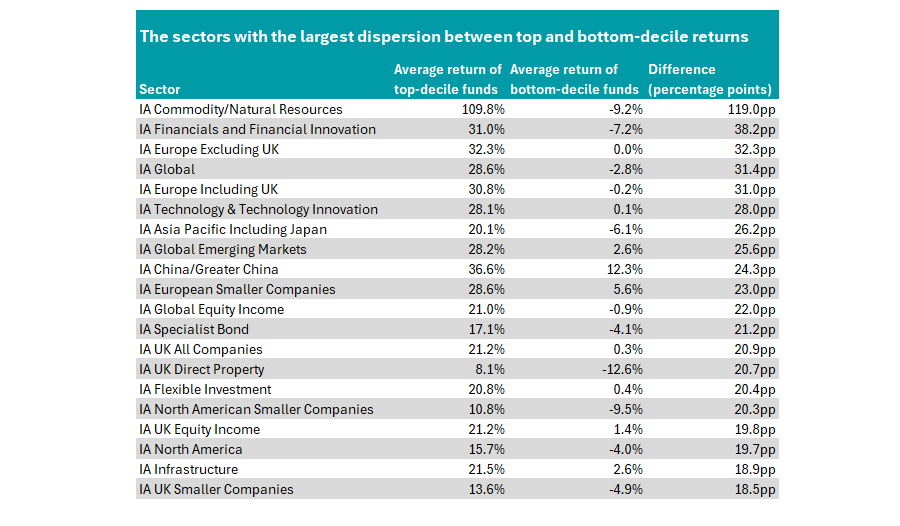

Investors have had to make the right call when picking commodities, financials and European equity funds, as these sectors have the widest dispersion between the best and worst performers, Trustnet research shows.

Picking the right asset class can sometimes only be half the battle, as the choice of fund can sometimes offset the money made by being the right asset class (or lost by being in the wrong one).

In the IA Commodity/Natural Resources, investors who picked a fund in the top decile for performance so far in 2025 have more than doubled their money on average, with the top 10% of the sector up 109.8%. However, the bottom 10% of funds have made a loss of 9.2%, showing how important selection has been here.

The top of the sector is dominated by gold and mining funds, which have shot the lights out as the yellow metal has been sought by investors flocking towards the safe-haven asset.

Gold shot above $4,000 for the first time earlier this month as US trade tensions, war in the Middle East and Europe and political uncertainty all caused a flight to safety.

UBS Solactive Global Pure Gold Miners UCITS ETF has been the top performer in the peer group, up 120.6% so far this year.

At the other end of the sector, funds focused on timber led the way lower, with Pictet Timber and iShares Global Timber & Forestry UCITS ETF making 13% losses each. They were joined in the bottom decile by two energy funds, which have struggled as the price of oil has come down following its rally in 2021 and 2022. The Brent crude spot price is down 11.6% so far in 2025.

However, while the disparity in returns in the IA Commodity/Natural Resources can be accounted for by the vast difference in underlying assets these funds invest in, this is not the case for others on the table below.

Source: FE Analytics

In second place was the IA Financials and Financial Innovation sector, where the top decile (made up of three Jupiter funds) has made 31%, while the bottom 10% lost 7.2%.

The three Jupiter funds are all managed by Guy de Blonay, who invests largely in developed markets with a tilt towards banks.

Analysts at RSMR recommend the Jupiter Financial Opportunities fund (third of the three performers), noting it is “likely to perform best later in the economic cycle or when interest rates are seen as peaking”, as evidenced by its strong returns in recent years as rates have risen and (more latterly) levelled out.

“The key to the positioning of the fund has been the macroeconomic outlook,” they said, with de Blonay then screening for stocks to fit these macro themes.

At the opposite end, Wellington FinTech Fund and T. Rowe Price Future of Finance Equity are the only two in the sector to make a loss so far this year.

These two sectors were followed by more traditional asset classes, such as the IA Europe Excluding UK sector. Europe has enjoyed a resurgence so far in 2025 as investors have moved away from the US on fears of toppy valuations among the market’s largest constituents.

However, fund selection has been perhaps even more important than the asset allocation. While the sector is up 17.2% on average, investors who picked a bottom-decile fund in 2025 would have made nothing, while those in the top 10% for returns would have almost doubled the average return, up 32.3%.

The top decile is dominated by tracker funds, although the top performer so far this year has been the Artemis SmartGARP European Equity fund, up 42.5%.

Meanwhile, the bottom decile is full of active managers, including abrdn Europe ex UK Equity, Premier Miton European, Comgest Growth Europe ex UK and BlackRock Continental European, which have all made losses in 2025.

IA Global and IA Europe Including UK round out the top five, with a more than 30 percentage-point dispersion between the best and worst performers in 2025 so far.

Overall, there were 10 sectors where picking funds in the top or bottom decile would have been the difference between making a double-digit gain and a loss.

Conversely, although the upside of picking a top-performing IA UK Direct Property fund was the lowest on the list (the average fund in the top decile was up 8.1%), the consequences were steep for picking a poor performer, with the average return from the bottom decile of the peer group netting a 12.6% loss.

At the other end of the spectrum, there was little difference between the constituents of most bond fund sectors, including IA UK Gilts, IA Sterling Corporate Bond and IA UK Index Linked Gilts, where the difference ranged from 1.9 to 5.2 percentage points.

IA Short Term Money Market and IA Standard Money Market funds had the least disparity, however, with the difference between the top and bottom deciles standing at just 1.6 and 0.1 percentage points, respectively.

Amongst a host of bond sectors and lower-risk multi-asset peer groups, IA Latin America was the only equity fund group where returns were broadly consistent.

The top-decile performers were up 29.6% on average, while the bottom 10% of funds made a 21.1% gain – a difference of just 8.5 percentage points. This suggests the decision to invest in the region was more consequential than the underlying fund chosen.