Baillie Gifford is synonymous with growth investing. When investors conjure an image of the Edinburgh-based firm they may well think of Scottish Mortgage or any of the plethora of growth funds that invest in high-risk, high-reward companies.

But one trust going against the grain is Scottish American (nicknamed SAINTS). Managed by James Dow, it focuses on a total return of both income and capital gains.

It is so differentiated from the typical portfolio at Baillie Gifford that it invests in something few would expect the asset management firm to own: property.

Some 9% of the trust (or £95m) is invested in direct property through an independent manager and its portfolio is far removed from the data centres or high-tech warehouses one might expect a cutting-edge firm like Baillie Gifford to buy.

The portfolio, which at the end of December stood at 11 holdings, includes properties rented out to two Aldi Supermarkets, two Greene King pubs, two Premier Inn hotels and a motorway service station.

It is rounded out by a Park Resorts holiday village, a Hollywood Bowl bowling alley, a Booker’s warehouse and an industrial site.

Manager James Dow said property has been part of the fund since around 1995 and is primarily paid for through the trust’s gearing, which currently stands at 4%.

This borrowing is long-term debt due in 2048 with a fixed rate of 3%, which Dow said was a level where the trust can make “extra income by investing in non-equity asset classes”.

“The thing that is interesting about them is, unusually for properties, they have all got either inflation-linked or index-linked increases in the rental over time. That is the trick of it. We can borrow at 3%, and that never goes up, but we get inflation-linked increases on the rent from these properties,” the Scottish American manager said.

“That’s quite attractive and the capital value goes up over time as well. It’s an interesting opportunity. The manager has a terrific track record of finding esoteric opportunities. They are not terribly exciting except when you look back at the long-term record.”

While the property portfolio is designed to increase the trust’s yield, at 3% it remains low compared to the rest of its sector (it is the second lowest yield among the seven IT Global Equity Income trusts) and other income-generating assets such as government bonds or savings accounts. Dow defended the dividend yield, however.

“Some people are going to say they will take their 4.5% nominal gilt or government bond or bank account paying 3.5% but there are a lot of savers who think this is a really resilient income stream they can rely on,” the manager said.

At the other end of the spectrum, “some things offer a 7% yield and you’ll get it for the first couple of years and then you’ll be like ‘what happened?’ because there won’t be anything left. This is a resilient 3% and the key thing is it should grow ahead of inflation over time”.

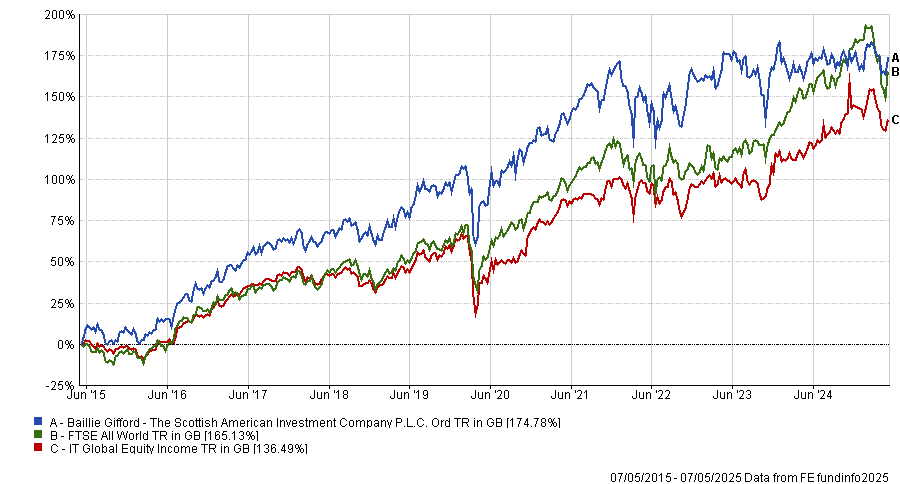

He also noted that both the capital returns and dividend growth have contributed to a strong total return for investors over the years. In the past decade, for example, the trust has made a total return of 174.8%, the third-best in its sector and ahead of the FTSE All World index.

Performance of trust vs sector and benchmark over 10yrs

Source: FE Analytics

“If you stack up SAINTS’ long-term capital and income return and compare the results, you would have been a lot better off in the 3% that grows ahead of inflation than taking 4% in a bank account that is getting eaten by inflation every year,” he said.

However, there will be years when the trust underperforms. Take 2024 as an example, when the trust lost 4.8% in total return terms – the worst performance in the sector. Its net asset value (NAV) return was 3.3%, however, with much of the losses coming from the share price.

“The income grew last year and the earnings of the companies grew, but the discounts that opened up in investment trusts meant that, even though we had a positive NAV, the share price return is slightly negative” he said.

Additionally, Dow blamed the trust’s underweight to the US (currently 26.3% of assets) and to cyclical businesses such as tobacco, oil and banks for the poor relative performance versus his peers in 2024.

He said: “The US market absolutely roofed it last year and Europe and the rest of the world did not. Within that, things that went up were the likes of Tesla and Nvidia, which is not part and parcel of what we are trying to do. It would be wrong for us to have those in the portfolio.”

The SAINTS manager noted that “a couple of peers are effectively capital growth trusts”, which means they convert capital to income and can own the likes of Nvidia, contributing to their performance. “A couple of those did much better than us because we are focused on steady income growth.”

“Then you have some of the cyclicals that went up last year. There is another approach to generating income which is buy your high yield banks, oils, cigarettes, telcos et cetera. It is not a good investment approach in the long term as they don’t grow and there’s a lot of dividend risk. But there are periods of time when those will do well and last year European banks had an amazing year.

“If you are into Microsoft, Procter & Gamble and CME Group then last year you will have missed out on that massive rally,” Dow concluded.