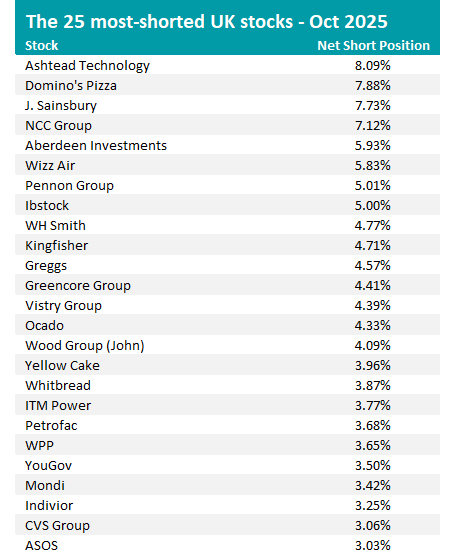

Short sellers continue to bet against companies reliant on the UK consumer although the biggest short position at present is on a subsea technology specialist.

Investors have to notify the Financial Conduct Authority (FCA) when their shorts – or bets that a company’s shares will fall – reach or exceed 0.1% of a company’s issued share capital. It is maintained by the regulator to promote market transparency and monitor short-selling activity.

Below, we look at the companies that investors are running the largest shorts against this month.

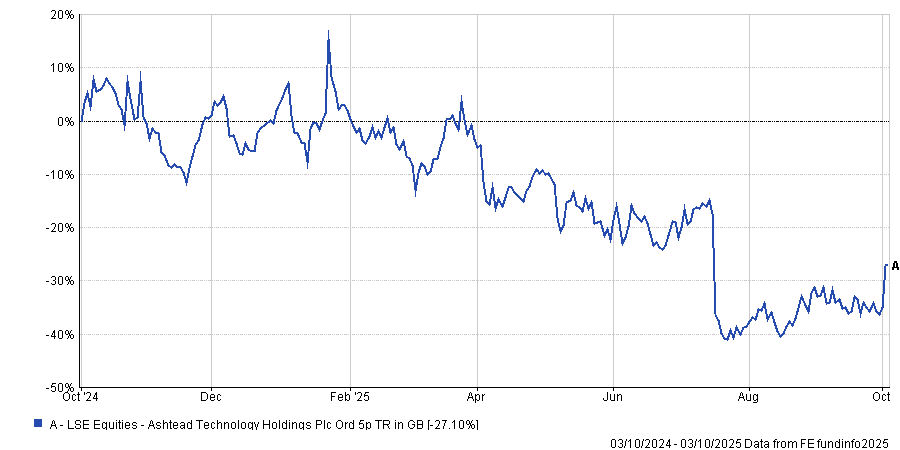

Performance of Ashtead Technology over 12m

Source: FE Analytics

The most shorted UK company at the moment is small-cap subsea technology specialist Ashtead Technology, with short positions amounting to 8.1% of its capital disclosed to the FCA. The largest shorts are being run by Acadian Asset Management (2.2%), GLG Partners (1.6%) and Qube Research & Technologies (0.9%).

FE Analytics shows the company’s shares are down 27.1% over the past 12 months. Ashtead Technology rents out subsea equipment to the global offshore energy sector, but investors are nervous about the disruption to large-scale energy projects being caused by global instability.

However, its half-year results for the six months ending 30 June 2025 showed revenues grew 23.3% to £99.1m while profit before tax edged up 0.8% to £17.8m.

Chief executive Allan Pirie said: “The group has continued to deliver strong profitability and year-on-year growth despite some market and geopolitical headwinds during the period.

“While this business environment somewhat tempered activity and led to a slower seasonal ramp up of revenues through the second quarter, we have been able to continue to strengthen our business, execute on our long-term strategy and focus on driving enhanced quality of earnings.”

Source: Financial Conduct Authority, as at 6 Oct 2025

Domino’s Pizza is the second most-shorted stock, with 7.9% of its capital in short positions from the likes of JPMorgan Asset Management, Fosse Capital Partners and Squarepoint Capital.

Its most recent results show first-half like-for-like sales were down 0.1% with lower-than-expected store openings and caution among its franchisees given increased employment costs. Underlying profit before tax was down 14.8% to £43.7m.

Chief executive Andrew Rennie said: “There's no getting away from the fact that the market has become tougher both for us and our franchisees, and that's meant that the positive performance across the first four months didn't continue into May and June.

“Given weaker consumer confidence, increased employment costs and uncertainty ahead of the Autumn Budget, franchisees are taking a more cautious approach to store openings for the time being.”

As well as Domino’s, short sellers are targeting several other food and hospitality businesses such as supermarket J. Sainsbury, baker Greggs, convenience foods producer Greencore and Premier Inn owner Whitbread.

Inflation and economic weakness mean investors are cautious around the UK consumer spending; Deloitte recently found that UK consumer confidence has fallen for the first time since 2022's third quarter.

“The overall picture remains one of cautious consumer sentiment: the continued impact of inflation on food and utilities, coupled with geopolitical uncertainty, suggests that a sustained recovery in consumer confidence may take more time,” Deloitte said.

Sainsbury’s has been regaining some of the market share it lost to Tesco and discount supermarkets but is seen as having more exposure to discretionary spending because Argos makes up around 15% of its overall sales.

Its biggest shorts are being run by Ilex Capital Partners (2.7%), AKO Capital (1.6%) and BlackRock (1.1%).

Greggs has seen slowing sales growth, blamed on a hot summer and the tough consumer backdrop. Earlier this year, AJ Bell head of markets Dan Coatsworth said: “Its investment case was predicated on rapid expansion and the nation maintaining its ferocious appetite for sausage rolls. Now we’ve got a situation where there are Greggs everywhere you go and tastes has evolved, moving away from pastry-based treats to healthier items.”

Other themes among the biggest shorts include construction-linked stocks: Ibstock and Vistry Group are tied to housing and construction. Shorting here may reflect weak housing demand, higher interest rates or slower infrastructure spending.

Energy is another common thread, with Petrofac, John Wood Group, ITM Power and Yellow Cake active in both traditional and clean energy.

Energy infrastructure provider Petrofac has been subject to long-term short selling because of worries over its debt, as has Wood Group – which recently accepted a takeover bid.