As concerns mount over US fiscal and political sustainability, central bank independence and inflation, gold has emerged as a standout performer – with allocations creeping upward in investment portfolios.

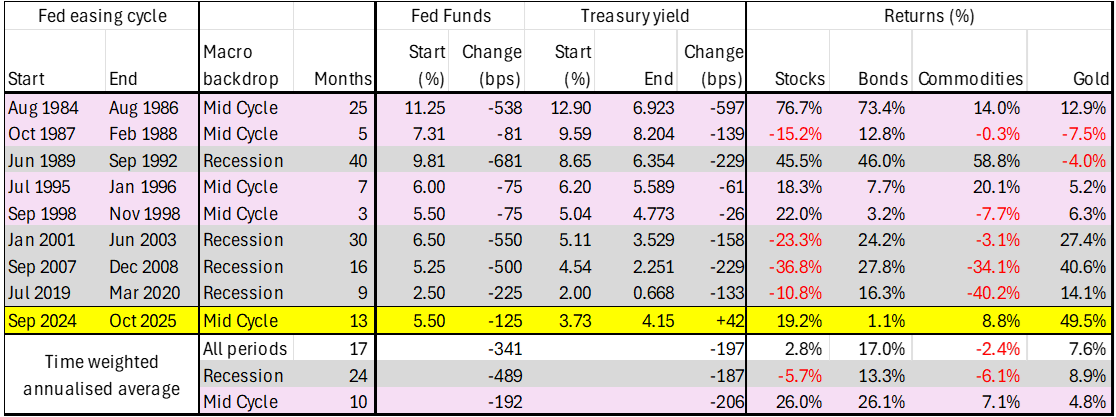

Royal London Asset Management (RLAM) recently conducted research mapping financial market behaviour during US Federal Reserve easing cycles since the 1980s, finding that within the most recent rate-cutting cycle starting in September 2024, bonds have delivered near-zero returns. In contrast, gold has gained 49.5%.

Financial market behaviour during Federal Reserve easing cycles

Source: RLAM. Annualised total return in US dollars. S&P Composite index for stocks, 10-year US treasuries for bonds and GSCI index for commodities.

Trevor Greetham, RLAM’s head of multi-asset, said: “A year ago, you could confidently say that bond markets do well when the Fed is cutting rates. Yet, this year, stocks are performing about the same [as they normally do during easing cycles] but we are only seeing 1.1% from bonds because rising yields are giving you capital losses.”

He said that investors are increasingly “looking at gold as a store of value in the way that they used to look at bonds”.

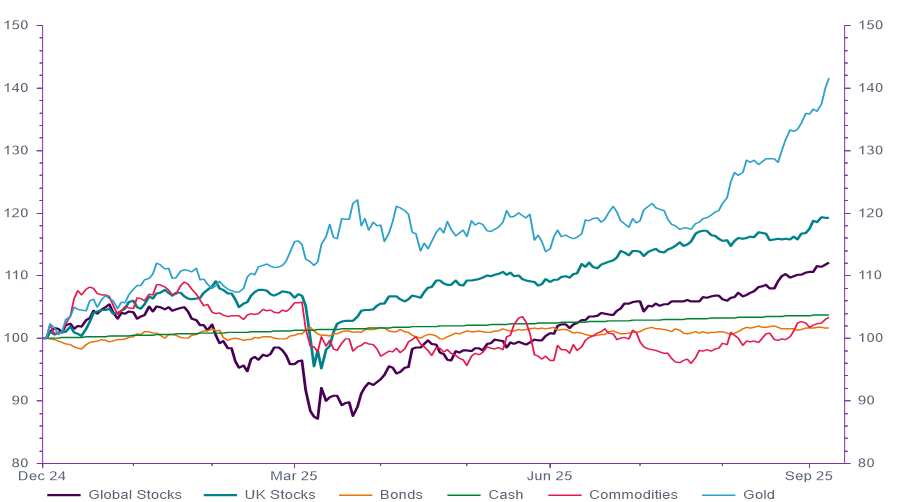

Greetham pointed out that, year-to-date, gold has also been outperforming major asset classes in sterling terms. It is up 42% compared to 20% from the UK stock market, for example.

Performance of gold vs major asset classes (in sterling) YTD

Source: RLAM, LSEG Datastream as at 6 October 2025

“This very vertical move in gold has coincided with a lot of uncertainty in the US, with the government shutdown and president Donald Trump talking about invoking the Insurrection Act,” said Greetham.

In addition, there are mounting concerns regarding the Fed’s independence, heightened by Trump’s attempt to dismiss governor Lisa Cook last month, weak US jobs market data in August, concerns over America’s debt sustainability and a weakening dollar.

“These are not small issues, which is likely why we are seeing many buying up gold,” said Greetham.

Indeed, gold crossed the $4,000 per ounce mark for the first time last week, adding more than $600 since early September.

Given its current strength, the Royal London Asset Management multi-asset manager noted that it is working as a good hedge against inflation, recession fears and geopolitical uncertainty.

And it appears the yellow metal is not expected to hit a ceiling just yet. Earlier this month, Goldman Sachs dramatically raised its gold price forecast, predicting the metal will hit $4,900 by December next year – up from its previous estimate of $4,300.

One of the main arguments supporting Goldman Sach’s bullish stance is the expectation there will be further rate cuts to come from the Fed. The firm projects a 100-basis-point reduction by mid-2026.

Dr Claudio Wewel, foreign exchange (FX) strategist at J. Safra Sarasin Sustainable Asset Management, said gold demand is likely to shift increasingly from individuals to pension funds and other asset managers.

“Rather than the traditional 60/40 asset allocation between equities and bonds, asset managers are considering increasing gold allocations significantly, due to its greater resilience as an inflation hedge amid rising longer-term bond risk premia,” Wewel said.

Even increasing allocations to gold up to 5% would mean fund managers are doubling or tripling their existing gold portfolio holdings.

“Tactically, we are currently slightly underweight bond markets and cash to be overweight stocks and gold, with gold making up 0.5% of our multi-asset portfolios,” Greetham said. “It is the most positive tactical trade we have done in what has been a very difficult year for tactical trades.”

However, as with any volatile asset class, the gold price can fall just as sharply as it rises.

Nic Puckrin, investment analyst and co-founder of The Coin Bureau, said that gold’s 2025 surge is “now as much a momentum trade as anything else, and momentum trades have a tendency to fizzle out”.

“While it is very possible that gold will continue to outperform other assets for the foreseeable future, it has certainly become a crowded trade,” he said. “And that means there is more risk involved in initiating exposure at this point.”