The change in economic and geopolitical policies from the US administration, combined with a significant increase in European defence and infrastructure spending, has led many investors to reassess Europe’s investment potential

At the heart of this shift is Europe’s pursuit of strategic autonomy. For the region to act independently in key areas such as defence, energy, digital infrastructure and critical supply chains, investment plans for public initiatives of a historic scale are in the pipeline. Planned investments in strategic autonomy amount to over €1.6trn.

Adding up all Europe’s plans, more than €3trn in public capital is being mobilised – a transformation in scope and ambition that reflects the new geopolitical reality.

This has significant implications for Europe’s economic prospects and investment appeal – particularly in defence, infrastructure, private assets, fixed income, and equities.

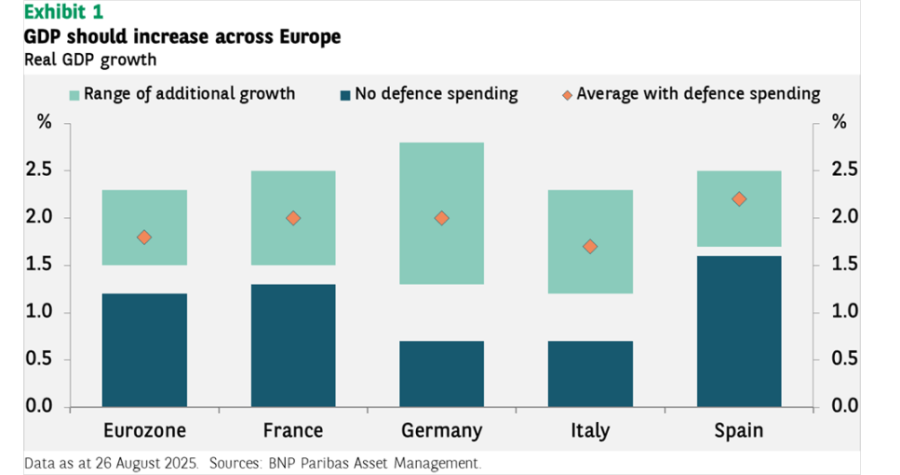

Defence and infrastructure spending to boost GDP growth

One of the clearest changes is in defence. US president Donald Trump’s push for greater burden sharing by Europe has borne fruit. There is acceptance now across most NATO countries to spend 5% of GDP on defence (broadly defined).

We estimate the increase in defence spending could double the rate of real (inflation-adjusted) GDP growth across the European region.

In addition, Germany has launched a 12-year, €500bn investment initiative including infrastructure, construction, renewable energy, healthcare and defence.

This is a huge change for Germany and Europe, which has historically been reluctant to spend on such a scale to boost growth. These outlays should have a meaningful impact on the continent’s growth rate as there is significant spare capacity in its economy.

European fixed income offers opportunities

For bond investors, confidence in the European Central Bank’s (ECB’s) vigilance on inflation risk is a key attraction. The ECB’s credibility has underpinned the resilience of European fixed income markets this year, with corporate debt in particular delivering positive returns and low volatility despite global uncertainty.

There is scope for a further pick-up in corporate investment and mergers and acquisitions activity as the economy gains momentum in the years ahead. Corporate debt issuers have continued to prioritise deleveraging, while inflows into mutual funds and demand for collateral for collateralised loan obligations (CLOs) are bolstering demand.

We believe the fundamental characteristics of companies in the euro high-yield segment are good. Recent company results have demonstrated the resilience of business models.

Profit margins have been stable, costs are well under control and there is potential for improvements in cash generation and balance sheets.

While we see limited scope for further significant spread tightening in 2025, we expect carry and security selection to drive performance.

Private capital’s role in a €3trn investment super-cycle

Europe’s private capital moment has arrived. The combination of large public investment plans, structural shifts in industrial policy and geopolitical realignment is generating a pipeline of investable projects and co-investment frameworks that go well beyond political wish-lists.

Strategic opportunities are opening up in energy, artificial intelligence, defence and aerospace and infrastructure. Europe’s transformation is being powered by large-scale, government-backed investment agendas, including the Clean Industrial Deal, ReArm Europe Plan/Readiness 2030, Digital Sovereignty, European Green Deal, Germany’s infrastructure fund, REPowerEU, and the European Chips Act.

These represent not just short-term stimulus initiatives, but conduits with long-term investment horizons designed to channel public and private capital into Europe’s real economy.

European equities – the better value

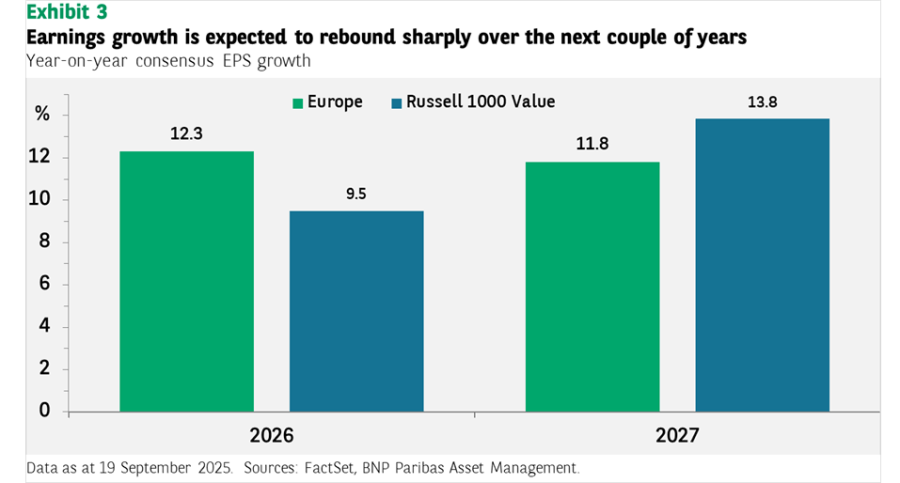

Increased government spending in Europe should have broad ripple effects across the economy, supporting earnings growth across multiple industries. Analysts expect a sharp recovery in European earnings over the next two years – on par with the US Russell 1000 Value index.

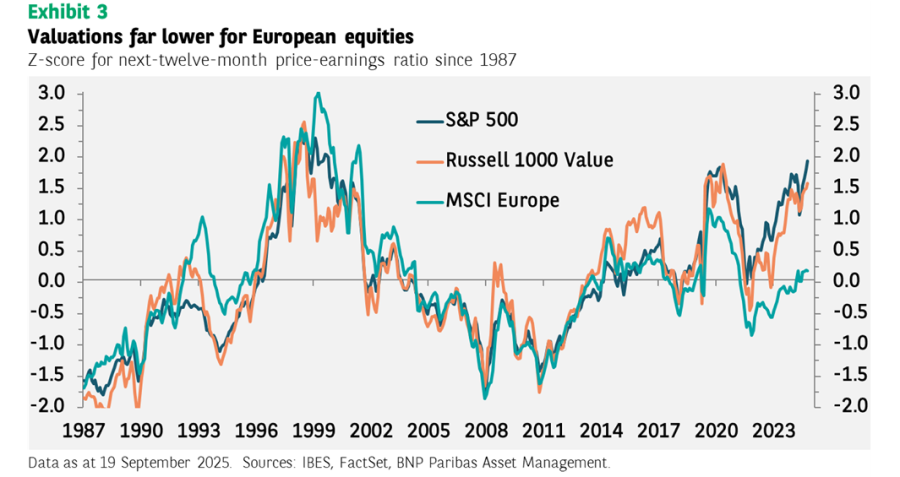

The comparison with Russell Value is apt: its sector composition mirrors Europe’s far more closely than the S&P 500, which is dominated by technology stocks. But the real story is valuations.

While the forward price-earnings (P/E) ratio for the Russell 1000 Value index is trading well above its historical average — with a z-score of 1.5 — Europe’s equivalent valuation sits almost exactly at its long-term norm (0.1). Investors can access similar earnings profiles to US value stocks but at a substantial discount.

This combination of attractive valuations, improving earnings and large-scale fiscal support makes European equities one of the most compelling global opportunities today.

A region reshaped

Europe’s investment case is being rewritten. Strategic autonomy is no longer a slogan but an economic reality backed by trillions of euros in planned spending.

Defence and infrastructure investment are set to lift growth, the ECB’s credibility continues to support fixed income markets, private capital has unprecedented opportunities and equities offer value at levels rarely seen relative to the US.

The forces of geopolitics, industrial policy and fiscal ambition are aligning in a way not witnessed in Europe for decades. For investors, it is time to take another look at the continent – and not just as a diversification play, but as a growth story in its own right.

Daniel Morris is chief market strategist at BNP Paribas Asset Management. The views expressed above should not be taken as investment advice.