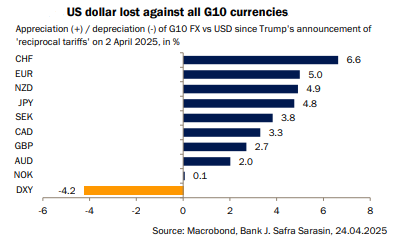

The US dollar has been hard hit by Donald Trump’s tariffs, losing around 4% on a trade-weighted basis since ‘Liberation Day’ on 2 April, and experts anticipate further weakness.

Claudio Wewel, FX strategist at J. Safra Sarasin Sustainable Asset Management, said: “While the US dollar traded at around its two-year highs during the first few weeks of Trump’s second term, it took a massive hit [after Liberation Day] as global investors embarked on a broad-based ‘sell America’ trade.

“Against this backdrop, gold may have become the most appealing reserve asset, while the attractiveness of euro and yen reserves has also risen significantly as markets fret about the erosion of the rule of law in the US. This means that, in the absence of a major US policy reversal, the dollar is likely to depreciate further in the coming months.”

Before 2 April, exchange rates were behaving in a textbook fashion and the threat of imminent tariffs weighed on the euro. But after Liberation Day, “these dynamics virtually changed overnight as investors started to lose faith in president Trump’s policy mix”, Wewel said. “Clearly, it is no exaggeration to speak of a regime shift.”

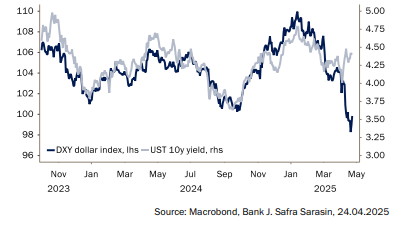

Unusually, the dollar fell while long-term US treasury yields rose – an anomaly that “points to a marked increase in US risk premiums and likely indicates that foreign investors have dumped US government bonds”, he noted.

The dollar has fallen in spite of rising long-term US treasury yields

International investors own such huge amounts of dollars, US treasuries, equities and private credit that the US has a negative net international investment position of $26trn, said Jim Luke, a commodities fund manager at Schroders.

“It does not take a Nobel Prize in economics to work out that the current tariff-based assault on the global trading system might lead to significant repatriation flows amid a questioning of just how ‘safe’ dollar assets now are, or how bright the relative US economic outlook is,” he said.

Aberdeen’s chief economist, Paul Diggle, also expects investors to re-assess the attractiveness of US assets, including the dollar – which he thinks is still overvalued. “High valuations, slowing growth and profound policy uncertainty mean a structural outflow of investor capital from US assets is now underway,” he said.

Yet there is light at the end of the tunnel for investors as several asset classes could benefit from a weaker greenback, as experts explain below.

Gold: The ultimate safe haven

Gold has proven its mettle as a diversifier recently and investors who hold it have made strong gains, offsetting losses elsewhere in their portfolios.

As Lale Akoner, a global market analyst at eToro, said: “A modest allocation to gold can act as a shock absorber in turbulent times, offering protection against both inflation and geopolitical instability.”

Gold’s recent surge mirrors the loss of trust in US assets, Wewel said. “Over the course of the Easter weekend, gold surged to a new (albeit short-lived) all-time high of $3,500 as concerns about the Federal Reserve’s independence mounted.”

Longer-term, he expects central banks to increase their allocations to gold and other currencies such as the yen and the euro at the expense of dollars due to “the increasing unpredictability of US policies”.

Luke believes that deglobalisation, high sovereign debt and untenable deficits could “create a situation where multiple pockets of global capital attempt to acquire gold simultaneously”.

“Gold at $5,000/oz by the end of the decade did not feel an outlandish scenario 12 months ago. It feels frankly conservative now,” he said.

Diversify or hedge your currency exposure

Investors, like central banks, may wish to diversify their currency exposure, Akoner said. “Some investors are allocating to assets denominated in euros, yen or Swiss francs. Others are using international funds with currency-hedged share classes to broaden the safety net and neutralise foreign exchange risk.”

Charles-Henry Monchau, chief investment officer at Syz Group, said commodity currencies such as Australian and Canadian dollars tend to strengthen when the greenback weakens.

“Bitcoin is sometimes seen as an alternative store of value when fiat currencies weaken, though this is more speculative and volatile,” he added.

Wewel, meanwhile, is backing the euro. As the second-largest currency within international foreign exchange (FX) reserves, it is particularly well-positioned to benefit from diversification away from the dollar.

Around 20% of international FX reserves are held in euros, while the yen and sterling each account for 5%, according to the International Monetary Fund.

“Given current valuations, which indicate that the yen continues to be significantly undervalued, while the pound remains markedly overvalued – both from a relative purchasing power parity and current account sustainability perspective – the pound will likely benefit relatively less from dollar debasement than the euro and the yen,” Wewel explained.

International equities could benefit from earnings tailwinds

Many investors’ equity portfolios are heavily skewed to the US. “If you’ve been riding the US mega-cap train too long, a tilt abroad could help restore some balance,” Akoner said.

“Stocks in export-driven economies such as Germany, Japan and South Korea often benefit from a cheaper dollar. Their goods become more competitive globally, boosting corporate earnings,” she explained.

“Emerging markets, too, have been standout performers. In the first quarter, Chinese and Korean stocks led a surge in emerging market equity funds, thanks in part to a weaker dollar redirecting capital flows.”

Monchau added that emerging market companies often have dollar-denominated debt, so a weaker greenback would be a tailwind for both equities and corporate bonds.

Companies based anywhere outside the US that earn dollar revenues would “benefit both from translation effects and stronger local currencies”.

On the other hand, US-based multinational corporations with significant overseas revenue, such as Apple and Microsoft, could prosper as their foreign income becomes more valuable in dollar terms, he said.