With markets volatile and economies uncertain, investors may feel especially wary of equities.

This is particularly true for investors who need their money in the next two to five years, as this isn’t a long enough time horizon to smooth out the volatility of equity markets.

But the real challenge in building a zero-equity portfolio is the lack of capital necessary to offset the effect of inflation over the long term, according to Nick Hyett, investment manager at Wealth Club.

A bond-only portfolio isn’t appealing either, because of the exposure to interest rate risk. “If interest rates rise or even don’t fall as much as expected, bond prices fall,” he explained. This is a particular risk for longer-dated government bonds.

As such, Hyett turned to alternatives “to help mitigate that exposure” – specifically private equity and infrastructure, with his perfect portfolio for a 0% equity investor outlined below.

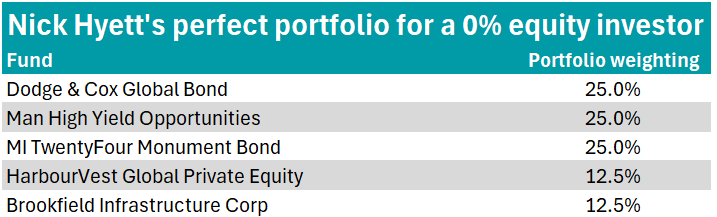

Hyett first allocated 25% of the portfolio to the $1bn Dodge & Cox Global Bond, which has 34.3% invested in government bonds and 83.7% in assets rated ‘BBB’ or higher.

“Its global portfolio includes a modest allocation to emerging market debt – a high-risk area, but one that has recently delivered attractive returns,” he said.

“An established track record and team-driven approach also give us confidence that the manager can stick to its knitting over the long term.”

Performance of the fund vs sector and benchmark over 5yrs

Source: FE Analytics

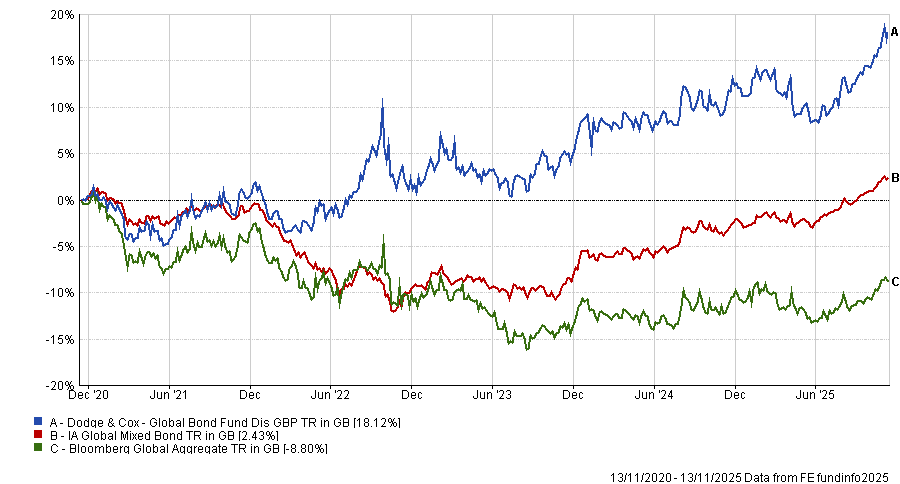

For investors with no equity exposure, high yield credit can also be an important source of additional return, which is why Hyett also allocated 25% to Man High Yield Opportunities. The £994.4m fund currently offers a yield to maturity of 9.2%.

He cited FE fundinfo Alpa Manager Michael Scott’s long track record of success in this higher risk part of the market, having run the same strategy at Schroders before moving to Man Group in 2019.

“The fund reflects a bias towards lower quality credits even within the high credit space with just 16.3% in ‘BB’ compared to 60.1% for the benchmark,” Hyett said.

Performance of the fund vs sector and benchmark over 5yrs

Source: FE Analytics

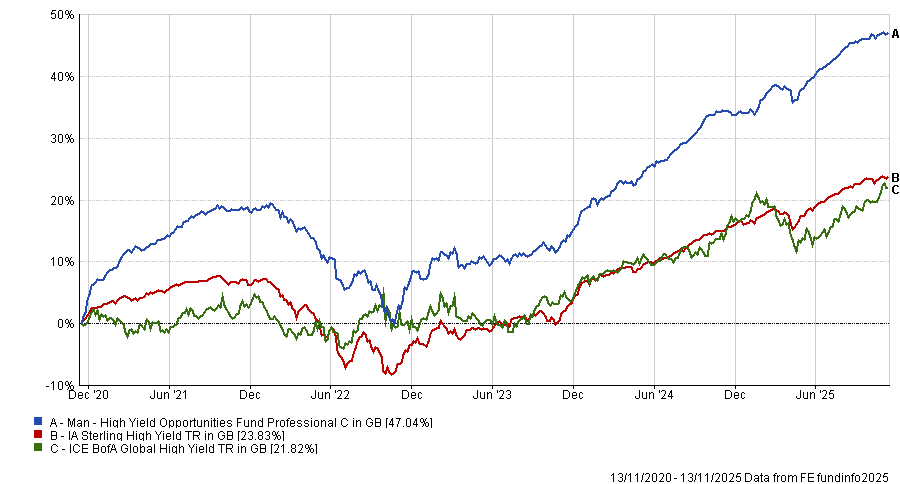

However, Hyett acknowledged that a lack of dedicated government bond fund could mean the portfolio is lower in quality and higher in volatility than a 0% equity investor would ideally like.

He said the 25% allocation to TwentyFour Monument Bond “is intended to address that”.

Launched in 2009, the fund is currently managed by Aza Teeuwen, Douglas Charleston, Elena Rinaldi and John Lawler.

“The £2.2bn fund focuses on floating rate loans, reducing interest rate sensitivity in the portfolio with an interest rate duration of just 0.1 years,” said Hyett.

Just under half (45%) of the portfolio is invested in ‘AAA’ rated assets or cash, and 100% of the portfolio is investment grade. Despite the high rating, Hyett said the fund’s assets still offer an attractive rate of return – with the fund’s mark-to-market yield currently sitting at 5.6%.

Performance of the fund vs sector and benchmark over 5yrs

Source: FE Analytics

To drive returns for the portfolio, Hyett turned to private equity and infrastructure.

He allocated 12.5% to HarbourVest Global Private Equity. The $2.8bn private equity investment trust provides broad-based exposure to private markets, with an underlying portfolio of more than 1,000 companies.

Hyett said this broad private equity beta has delivered “appealing returns” for investors, with a compound annual net asset value (NAV) return of 13.4% over the 10 years to August 2025.

However, like many investment trusts, it currently trades at a significant 33.5% discount to NAV.

“Management are taking advantage of that with a sizeable buyback programme,” said Hyett, with the trust buying back $220m of shares and adding 5.2% to NAV since September 2022.

“Should the buyback programme drive a return to par, then the upside for investors is substantial – an attractive option in a portfolio that could otherwise struggle for capital growth,” he said.

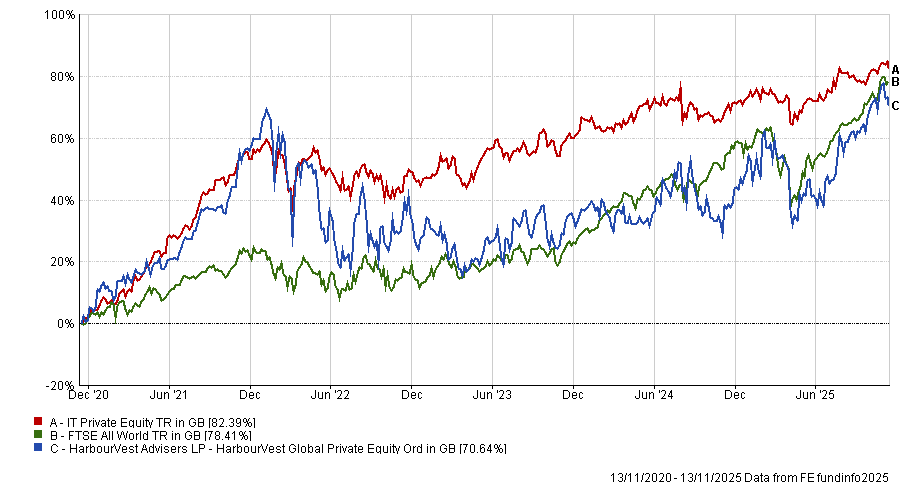

Performance of the trust vs sector and benchmark over 5yrs

Source: FE Analytics

Finally, Hyett suggested allocating the remaining 12.5% of the portfolio to the US-listed Brookfield Infrastructure Corporation (BIPC), which offers a forward dividend yield of 3.8%, benefiting from long-term appreciation through Brookfield Asset Management’s over $1trn in assets under management.

The scale of BIPC’s parent company “allows [BIPC] to do deals other managers could only dream of”, Hyett said.

Through BIPC, retail investors can invest alongside Brookfield in many of its flagship deals – ranging from US gas pipelines to Australian container terminals.

“Infrastructure combines income generation today, with the potential for steady capital growth – attractive in a fixed-income-heavy portfolio,” said Hyett.

Although it is US-listed, UK retail investors can access BIPC through investment platforms that support overseas shares.