No one fund can capture every positive trend in the investment universe, so it is crucial that investors build a portfolio that ensures diversification, flexibility and risk management in equal measure.

In a recent article, Trustnet explored how multi-asset fund of funds can serve as a simple, all-in-one solution for beginner investors taking their first step in the portfolio-building process.

For those prepared to make their next move, the same experts recommend satellite holdings below – more specialist funds that complement a core strategy – to hold alongside the previously recommended fund of funds.

Vanguard LifeStrategy range

Dzmitry Lipski, head of funds research at interactive investor, was one of three fund pickers to select the Vanguard LifeStrategy range. He noted that, given the current volatile climate, investors may want to add diversification and potential for extra returns via alternatives like commodities or gold.

“A good option is the WisdomTree Enhanced Commodity ETF which invests across industrial metals, precious metals, energy and agriculture,” he said.

With an ongoing charge of 0.35%, the exchange-traded fund (ETF) combines passive tracking of the Optimised Roll Commodity index with active enhancements designed to outperform the Bloomberg Commodity index.

“With disciplined cost management and a diversified structure, the fund is well positioned to benefit from falling rates,” Lipski added.

Meanwhile, Rob Morgan, chief analyst at Charles Stanley, said Templeton Emerging Markets Investment Trust would plug the range’s more limited exposure to emerging markets.

“Ignore emerging markets at your peril,” he said. “In a world that has gotten used to US hegemony, there are huge opportunities to back today and tomorrow’s titans of the global south.”

At over £2bn in size, the investment trust is “the largest emerging markets investment trust by some distance”, Morgan said, pointing to its “long history and a management team with considerable industry experience”.

It targets long-term themes, including ‘premium’ consumer goods, digitisation, healthcare and technology.

The trust is particularly “focused on the big getting bigger”, Morgan said, which is evidenced by its top 10 holdings being dominated by mega-caps including Taiwan Semiconductor, Tencent and Samsung.

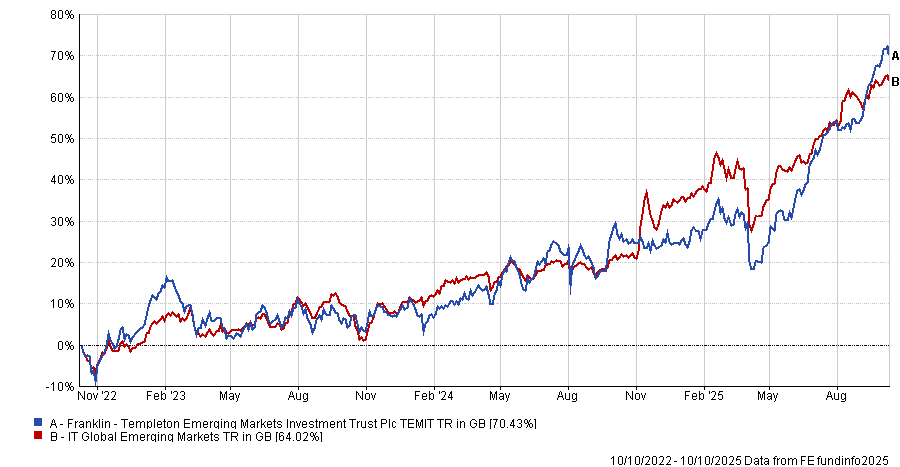

Performance of the trust vs sector over 3yrs

Source: FE Analytics

Dan Coatsworth, investment analyst at AJ Bell, said the Vanguard LifeStrategy range could also be well-complemented by WS Gresham House UK Smaller Companies.

As well as ensuring the beginner investor has some small-cap exposure, Coatsworth said the fund could “bring private-equity-style investment techniques to the public markets”.

The fund has outperformed the IA UK Smaller Companies sector average over one, three and five years, gaining 67.4% over the half-decade, while the sector managed a 22.3% average.

However, investing in small-caps will add extra risk to an investor’s portfolio, Coatsworth warned, noting that they should therefore only make up a small part of their holdings.

Schroder Managed Balanced

Kate Marshall, lead investment analyst at Hargreaves Lansdown, suggested that Greencoat UK Wind would ensure some diversification and income alongside the £1.9bn Schroder Managed Balanced fund and similar portfolios.

The £2.3bn investment trust invests solely in operating onshore and offshore UK wind farms that are currently producing income, which Marshall said “means it offers something very different from most other funds or investment trusts that provide a more core approach”.

Under the Labour government, the UK is currently targeting a 95% clean electricity grid by the end of this decade – a pledge which will require a major expansion in offshore and onshore wind and therefore benefit a vehicle like Greencoat UK Wind.

It aims to pay investors a resilient inflation-linked annual dividend while preserving the value of the investment, meaning the majority of returns will come in the form of income rather than capital growth.

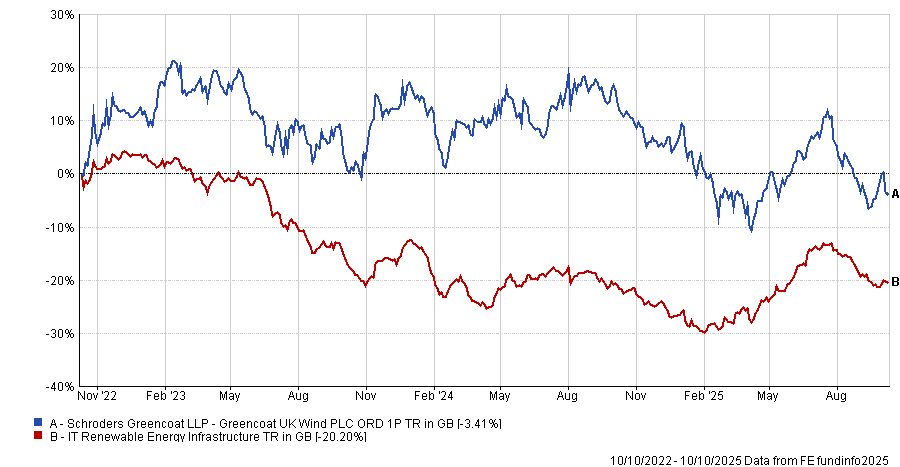

Performance of the trust vs sector over 3yrs

Source: FE Analytics

For those who want exposure to the artificial intelligence (AI) growth surge, Marshall recommended holding the Polar Capital Technology trust.

The £4.9bn investment trust aims to grow investors’ money over time by investing in next-generation technology leaders with long-term growth potential.

“AI is a broad category in this trust and includes companies enabling AI technology (like those making semiconductor chips or providing cloud computing services), AI beneficiaries (mainly technology companies) and AI adopters,” said Marshall.

The managers target the most financially strong companies run by experienced management teams, rather than early-stage or blue-sky companies. This means top holdings are dominated by Magnificent Seven stocks Nvidia, Microsoft, Meta and Alphabet, alongside companies deemed critical in the AI race, such as Broadcom.

The trust is managed by Fatima Lu, Ben Rogoff, Nick Evans, Xuesong Zhao and Alistair Unwin.

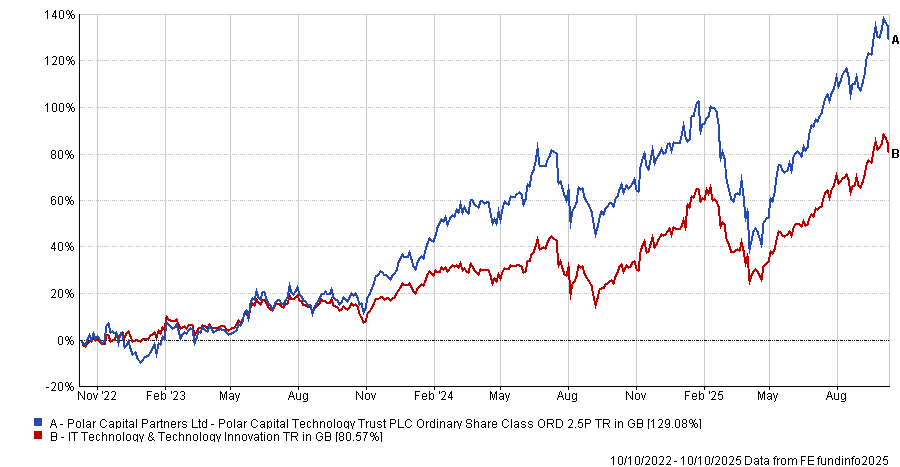

Performance of the trust vs sector over 3yrs

Source: FE Analytics

Legal & General Multi-Index range

Ittan Ali, research manager at Titan Square Mile Investment Consulting and Research, recommended the $10.1bn Polar Capital Global Technology fund, which the research house has awarded an ‘A-rating’ – it is the open-ended version of the Polar Capital strategy above.

Ali said: “[Technology] is an ever-evolving area of the market and requires constant vigilance. Polar Capital’s large team of technology investment specialists therefore provides them with a distinct advantage.”

Co-managers Ben Rogoff and Nick Evans are currently leaning into the AI surge, with the portfolio containing an increasing number of smaller companies they believe could benefit alongside the more well-established players.

Alongside the likes of Nvidia and Meta, the fund’s top 10 also includes Canadian electronics manufacturing services company Celestica and optical packaging provider and manufacturer Fabrinet. The share price of each company is up 164.1% and 64.6% respectively year-to-date.

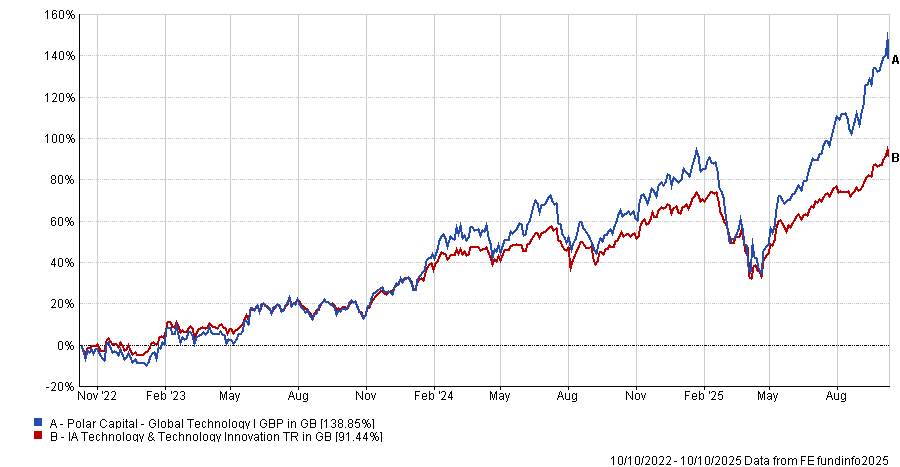

Performance of the fund vs sector over 3yrs

Source: FE Analytics

CT Universal MAP Growth

Unlike the others, Ben Yearsley, director at Fairview Investing, did not recommend a fund of funds as a core holding for beginners, but rather the CT Universal MAP Growth fund.

Although he said the list of funds an investor could hold alongside it is “extensive”, he noted that they do not need any further exposure to tech, due to the fund’s large weighting to the global indices.

“The point about a core/satellite approach is that funds you add to the core holding should not be doubling up on the existing exposure,” Yearsley said.

As such, he pointed to Polar Capital Global Insurance, First Sentier Global Listed Infrastructure and/or International Biotech Trust as a means of diversification and increased exposure to less volatile sectors.