Almost half of Janus Henderson funds failed to achieve a good rating from the firm in its 2025 value assessment, including the firm’s UK Alpha and Strategic Bond funds, as well as its Multi-Manager range.

The asset manager uses a traffic light system to identify whether funds have passed or require improvement. Green means they are deemed good value for money, amber suggests the fund is being monitored, while red implies it needs improvement.

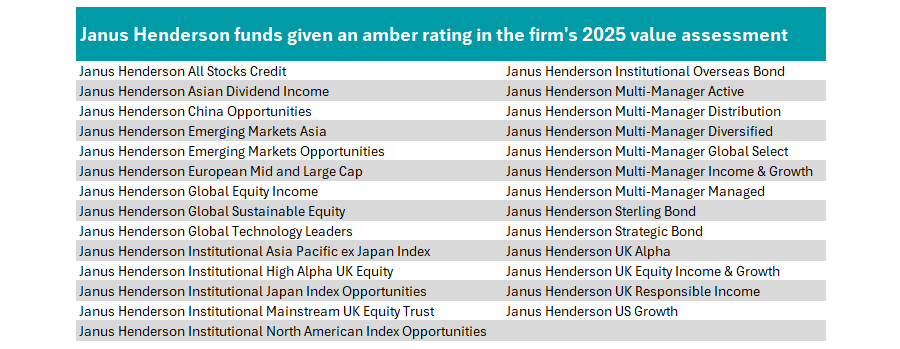

The 27 funds that did not get a green light are in the table below. The figure represents a 50% rise in the number of funds that are no longer deemed good value for money. In 2024, the tally stood at 18.

Source: Janus Henderson

Janus Henderson measured its funds against seven criteria and awarded them a grade (red, amber or green) for each one, then an overall score.

Some 23 funds were given a red light for performance, with a further 14 given an amber light for investment returns, meaning some 60% of the firm’s fund range failed to deliver ‘good’ returns over its preferred timeframes of five and 10 years.

However, no funds were given a red light as their overall score, although Janus Henderson Strategic Bond was upgraded from red to amber over the course of the past year.

“We acknowledge the fund has not provided value from a performance perspective over the five- and 10-year periods,” the firm said in its report.

“The review of Janus Henderson’s fixed income capabilities by the company’s new global head of fixed income is expected to result in some enhancements to the investment process so that it has greater potential to provide value to investors in the future.”

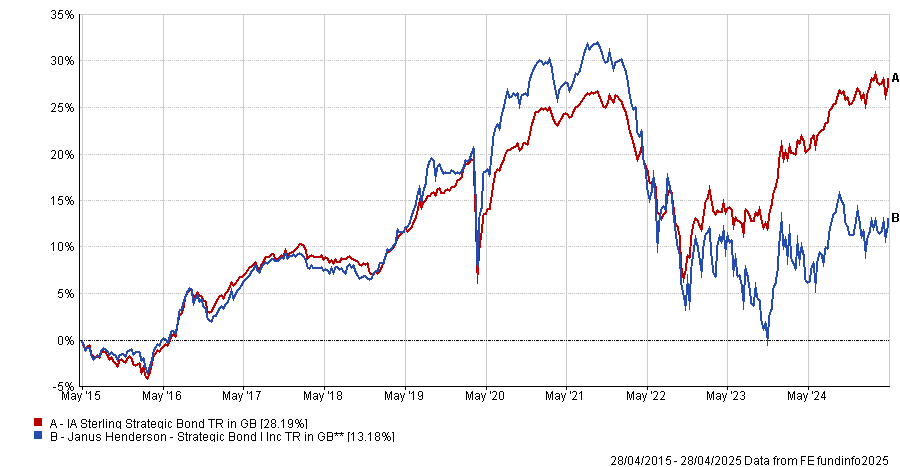

Janus Henderson Strategic Bond has been the fourth-worst performer in the IA Sterling Strategic Bond sector over the past decade and has sat in the bottom quartile of the peer group over three and five years as well, although its one-year return is above the sector average.

Performance of fund vs sector over 10yrs

Source: FE Analytics

Another fund range under pressure is the multi-manager group, with all five funds in the suite dropping from green to amber.

“We believe the introduction of an index benchmark will allow the investment team to have greater conviction in their asset allocation decisions and therefore the fund to have greater potential to provide value in the future,” the report said.

This change was one of a number highlighted by the firm since its 2024 report. It has reduced the annual management charge on share classes across numerous funds including the above range.

It has also swapped benchmarks on a swathe of portfolios, including the Janus Henderson Sustainable Future Technologies fund, and has shuttered seven funds since the 2024 report.

Pat Shea, chair of Janus Henderson Fund Management UK, said: “We continually assess and scrutinise the level of service provided to our investors to ensure it meets the highest standards of integrity and excellence.”

While “the majority of our UK authorised funds are delivering value to investors”, he noted that “there are still a number of funds with areas in which we can improve”.