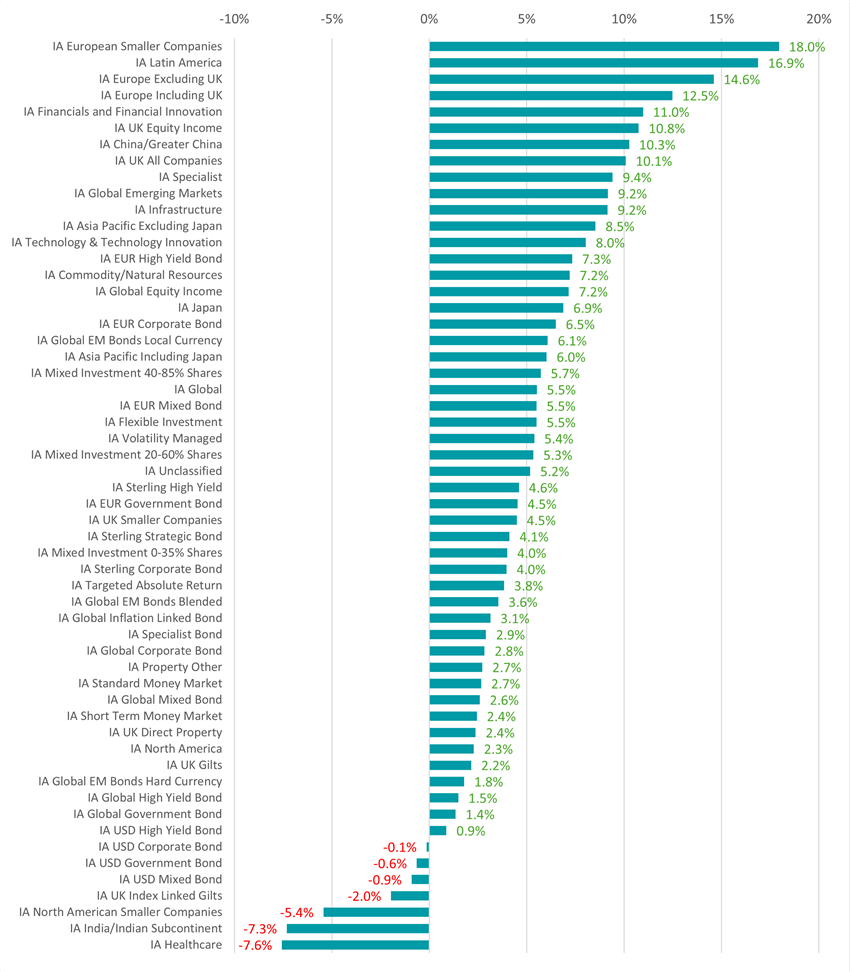

Latin American funds have been replaced as the top performers of 2025, FE fundinfo data shows, as investors continue to flock to European equities.

For most of the year, IA Latin America has been the sector with the highest average return. Investors have been buying up Brazilian and Mexican stocks for their discounted valuations, stronger local currencies and supportive macro environment.

However, IA Latin American funds have now slipped into second place with the IA European Smaller Companies sector becoming the peer group with the highest average year-to-date return.

Performance of fund sectors over 2025 to date

Source: FE Analytics. Total return in sterling between 1 Jan and 31 Jul 2025

European smaller companies have rallied in 2025 as interest rate cuts by the European Central Bank (ECB) reduced borrowing costs and revived domestic demand. These firms, which are more exposed to local economies than exporters, have also benefited from Germany’s large fiscal stimulus and improving sentiment across the eurozone.

Meanwhile, investor appetite has shifted toward undervalued areas of the market; small‑caps trading at lower valuations than large peers after several years of underperformance. Strong gains in markets like Spain, Poland and Greece also highlight how local growth stories and infrastructure spending are driving outperformance within the broader European rally.

Nicole Vettise, head of client portfolio management – equities at Neuberger, touched on these themes in a recent update: “Amid the noise of headline indices and the relentless spotlight on mega-cap growth names, a powerful story has quietly unfolded beneath the surface: value and small-cap stocks are staging a comeback that many investors may have missed.

“While much of the market’s attention has remained fixed on a handful of high-profile names, the low beta segments of the market – particularly value-oriented and smaller companies – have delivered superior returns with less volatility. This shift reflects a changing macro environment: as economic growth moderates and policy uncertainty rises, investors are seeking resilience and consistency, turning to stocks that combine attractive valuations with robust fundamentals.”

The best performing funds from the sector this year are Mirabaud Discovery Europe Ex-UK (up 28.1%), Janus Henderson European Smaller Companies (27%), UBS MSCI EMU Small Cap UCITS ETF (26%) and JPM Europe Small Cap (25.8%).

Positives like the ECB’s rate cuts and Germany’s spending boost have not just benefitted smaller companies funds, however, with the IA Europe Excluding UK and IA Europe Including UK sector’s being the third and fourth best peer groups over the year to date.

Artemis SmartGARP European Equity, iShares EURO Dividend UCITS ETF, SSGA SPDR MSCI Europe Financials UCITS ETF, First Trust Eurozone AlphaDEX UCITS ETF and Invesco EURO STOXX High Dividend Low Volatility UCITS ETF have made the highest returns from these sectors.

The strong performance of the IA China/Greater China sector – in seventh place – marks a turnaround from recent months, when it had been ranked in the middle of peer groups for year-to-date performance.

Sentiment towards Chinese equities has been improving recently in recognition of the country’s technological innovation, such as the DeepSeek AI model, and attractive valuations when compared with the developed world. Last week, Killik & Co senior portfolio manager Andrius Makin told Trustnet that valuations in China are “so compelling that it makes sense to be overweight”.

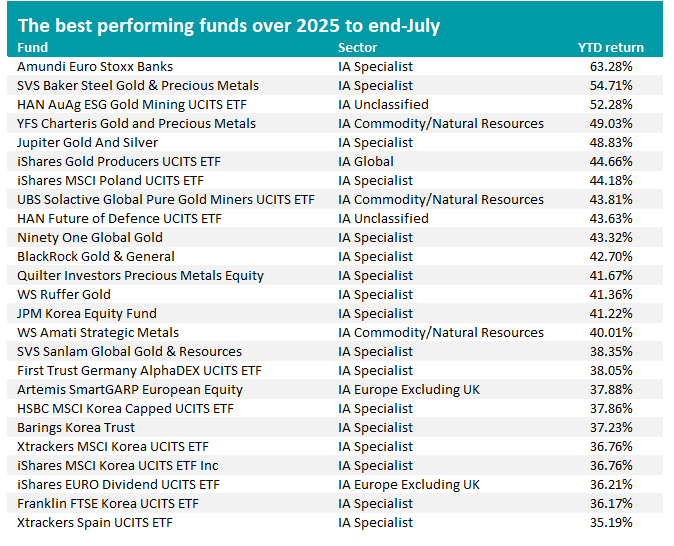

Source: FE Analytics. Total return in sterling between 1 Jan and 31 Jul 2025

The best fund over 2025 to date focuses on a specific area of the European stock market: banks. Amundi Euro Stoxx Banks made a 63.3% return in the first seven months of the year, putting it in first place by a decent margin.

European bank stocks delivered strong returns through to the end of July 2025, with the FTSE World Eurozone Banks index rising 64.7% (in sterling terms), outperforming North American and Asian peers, which gained 11.2 % and 12.7% respectively.

Deutsche Bank and BNP Paribas posted robust second‑quarter results, with Deutsche delivering €1.5 bn in net profit and BNP achieving approximately €3.3bn despite a slight net income dip, both beating analyst forecasts. Notable performers also included Societe Generale and Erste Group, which raised 2025 profit and capital targets following strong second-quarter earnings.

However, the clear trend among the best individual funds over 2025 so far remains gold, which surged in the first seven months of 2025 and is among the top‑performing major asset classes this year.

Demand for the yellow metal has been driven by a number of macro factors. Weaker US treasury yields and rising rate‑cut expectations have lowered the opportunity cost of holding gold, while tariffs and mounting geopolitical uncertainty have fuelled safe‑haven buying.

Central banks and institutional investors also continue with sustained purchases. Although central bank acquisitions eased in the second quarter, total holdings remain historically high while ETF inflows surged to record levels.