Donald Trump has tarnished the American brand,” he said.

The US administration's “flip-flopping” approach has permanently damaged the confidence of its closest allies and investors, he argued. “This is a Humpty Dumpty moment for US trade relations. Even if we manage to piece things back together, it will never be the same,” Eckel concluded.

However, some experts believe all is not lost.

Will McIntosh-Whyte, multi-asset manager at Rathbones, said: “If, and it is a big if, trade deals can be done and some sense of calm to global trade returns”, the US could bounce back.

“I think sense will ultimately prevail, and the dynamic US economy will prove once again to be an excellent place to allocate capital,” he concluded.

Darius McDermott, managing director at Chelsea Financial Services, added that Trump is a populist who “loves to be loved”. If his core voter base starts to feel the most pain from his policies, he could rapidly reverse his approach, McDermott said.