Smaller companies once promised steady outperformance versus their large-cap peers through what investors called the ‘small-cap effect’ but this now seems an empty promise, as many of those same companies are still sitting in small-cap portfolios today, with managers lamenting a sense of déjà vu.

The stagnation of the market was highlighted by David Lewis, co-manager of the Jupiter Merlin fund-of-funds range, who formerly focused on smaller companies early in his career.

A recent deep dive into his former hunting ground revealed that “some value-oriented UK small-cap managers are investing in the same companies that I used to invest in 20 years ago”. “They were small-caps then, and they are small-caps now,” he said.

“The opportunity in small-caps was rich if you cast your mind back when there was a lot of talk of the small-cap effect. But over the past 10 or 15 years, that's categorically not been the case.”

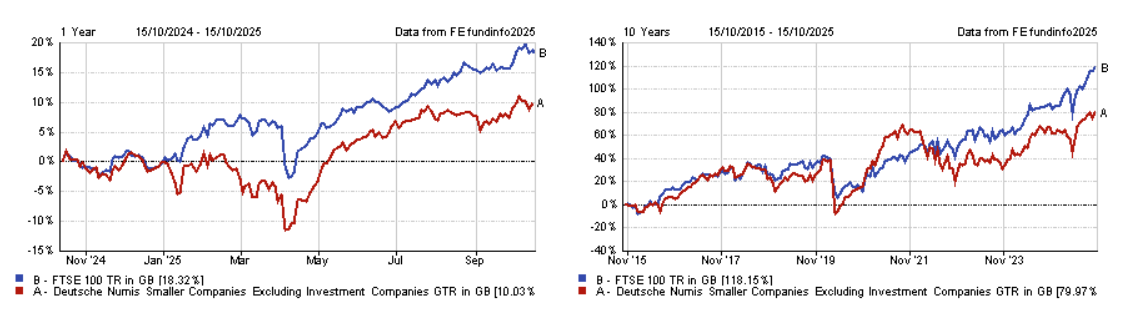

Data backs that up. The Deutsche Numis Smaller Companies index has returned 10.3% so far in 2025, roughly half the gain of the FTSE 100’s 18.8%. Over five years, the large-cap index has risen by about 29%, while small-caps are up just 19%. The gap has widened particularly since 2022, a year in which small-caps fell 17.9% against the FTSE 100’s 4.7% rise.

Performance of indices over 1yr and 10 yrs

Source: FE Analytics

Lewis said the stagnation of the market reflects the difference between small-cap traders and compounders.

“For value small-caps strategies, it's all about buying low and selling high like in a trading situation, because these companies are not necessarily ever going to be anything other than a small-cap,” he said.

“Whereas, if you can invest in quality companies that can reinvest in themselves at higher rates of return and grow over time, then you potentially can create really good returns.”

Lewis noted that the quality component has managed to compound outperformance by well over 2 percentage points per annum over the past 50 years in smaller companies.

Matthew Read, senior analyst at QuotedData, agreed that “there’s an element of ‘Groundhog Day’ in seeing the same names cropping up in small-cap portfolios year after year, never seeming to graduate to mid-cap status”.

But he argued the problem lies more in market behaviour than in the companies themselves. “Rather than indicating that the small-cap universe is a stagnant pool of underachievers, this trend says more about the market dynamics around discovery, rerating and capital flow.”

Read pointed out that many small-cap firms are performing well operationally, but investors have shifted towards global large-caps through passive funds.

“The real issue is that many of these companies do perform – they grow revenues, they become more profitable – but the market, preoccupied with having increasingly global allocations, simply doesn’t reward small-caps and good companies just seem to get cheaper and cheaper,” he said.

Money has chased US mega-caps and shunned smaller companies, particularly in the UK. Valuations have fallen to “extreme levels” domestically, Read added, which leads to two outcomes – markets either correct or companies get bought out.

However, he rejected the notion that the ‘small-cap effect’ is dead.

“We’d strongly argue that this binary view of small-caps as either value-traps or rocket ships misses the broader opportunity. Quality does exist in small-caps and it compounds over time. Funds like Montanaro UK Smaller Companies and BlackRock Throgmorton are proof of this concept.”

Rate dynamics add another layer of complexity, as Darius McDermott, managing director of FundCalibre, pointed out.

“Typically, falling rates favour growth and quality stocks, while rising rates have supported value strategies. But this dynamic is more nuanced the further down the market-cap spectrum you go,” he said. “Even as value has outperformed recently, the majority of the returns made in small-cap investing is inherently long-term, regardless of style.”

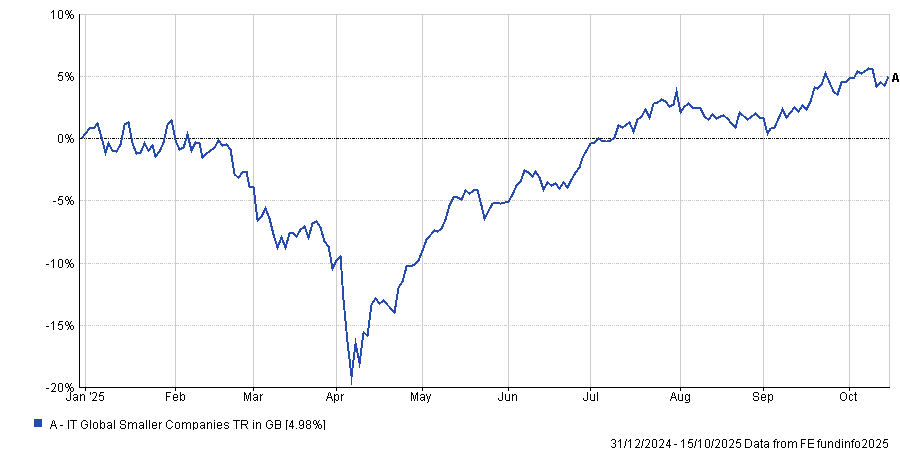

Globally, some signs suggest that small-caps may be emerging from their long spell of neglect, with the average investment trust in this space recovering 25 percentage points since the market trough back in April, as the chart below shows.

Performance of sector over the year to date

Source: FE Analytics

Victor Zhang, chief investment officer of American Century, said that this new bout of outperformance was helped by renewed merger and acquisition activity and that “there’s an argument to be made that small-caps may receive more attention in the future”.

“Federal Reserve rate cuts should help revive private equity buyouts that rely heavily on borrowed funds. Given the historically appealing valuations of many of these companies, small-caps could become attractive targets,” he said.